We appreciate the details you've shared, Jdxfour. I'm here to help you fix your reconciliation issue.

We can perform a special reconciliation using the "mini reconciliation" method, which involves setting an "off-cycle" reconciliation date to address discrepancies. Before we proceed, please make sure you have the ending balance from your most recent reconciliation at hand.

Here’s how to fix the transactions based on the posting account:

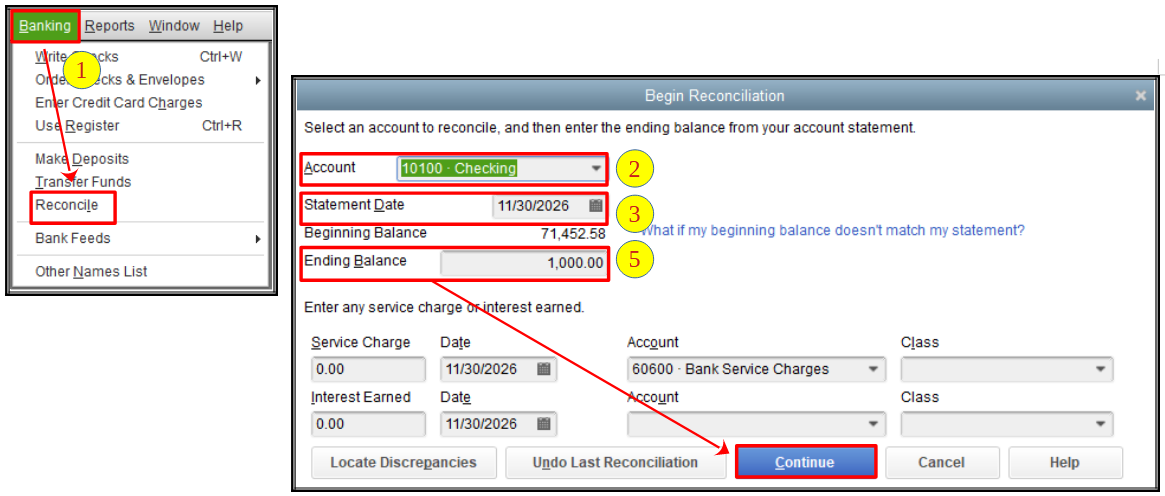

- Go to Banking and select Reconcile.

- Choose the bank or credit card account with the transactions that need reconciliation in the dropdown.

- In the Statement Date field, enter an "off-cycle reconciliation" date. This date can be between your last reconciliation and your next scheduled one.

- Please note that when you enter an "off-cycle" date, QuickBooks will alert you that you are performing a mini reconciliation. This process allows you to reclassify previously unreconciled transactions without affecting the regular reconciliation cycle.

- Enter the balance from your last successful reconciliation in the Ending Balance field, then select Continue.

- In the Reconcile window, check off the transactions you are adjusting and re-reconciling.

- Ensure the Difference field shows $0.00.

- When everything looks good, select Reconcile Now.

After selecting Reconcile Now, QuickBooks asks if you want to Create a Payment Check or Create a Bill to Pay Later.

- Select Create a Bill to Pay later.

- If needed, print your Reconciliation Report for your records.

- Once printed, a bill will appear on the screen with the amount you just reconciled. Select Clear to remove all information from the bill.

- Close the bill.

This process balances the account, and since you’re creating a bill to pay later, your credit card balance won’t be affected.

Please refer to this article for more details: Reconcile previously deleted and re-entered checking or credit card transactions.

Additionally, you can refer to this article to complete year-end tasks and prepare for the new year: Year-end guide for QuickBooks Desktop.

We're always here to provide further assistance with the process, Jdxfour. Have a great day ahead.