Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOur company has taken a cash advance on our credit card. I need to enter the transaction so I've gone to Make Deposits and chose the correct account to deposit to but I don't know what to put for Received From. The money hasn't come from a customer, it's a cash advance from the bank. Thank-you in advance for your help!

Solved! Go to Solution.

I appreciate you for adding more details about your concern, mjoal.

When making a deposit, the account entered in the Deposit To field should be a bank and not a credit card. The desktop program will prompt you the following message if you select the Visa Credit line” This account is the wrong type for this field”. Make sure to use the correct account type to properly track the transaction.

There’s no need to set up another account since you already have created the credit card account. All you have to do is input the cash advance in QuickBooks.

If you still want to use your credit card information in the Deposit to and Received From fields, I suggest consulting an accountant. They can guide you on how to handle this type of scenario, especially for the posting account. I'm adding a link where you can search for an accountant in your area: Business is better with a ProAdvisor.

You can bookmark this guide for future reference. It contains instructions on how to combine multiple entries into a single record and steps to record payments into the Undeposited Funds account: Record and make bank deposits in QuickBooks Desktop.

Stay in touch if you have any clarifications or questions about the product. I’ll zip right back in to answer them for you. Have a great day ahead.

Leave the Received From field blank, or enter your CC vendor (the vendor you pay the CC bill do), and then use your CC account in the From Account field.

When I choose Deposit To and enter the CC account (where the $$ has gone into) then From Account can't be the same CC account . I want the $$ deposited into the CC account but what then do I put for the From Account? Do I need to set up the bank as a vendor?

Thanks for getting back to us, @mjoal.

Yes, you need to set up the bank account of your vendor so you can deposit the cash advance taken on your credit card. I'll show you:

You can refer to this article for more info about the steps above: Create, edit, or delete account in QuickBooks.

