I know the steps you can perform to record your fees, mistev78.

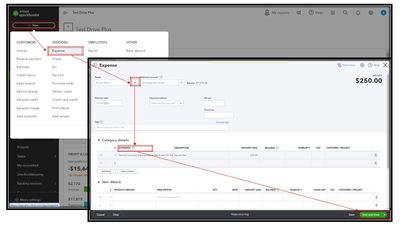

When you're charged for square fees, you can manually record it as an expense in QuickBooks:

- Hover to + New, then select Expense.

- Select the payment processor from the Payee dropdown.

- If you haven't set them up in QuickBooks, select + Add new.

- In the Category column, choose the expense account to record the fee and enter the amount.

- Select Save and close.

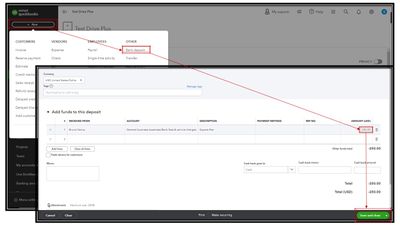

Meanwhile, you can record the Square transaction as a bank deposit if you want to match it to the invoice payment. It's essential to mark the invoice as received payment before taking the steps below.

- Click the + New button, then tap Bank Deposit.

- From the Account dropdown, choose the account that has the deposit in question.

- Select the payment transaction and add a negative line item for the fee in the Add funds to this deposit section.

- Click Save and close.

Once done, you can match the total deposit to your square payment once it appears on your bank feeds.

Moreover, after categorizing and ensuring all transactions are matched, you can start reconciling your QuickBooks account. This will ensure that all financial records are accurate and discrepancies are resolved promptly.

I'm still here to assist you further with recording your fees on QuickBooks. Just tap the reply button for your response. I'm here to help you with anything you need.