Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I'm running QB Desktop Pro 2020. I have an American Express credit card account. For years, we've been entering the AMEX statement total amount as a vendor bill, categorizing the expenses and totaling the QB expense accounts they should go towards manually (outside of QB), and paying the bill with a check.

What I'd like to do is to get the AMEX card transactions into QB (I'm familiar with importing a .QBO file), learn how to create rules to categorize the expenses (so I don't have to do the manual totaling), and how to pay/record the payment to AMEX. I'd like to make/record this payment in a way other than writing a check, because the mail is very slow lately. I have paid AMEX through their website, but am stumped on how to record this in QB.

Thanks in advance for your help. Forgive me if i got the terminology wrong!

Steve

Whether you use the bank bill pay, or the CC web site to pay the bill, you are using a check. The check is electronic instead of paper though, use EFT (electronic transfer of funds) instead of a check number

Thanks for the tip Rustler! It's beautiful in its simplicity. It'll help with this and elsewhere.

Following up now... I've got my credit card account now set up in my Chart of Accounts, and have brought in my month's worth of transactions by importing a QBO file. I've categorized all the transactions by selecting their appropriate expense accounts and batch approving them. Question, what do I do to pay my credit card company? Is it writing a check to the vendor (AMEX) and posting it to the credit card account?

Thanks for the tip Rustler! It's beautiful in its simplicity. It'll help with this and elsewhere.

Following up now... I've got my credit card account now set up in my Chart of Accounts, and have brought in my month's worth of transactions by importing a QBO file. I've categorized all the transactions by selecting their appropriate expense accounts and batch approving them. Question, what do I do to pay my credit card company? Is it writing a check to the vendor (AMEX) and posting it to the credit card account?

Hi there, @scieslicki.

I appreciate you for getting back to us here in the Community. Allow me to chime in and help you with your questions about the credit card account in QuickBooks.

