Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have to post all daily sales in our small gift shop via Journal Entries. While working on the 1st quarter financials, I inadvertantly deleted two journal entries. I need to re-enter them for the books to be correct. How can I fix this without undoing a complete bank reconciliation/

1. Go to your audit log (gear icon/tools/audit log) where you can see your original journal entries and reference them to "re-create" them

2. Once the JE's are re-created, select the related bank account, then reconcile, and re-enter the month-end date and month-end balance from the bank statement, and re-reconcile so that your beginning balance for the next period is corrected.

Thanks for posting in the Community, @grozaconsulting. I can help with reconciled transactions being deleted.

Once you have recreated the journal entries, you can manually change the status of the transactions to reconciled. Here's how:

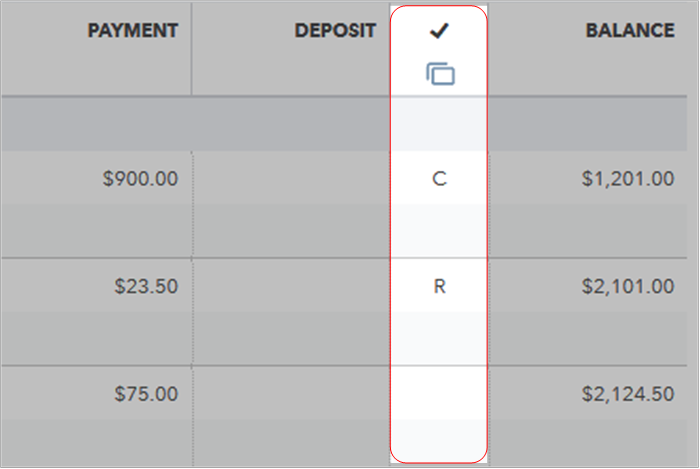

The following is a screenshot to serve as a visual reference:

For additional insight into this process, such as how balances will change when transactions are modified, please see the following article: How to unreconcile a transaction or undo a reconciliation.

Should you be unsure of what figures that made up the journal entries, I recommend using the Audit Log, which contains a record of changes to transactions. You can locate information on using this tool at the following article: The Audit Log: What it is, how to use it.

That's it. I'm sure you'll have the transactions recreated and reconciled in no time.

As always, I'm just a few clicks away if you should need anything. Hoping this response finds you with a smile.

FYI, the advice that I provided is actually more efficient, by simply re-entering the month-end date and month-end account balance and hitting the reconcile button after re-entering the journal entries that were deleted.

It is NOT a best-practice to "manually" change things within the account register, and I'm not sure why the QuickBooks Team is recommending this method, as any good ProAdvisor who is an Accountant would advise against "manually" changing things in the account registers. The application should be used the way it is intended, and beginning balances are not always fixed when you "manually" change things directly in the register, and it takes longer.

David - As an experienced Accountant and QuickBooks Online ProAdvisor, I would like to ask the QuickBooks Team to please stop advising people to make manual changes directly within the account registers, as this is not a best practice and not how the QBO application should be used.

This advise confuses small business owners, as they often will start doing their account reconciliations "manually" and "directly" within the account registers, and sometimes they start entering all their transactions in the registers manually like it was a checkbook, which can really mess things up in QBO. You will not have an actual reconciliation report when this is done.

The best practice is to use QBO the way it is intended to be used, to reconcile accounts the correct way, making sure that the beginning balances are correct for the next month. Once the deleted transactions are re-entered, they "automatically" pop-up to re-reconcile through the correct reconciliation process and then you will have an actual reconciliation report to reference.

Thanks for sharing your thoughts on this, @Regina_Lend_A_Hand_Accounting.

I generally try to ensure that my responses and answers match the suggested steps in QuickBooks content. The QuickBooksHelp article Fix an opening balance to match a bank statement references the following step for resolving similar scenarios:

Ultimately, both options are going to resolve the beginning balance issue caused by deleted reconciled transactions. I realize that people can have preferences with software and I always encourage them to do what they're most comfortable with.

Also, I wanted to let you know that I've submitted feedback with regards to your content suggestion. Feedback is used to determine what changes and improvements can be made to the software and support.

The sharing of ideas and solutions is one of the many things that make the Community such a lovely place. Hope you have a wonderful day.

Thank you, David

I agree that you can make "manual" changes to the status of transactions within the account registers and it can result in the correction of the account balance on a given date. However, if you change the reconciliation status of an item directly within the account register there will be no reconciliation report that reflects this as the process of "reconciliation" has not actually been done. This is not about a preference, this is about the cause and effect of the order of operations. Best practices are developed by Accountants that are using QBO on a daily basis for many clients. Small business owners should understand what happens when they circumvent the recommended process for entering and reconciling transactions. They will actually lose reporting ability and they can easily miss something that they would see in the reconciliation screen. Just because an article was written that explains how you can correct account balances within the account register manually, does not mean that it is the best practice, or even most efficient.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here