Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, @evan.

You've come to the right place! I have all the instructions you'll need to get your invoices uploaded. This way, you won't need to enter them manually.

In QuickBooks Online, you can import multiple invoices in one go. First, you'll have to prepare your spreadsheets in .CSV format. You may create your own or download a sample file.

Here's how:

Then, before you upload, here are some key points to keep in mind:

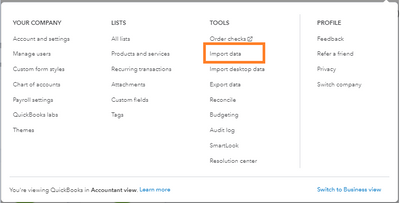

Once it's ready, follow these instructions to import your file:

Then, make sure your spreadsheet’s column headings match with QuickBooks fields. For the detailed steps, proceed to Step 3 in this article: Import multiple invoices at once.

Please feel free to click the Reply button if you have other questions about this process and let me know how it goes. I'd be happy to further assist you. Have a wonderful day!

Great, thank you. Is there a way to then mark it as paid without having to create an independent sales receipt?

Thank you! Is there a way to then mark the invoice as paid, without having to create sales receipts?

Welcome back, @evanrstanley-gma.

I'm here to provide details concerning mark invoices paid in QuickBooks Online.

When marking the invoices as paid, there is no need to create sales receipts.

To mark an invoice as paid, you must record the customer payment after processing it in QuickBooks. Or else, the invoice is unpaid and remains open, appearing on your reports.

Here's how to receive the payment:

If you receive partial payment, there also a way how to record them in QuickBooks. Visit this page for your guide: Record invoice payments in QuickBooks Online.

Please refer to this article on how you can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip in QuickBooks: Handle a customer credit or overpayment in QuickBooks Online.

If you have any additional query, know that you are always welcome to post again. Continuing success to you and your company.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here