Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am glad you asked how to enter an invoice you paid in cash, @Just another day. This is one of the steps in making sure that you have accurate records. I can guide you on achieving this goal.

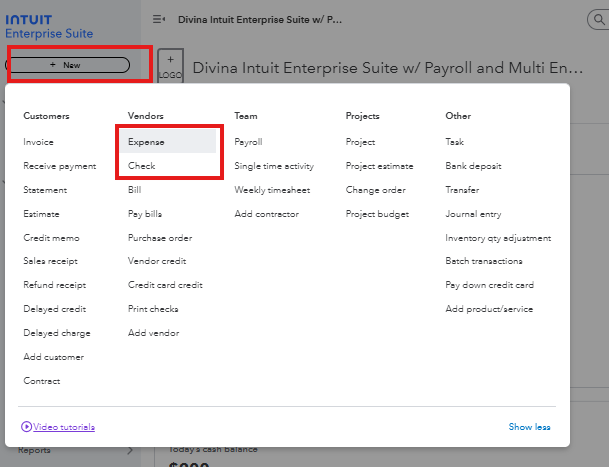

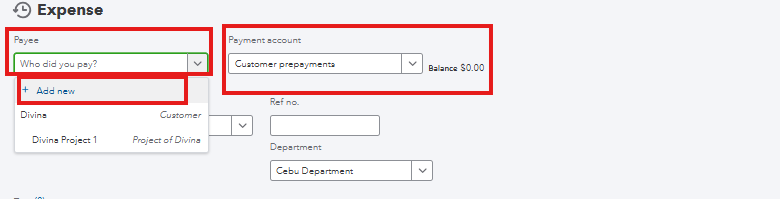

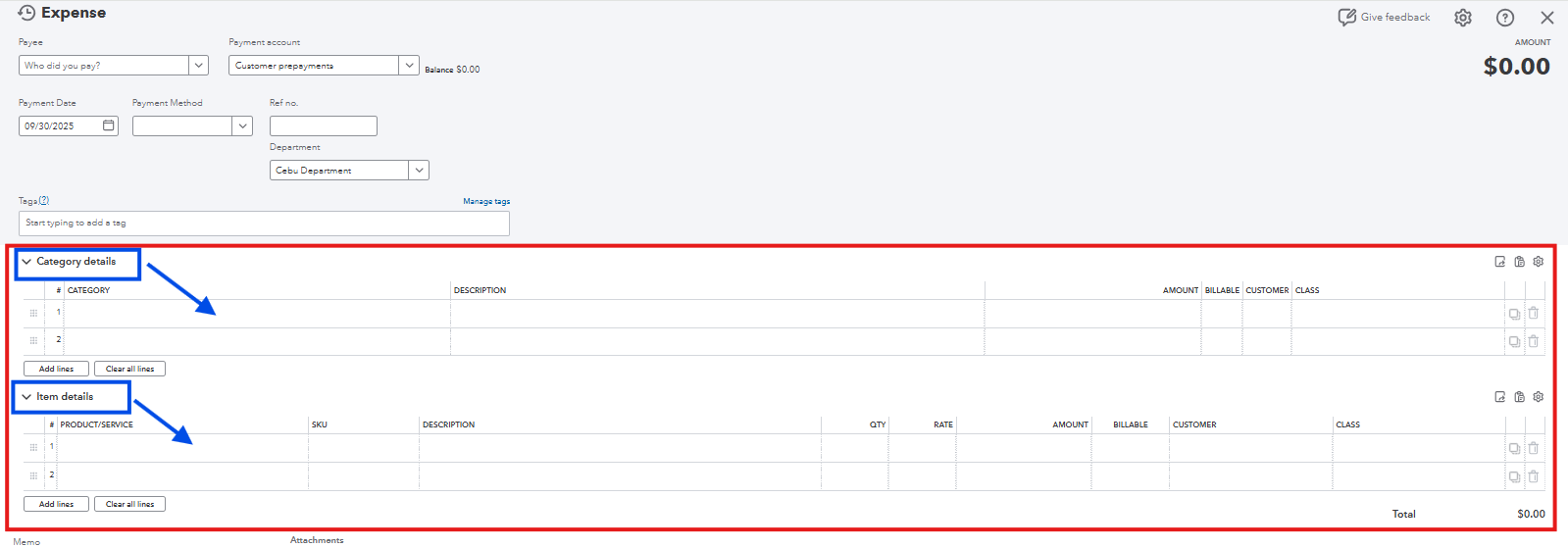

Since you mentioned it is an invoice you paid in cash, I can think of this as a service or a product you purchased. There are several ways to enter this in QuickBooks Enterprise Suite; you can create either an Expense or a Check. Depending on how the cash payment is being disbursed. Here's how:

If you are referring to an item or service that your customer paid to you in cash, you can create a sales receipt for it.

