Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am new to QBO. Our account is set up to receive manual feeds from our bank. A deposit was posted to our bank account on Nov 4th for $540. At the time, there was no matching receivable. I have now created an invoice with more detail than the manual feed has but I can't match it to the deposit that has already been entered automatically by the bank feed. Should I just delete the bank feed from the bank register and use receive payment?

Thank you for choosing QuickBooks as your accounting software, JP141.

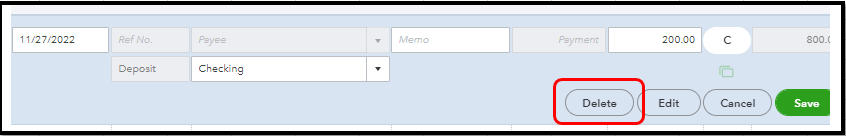

Yes, you can delete the deposit posted on the Banking page. Then, manually record the payment.

I'll show you the steps for deleting a deposit.

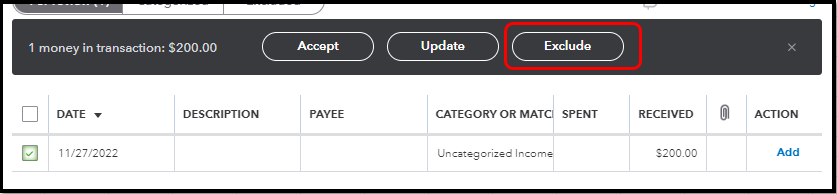

This entry is posted back to the Banking page. You can exclude the deposit so it won't show up. Simply mark the transaction and select Exclude. Here's a sample screenshot below.

I'll also share some insights why there are transactions that don’t have a match. Here are the possible reasons why.

For a detailed explanation and how to match transactions moving forward, check out this article: Learn how to review downloaded bank transactions and put them in the correct accounts.

To ensure QuickBooks matches transactions with what's in the real-bank account, I recommend reconciling the bank every month. Check out this complete reconciliation guide.

Get back to me whenever you have additional questions about matching bank transactions. I'll be right here to help you.

I need help understanding why transactions don't clear in the banking transactions for the following:

1. Created an invoice. Assume the book entries are Dr. A/R and Cr. Revenue

2. Posted the received cash payment and selected the bank account as the deposit category. Each deposit is for the exact amount. Assume the book entry would be Dr. Cash and Cr. A/R.

3. Why is the A/R transaction still in my reconcile detail? How do I clear it? It has nothing to do with my cash at this point.

HELPPPP!

Hi there, Molly. Let me clear things up for you.

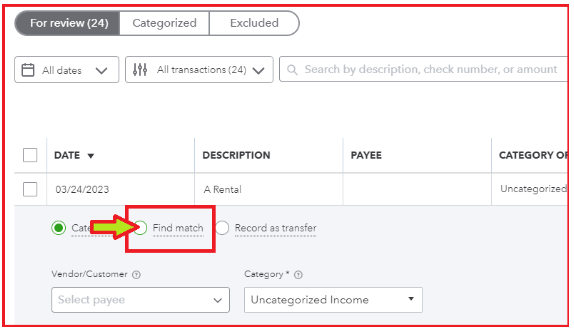

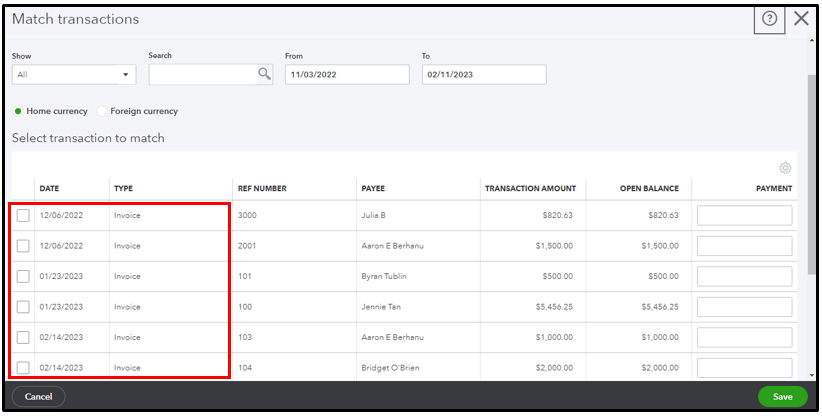

In QuickBooks Online (QBO), you just have to match the downloaded transaction to the invoice payment. You don't need to manually create the payment. We can utilize the Find Match feature to show all potentially matched transactions. Then, review the list of possible matches and select one if you find it.

Here's how:

For more information, refer to this article: Categorize and match online bank transactions in QuickBooks Online.

In case you would like to reconcile your account, here are a few additional articles to help you accomplish a successful reconciliation:

The Community is always here to help if you have other questions about matching transactions in QBO. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here