Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi all, got a new client recently. They're a sole proprietor and tracking both personal and business together in QBO. I KNOW this isn't ideal, but I've just been hired to clean up- everything is already all mixed up and we're fixing up the categories, etc... it's under control. But I'm looking for the best way to deal with owner's draws, as I've never come across this particular banking setup before. Might be a silly question, but it's a new scenario for me.

Business owner has 2 checking accounts- one personal, and one used for business. Since they're both being tracked in the same QBO file (again, I KNOW this isn't ideal, but what's done is done, just trying to clean up), when they send the money over from 'business checking' to 'personal checking', QBO wants to treat this as a transfer as usual where they're both recorded as a transfer/match. So, in this situation, I'm not sure how to record an owner's draw? Or if I even need to?

I've considered just recording as a transfer/match on both ends and then doing quarterly journal entries to adjust for owner's draw, but I don't think that's correct. I've also considered recording one transfer as an 'add' to owner's draw and the other as 'transfer' as usual, just without a match, but I don't think this will work either. Unless I'm missing something. And if I record a 'check' from business to personal, it'll show up as an expense on the P&L, which is also undesirable. My brain is fried trying to figure out how to handle this in a way that won't create duplicates, account issues, problems reconciling, or incorrect reports. Since they're a sole proprietor and the money is coming directly to them in the same QBO file anyways, I don't see a huge need to even show the draws since it's technically just a bank transfer from themselves to themselves, but for peace of mind, I'd prefer for it to show up on the reports just so there's a record of it.

Maybe this is really simple and I'm just missing something, but I can't figure this out. Any suggestions?

Hello there, @Ralphthefluffycat.

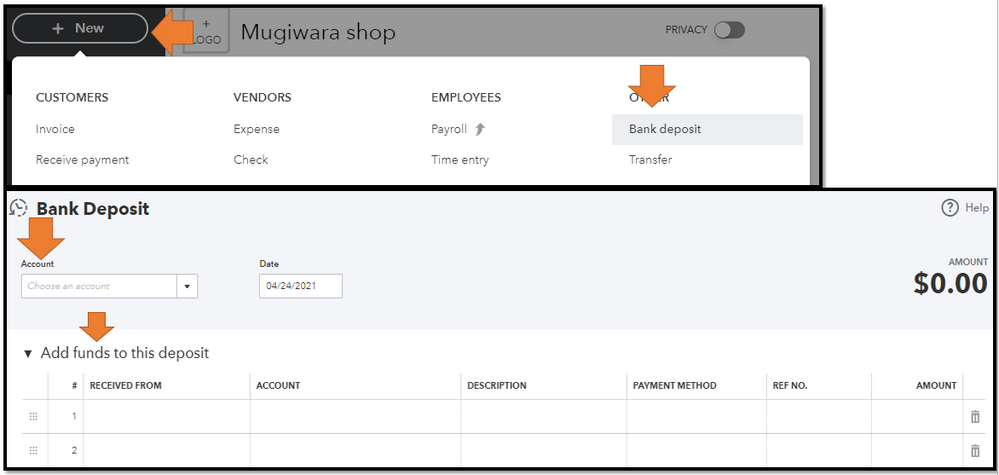

You can create a bank deposit and expense as owner's draw instead of transfers. Let me guide you on how:

For more info about the process, please see this article: Record and make bank deposits in QuickBooks Online.

Also, to ensure that your books are accurate and to avoid messing up the data, I highly recommend seeking assistance from your accountant. They can give advice and guide you in properly recording the owner's draw in QBO. If you're not affiliated with one, you can use our Find an Accountant tool to look for a Pro-Advisor near your area.

Please know that I'm always around here in the Community to help. Just post a reply below if you have further concerns about managing your accounts in QuickBooks. Have a good day.

First ,

You need to communicate with the client that personal expense and income should not be added in Quickbooks.

No need to add any personal bank account in QB.

Only add business accounts.

All business income and expense should be transferred to income statement.

All other transactions should be considered as the owner's drawing or fund deposit.

Alternatively, create a new account in the chart of accounts - the owner's short term loan and use that account for personal transactions.

Let me know if this helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.