Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I recorded a check as "bounced" that was rejected by the bank, due to "hundred" not being written out correctly. The invoice shows unpaid, and it automatically recorded the journal entry correctly. However, the deposit still shows for the full amount. Do I need to manually correct the deposit, or will QB due this function automatically? The owner, always wants the reconciliation to match exactly.

Thanks in advance!

When you say that the QuickBooks corrected this have you looked at the correcting entry in journal entry form? The original deposit should show as this was the deposit made and will correspond to a line item on your bank statement. There should be a second entry for the amount of the bounced check. The entry is a credit to the bank account in the amount of the bounced check and a debit to accounts receivable in the same amount.

I had a check get returned. Both the original deposit and the return from the bank are showing as deposits and making it unable to be reconciled. How do I change one to a debit so that it balances?

Thanks!

Hello there, @Cari_Rose.

I'm glad you've reached out to the QuickBooks Community. Let me help guide you on correcting your recording transaction in QuickBooks Online (QBO).

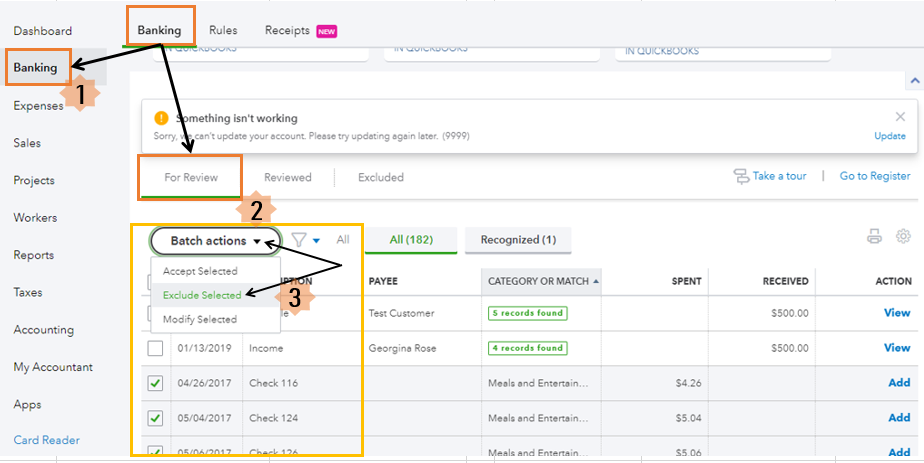

In this case, you can exclude the transaction in QBO then manually upload it again. From there, you can select the debit when mapping the bank statement.

To exclude the transaction, here's how:

Once done, you can now upload or import the bank transaction by following these steps:

For additional reference, you can check this article on how to import bank transactions using Excel CSV files.

If you need further assistance with the steps, I recommend contacting our QuickBooks Online Support Team. They have additional tools to pull up your account and do a screen-sharing.

Here's how to contact our customer support:

For future reference, you can also visit this article for the detailed steps and video tutorial on how to reconcile your accounts.

This should get you on the right track. Fill me in if you have additional questions about excluding or uploading banking transaction. I'm always here to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here