Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe amount transferred from Jobber is less than invoice and there's nothing to match to. How do I categorize then? I don't want to have the income doubled up.

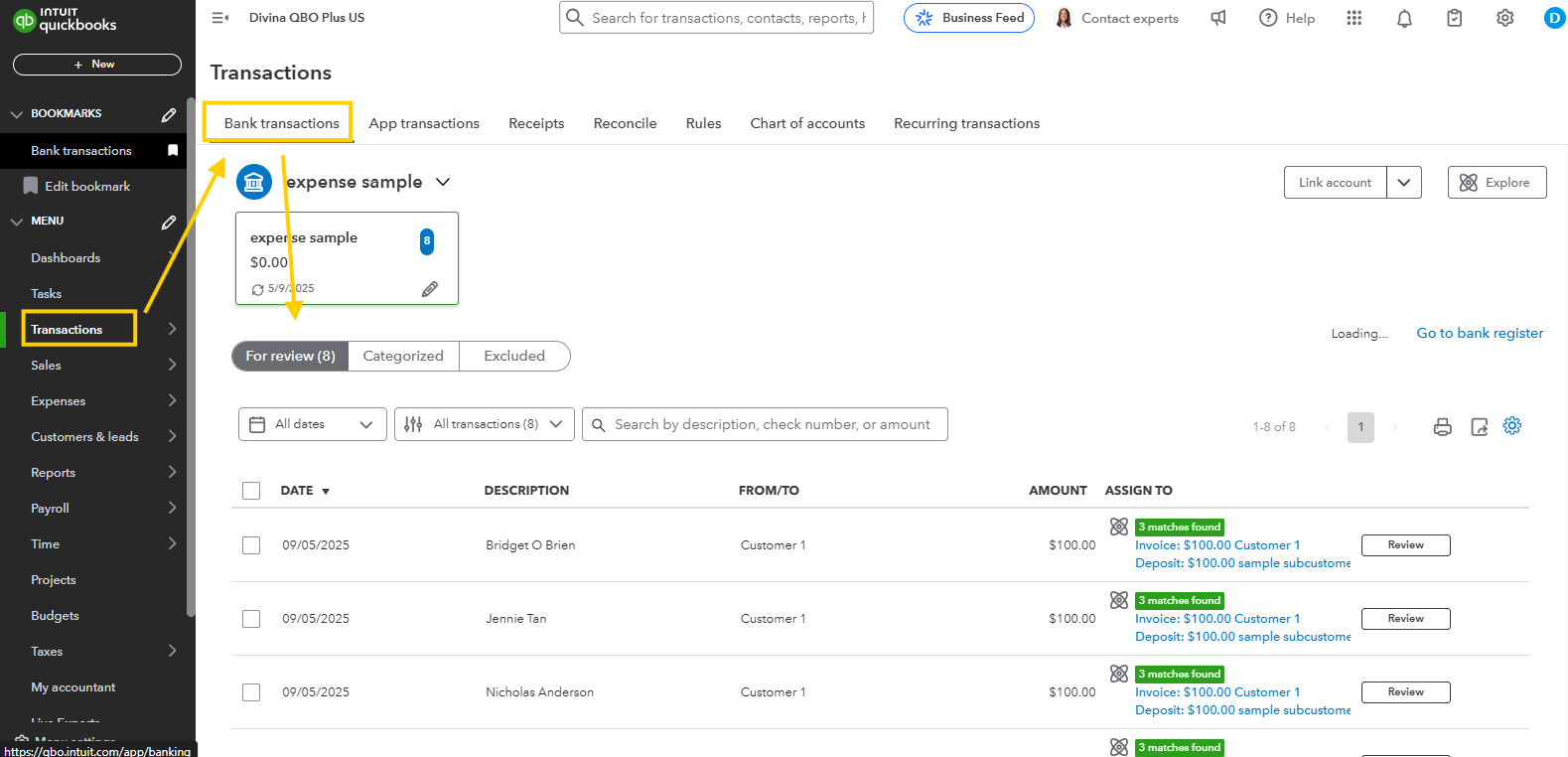

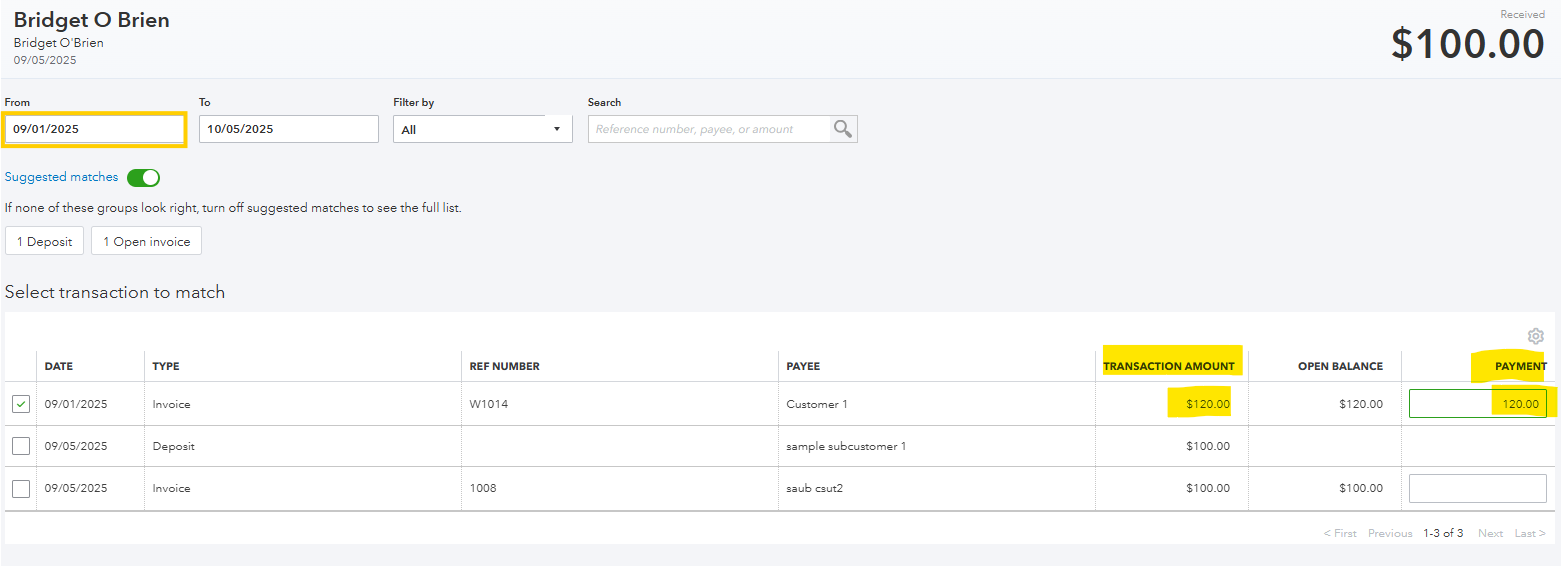

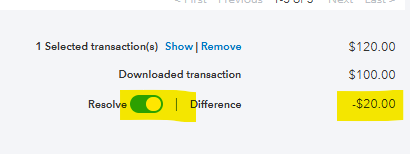

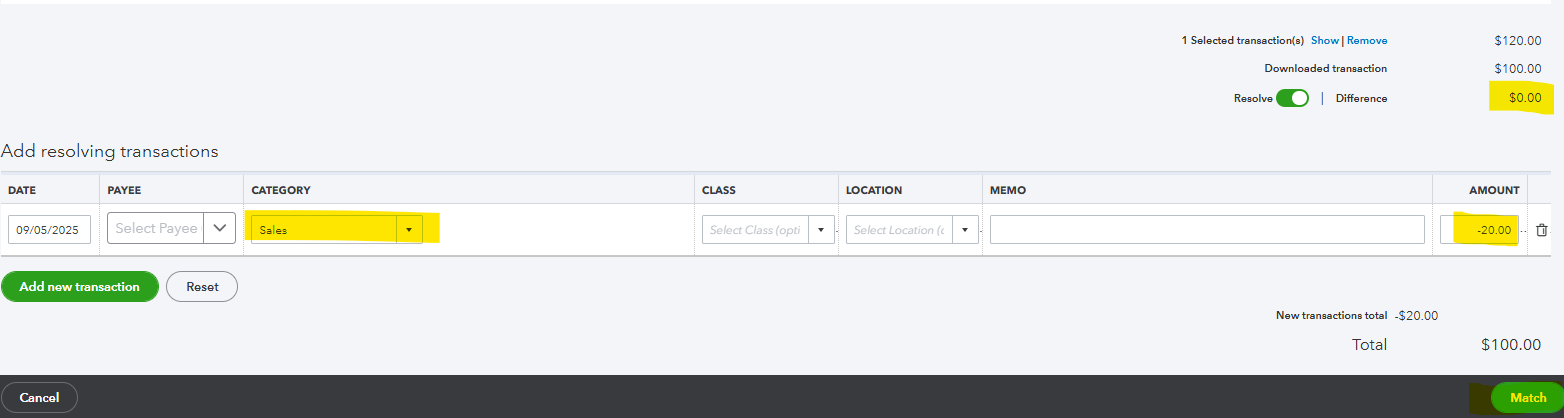

You can manually match the transactions and use the Resolve Difference feature to match them, @jason207.

Since you're using Jobber, a third-party merchant service for accepting customer payments, processing fees are deducted from the payment. This explains why the payment amount in your bank register doesn't match the deposit amount in QuickBooks Online.

Here's how to resolve this:

This matches your payment and records the fee properly, without doubling your income.

Once everything is fine and you have successfully reconciled your account, you can generate and export a reconciliation report in QuickBooks.

If you need expert guidance, I recommend checking out our QuickBooks Live Expert Assisted. They are dedicated bookkeepers who can bring your past books up to date and manage your bookkeeping for you from start to finish.

Let me know if you need additional help managing your transactions.

Thank you for your response! I understand why the amount is less, what I need to know is how to record it in quickbooks? So the job being paid and the bank reconciliation don't create a double record. I believe right now, when jobber tells QuickBooks it's paid, it goes into my profit, but then if I do the bank reconciliation and record it as services/income, I believe that would take create a double record. I want to make sure to avoid this and record it properly.

