Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowDeposit for purchase return will go to the same original account you used to record the Home Depot purchase, not the Sales Income account.

Hope this helps!

You spent a certain amount and recorded the outflow form checking (or as a charge on HD or other card account). Now you got either a credit to apply to HD or cc account (enter as cc credit) or you received actual cash at the store.

What did you do with the cash? Or reverse of a debit card transaction? It went into the bank - Anything going into the bank is a deposit, but as @vpcontroller said - it is now also a reverse (you have to enter it as such) of the original purchase purpose.

Greetings, @aaadditions.

I can provide you with some additional information about how you can enter a refund without it showing as a deposit. At this time, we don't have an option to record a refund as some other name rather than a deposit. However, I can personally submit feedback on my side so that our Product Developers can consider this feature in an upcoming update. When a refund occurs back to an account, it will always show as a deposit.

If you think of any other questions you'd like to ask, just let me know. I'm always here to lend a helping hand.

yes please I would like additional info. on how to enter it without it showing as a deposit

I used my credit card in a Restaurant now they gave me a rebate ,how to record it because it shows as "Transfer from Uncategorized Asset"

I'm here to make sure everything matches your credit card account, @ss771357.

If QuickBooks doesn't know how to categorize a transaction, it uses the Uncategorized Income, Uncategorized Expense, or Uncategorized Asset accounts to temporarily hold them.

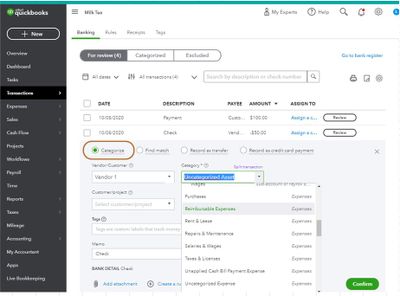

To modify the transaction, you'll have to switch the radio button from "Record as transfer" to "Categorize." From there, you can select the appropriate account to record the rebate.

For more insights about the procedure, you can follow the steps provided by my colleague above or check this article: Categorize online bank transactions in QuickBooks Online.

I'm always here if you need further assistance. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here