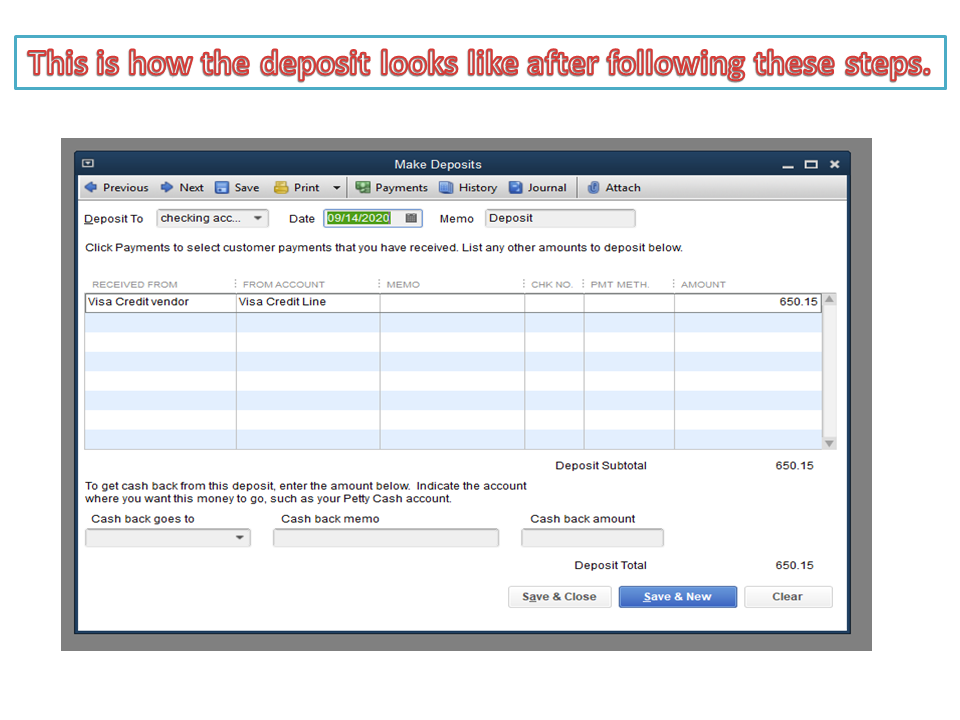

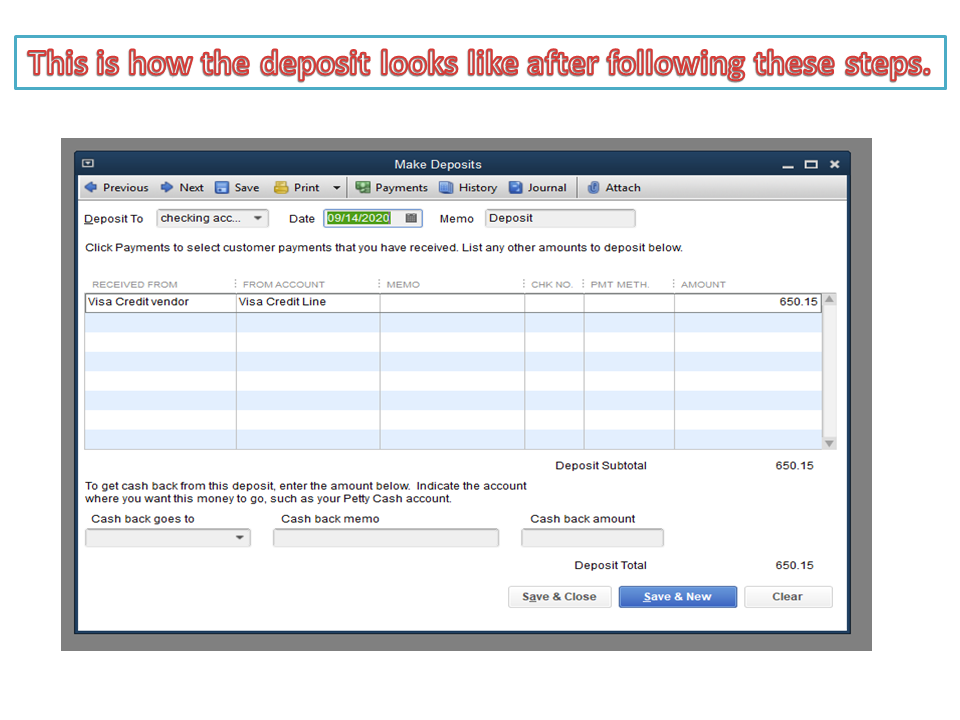

Once done, you can now make a deposit the cash advance. I've added a sample screenshot for visual reference.

Also, here is an article you can read more about reconciliations in QBDT: Reconcile an account in QuickBooks Desktop.

Stay in touch if you have further questions or any questions about QuickBooks. I’m here to answer them for you. Have a great rest of the day.

I apologize, I still don't understand. I see on your screen shot you have deposit to: Vendors Account and From Account: chequing. We have a Visa Credit Line so the money is coming from the Visa Credit Line via the bank and was deposited to the Visa Credit Line so we now have a credit card statement showing the cash advance on it. What is the second account I need to set up? I have the Credit Line account set up in Chart of Accounts but I'm confused what I do next. Thank-you for your patience in explaining this to me!

I appreciate you for adding more details about your concern, mjoal.

When making a deposit, the account entered in the Deposit To field should be a bank and not a credit card. The desktop program will prompt you the following message if you select the Visa Credit line” This account is the wrong type for this field”. Make sure to use the correct account type to properly track the transaction.

There’s no need to set up another account since you already have created the credit card account. All you have to do is input the cash advance in QuickBooks.

If you still want to use your credit card information in the Deposit to and Received From fields, I suggest consulting an accountant. They can guide you on how to handle this type of scenario, especially for the posting account. I'm adding a link where you can search for an accountant in your area: Business is better with a ProAdvisor.

You can bookmark this guide for future reference. It contains instructions on how to combine multiple entries into a single record and steps to record payments into the Undeposited Funds account: Record and make bank deposits in QuickBooks Desktop.

Stay in touch if you have any clarifications or questions about the product. I’ll zip right back in to answer them for you. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here