Thank you for your response. I do understand why the amount is different. What I need to do is make sure that the income is not double recorded in quickbooks. When Jobber tells quickbooks, the invoice has been paid. I believe quick books, then records that as income. Then, when I do the bank reconciliation? I need to know how to categorize it. So it's not double recording in a quick booksThank you for your response. I do understand why the amount is different. What I need to do is make sure that the income is not double recorded in quickbooks. When jobber tells quickbooks, the invoice has been paid. I believe quick books, then records that as income. Then, when I do the bank reconciliation I need to know how to categorize it so it's not double recording in quick books.

There's no need to manually categorize transactions from Jobber as income again, Jason.

When processing transactions from Jobber as a third party, they are automatically recorded and categorized as income. Thus, this removes the need for manual categorization and helps prevent duplicate entries in QuickBooks Online (QBO).

You can just directly add all the transactions from the application and proceed to reconcile.

Once you're done with the reconciliation, you can run a Profit & Loss report to ensure that your income isn't double-counted.

Feel free to reply to this post if you need further assistance.

Thank you for your response. I think maybe there's a misunderstanding. When quick books looks at the deposits in my bank account it wants to match or categorize it in some sort of way. If I categorize it as income, won't that create a double deposit? Because when jobber told quickbooks, the invoice was paid doesn't that amount go into my income as well?

You're right, Jason207.

If you categorize the deposits as income in your QuickBooks Online (QBO) account, it could result in duplication, as the invoice payment from Jobber is already being recorded as income when marked as paid.

With that in mind, may I ask if the customer payments from Jobber has been posted under Undeposited funds or Payments to deposit account? If it has, you can create a deposit to accommodate the payment across all relevant invoices and account for the fees involved, ensuring that the total invoice amounts matches the downloaded transaction from your bank. This way, you can match the customer payments correctly.

Here's how:

Refer to the section titled Include bank or processing fees in this article for more detailed guidance on this procedure: Record and make bank deposits in QuickBooks Online.

To ensure that the income hasn't been recorded twice, you can generate a Profit and Loss report.

The comment section on this thread remains open for any assistance you need when categorizing your deposit in your QBO account. The Community is here to help every time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here