Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHello there, @usercnypumps.

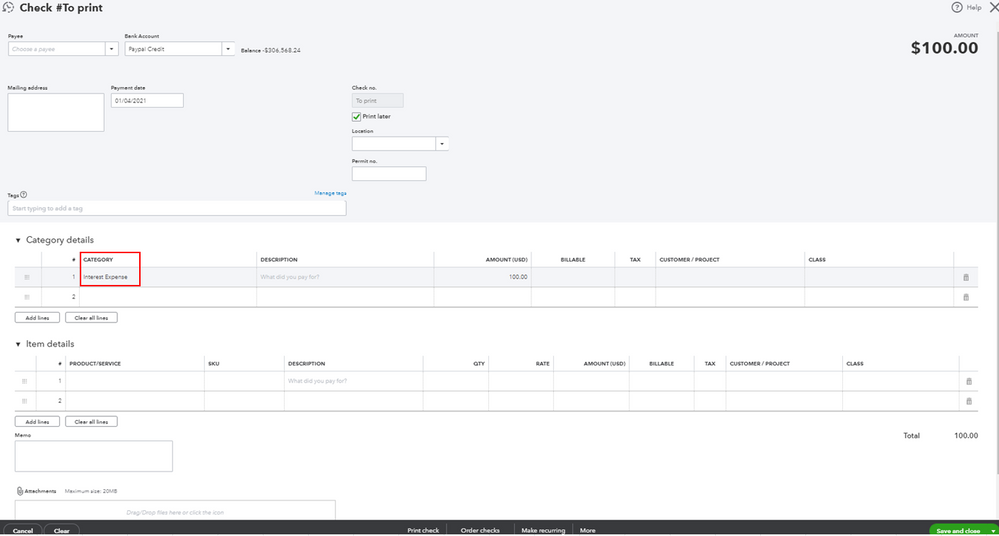

You'll first have to set up a liability account to record your loan and its payments. That should include the interest you've paid. Then, record your loan repayment by creating a check. From there, you'll have to select the expense account from the Category drop-down to record the interest accordingly. Let me guide you how.

For the detailed steps, you can also refer to this article: Set up a loan in QuickBooks Online.

Additionally, you can also pull up the Transaction Detail by Account report. This way, you're able to monitor your expenses and manage them accordingly. Just go to the For my accountant section from the Reports menu's Standard tab.

I'm also adding this article to effectively manage your business transactions in QBO: Help Articles. It includes topics about banking, expenses and vendors, and reports to name a few.

You're always welcome to comment below if you have other concerns about managing your expenses and vendor transactions in QBO. I'm just around to help. Take care always.

I believe I've done all these steps. The total loan payment shows up in my expenses, but there is no separate amount showing the interest paid. Looking for a way to keep a running total of interest paid on loans.

Hi @usercnypumps,

Welcome to the Community. Allow me to chime in and provide additional information about tracking interest paid in loans.

When you create a check for the repayment, there are two accounts you need. Liability account for the payment and an expense account to track the interest amount.

You can run the report from the chart of accounts to keep track of the information. Please refer to these screenshots:

Additionally, I recommend visiting the following article to learn how to personalize reports in QuickBooks: Customize reports in QuickBooks Online.

Fill me in if you have additional questions about tracking loans in QBO. I'm always here to help. Take care always.

So my question now is: after creating the check, my entire loan amount appears on my expense account. Though the principal portion of the payment was put into the liability account I created for it. But when figuring deductions, the principal amount should not be included, just the interest.

Thank you for getting back to us and clarifying things, @usercnypumps.

Allow me to fill you in on everything about recording loan repayment in QuickBooks Online (QBO).

The principal amount of the loan or the entire loan amount will always show on your expense account once you record loan repayment. However, if you wish to only show the interest payment to an expense account, you can manually record the loan interest payments to a different account. Here's how:

First off, you'll want to set up another expense account for the interest.

Once done, you can now use the account when creating a check or expense transaction for the interest payment.

After recording the interest payment, you can run the QuickReport of the expense account for interest paid and verify it from there.

You might want to check out this article for more details: Set up a loan in QuickBooks Online.

Should you need any assistance managing your loan payments, I'm available here to help any time!

where is this in the much better QB desktop app?

Hi @Fleming1. I'll show you how to track loans in QuickBooks Desktop.

To start tracking loans, we'll have to set up a liability and expense account for the loan and interest payments, respectively.

Here’s how to set up a liability account for your loan.

Then, follow these steps to create an expense account.

After that, create a new vendor for the bank or company you need to pay for the loan.

Once everything is set, you can now record the loan amount and the repayments. For the detailed steps, check out this article and proceed to step 4: Manually track loans in QuickBooks Desktop.

Please come back should you need more help in setting up a loan in QuickBooks Desktop.

I have a question about creating an expense account for my loan with no interest. My loan has an origination fee and a filing fee included in the loan. Under detail type I'm not sure which one to choose. Do you have a suggestion on a detail type? Thank you.

Thanks for reaching out to the Community, res@finisroadrvp.

To properly identify which detail type you should use for your loan account, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

I'll be here to help if there's any questions. Have a wonderful day!

Could you tell if I can keep all of my interests paid for multiple loans on one "Interest Paid" account?

Or, should there be a separate "Interest paid " account for each loan?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here