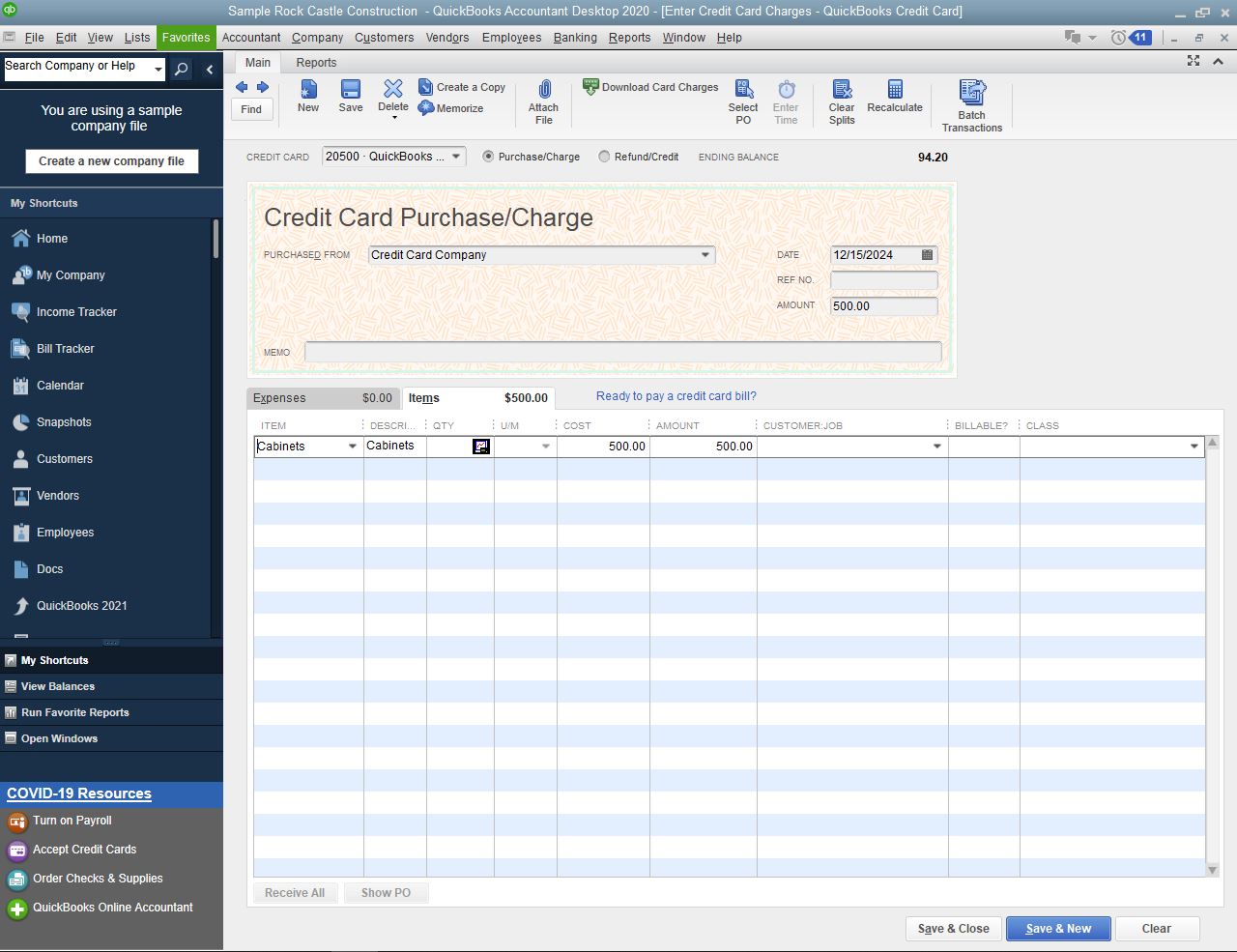

Since the credit card is already in your chart of accounts, you can now enter the charges. This way, the amount you owe will reflect in the credit card account (Other Current Liability).

Here's how:

Yes, you can use the Write Checks option to pay your credit card company. I recommend adding the vendor name in the Pay To The Order Of ▼ dropdown and add the credit card account below the Expenses tab.

Please follow these steps:

For additional reference, you can use the following article to learn more about how the credit card balance (positive, negative, and zero balance) works in QuickBooks: Set up, use, and pay credit card accounts.

Fill me in if you have additional questions related to your credit card, like how to create a recurring payment. I'm always here to help. Take care always.

Thank you for the explanation AlcaeusF. I have already imported my first month/statement worth of credit card transactions via File>Utilities>Import>Web Connect Files. This replaces the need to enter the transactions manually as you detailed above, correct? I've also assigned expense accounts to all the transactions and batch approved them. what I'd like to try to do next is figure out how to create rules to automatically assign the expense account based on a name or character string in the transaction description field. However, when I try to create the rule I get an error:

Thanks for sharing a screenshot of the error, scieslicki.

It usually indicates that there are missing details or parameters when creating the bank rule. Makes sure to select or type in the information in the drop-down list for Description.

More importantly, you also need to select the name of the customer or vendor in the drop-down list for The Payee Field To. QuickBooks will use the name in this field to rename to automatically match a transaction. Here's an article for more details: Use Renaming Rules for Bank Feeds.

You are also correct that importing data through Web Connect replaces the need to enter the transactions manually.

Let me share these articles for additional details and reference when managing bank transactions in QuickBooks:

You can always ask follow-up questions in case you need more help with QuickBooks. We're always here to guide and assist you all the way.

JenoP - here is a screen shot of the rule parameters I am trying to use. When I click SAVE, that's when I get the error shown in my previous post. What could cause the error? Thanks!

Thank you for getting back to us and providing us with more details of the error you're having, @scieslicki.

To save this renaming rule and avoid this error, you'll also need to add a vendor or customer to associate the bank transaction with.

Here's how:

To help you in modifying or adding transactions with renaming rules, refer to the following article: Use renaming rules for Bank Feeds.

Here's everything that you need to know in setting up, downloading, and adding or matching bank feed transactions: Get started with Bank Feeds for QuickBooks Desktop.

I'm always here if you have any other concerns or follow-up questions with your bank rules. Just let me know by leaving a reply below. Take care and have a great rest of the day!

MaryJoyD - thank you for the information. When you say "Set the account you'll want to associate the transaction with", can you please explain? I currently have my credit card company (American Express) set up as a vendor. Is this what I should be using for all my transactions?

Maybe this explanation of what I was doing before I started trying to utilize bank feeds might help:

- I made Amex purchases throughout the month, without entering any transactions into QB

- The Amex statement arrived in the mail

- I entered the total statement balance as a vendor bill, and manually totaled up the expenses and assigned those totals to expense accounts on the bill. For example, I made 2 gasoline purchases in the month for $20 and $30. In the Enter Bill screen, I entered the bill total as $50 and assigned it to my Gasoline expense account.

How is using bank feeds different? I'm getting a little confused...

Good evening, @scieslicki.

I'm glad you reached back out to us with your concerns. Let me share some light on this subject.

Since you're having a bit of trouble understanding our explanations, I suggest contacting our Customer Support Team. They'll be able to take a look at your situation and explain your options as soon as you get talking with them. Here's how:

It's that simple.

Please inform me on how the call goes. If you still have any other questions, feel free to ask. I'm only a post away if you need me. Have a fantastic day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here