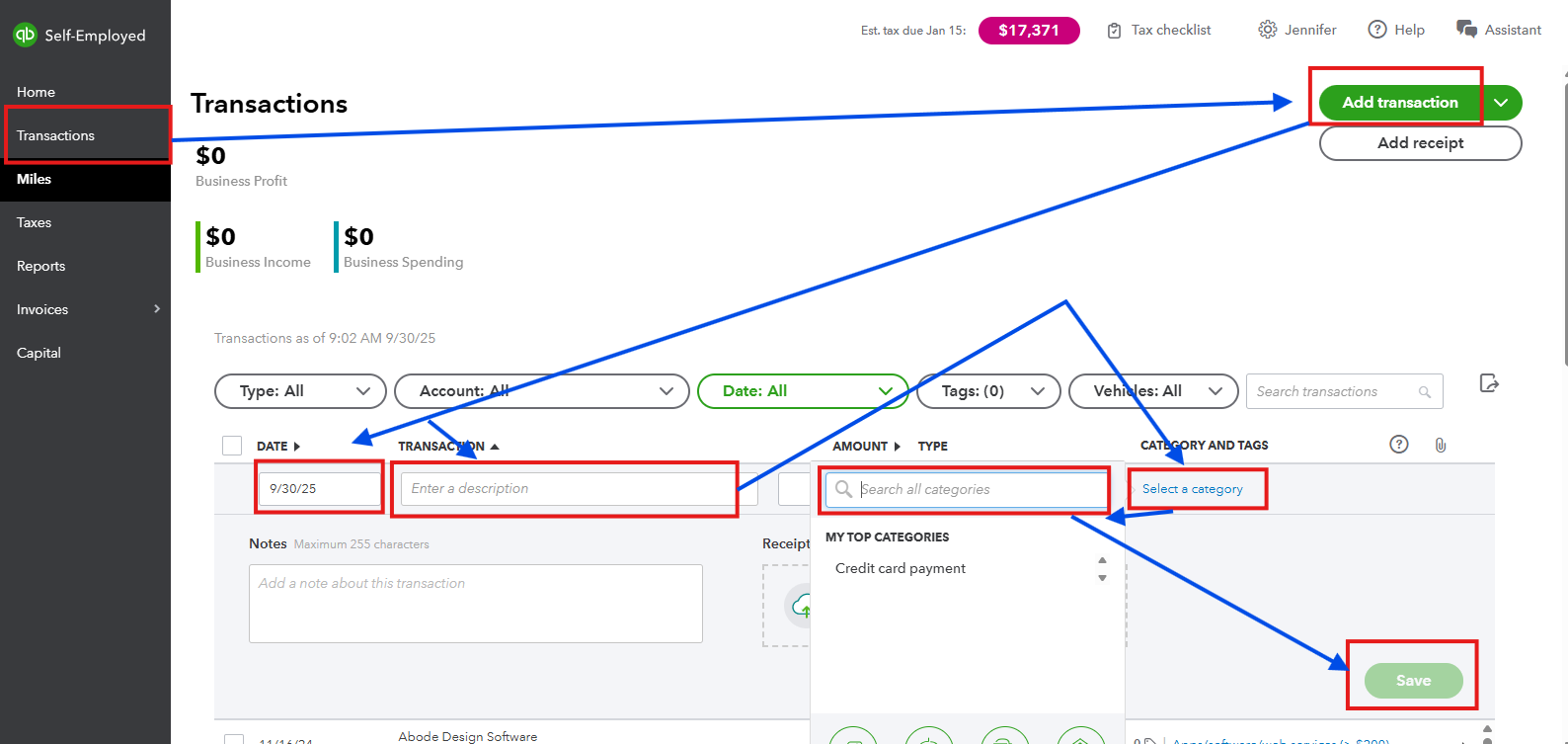

However, if you have a QuickBooks Self-Employed (QBSE) account, you can log an entry that you paid in cash by creating a new transaction and placing it in the correct expense account. Feel free to follow the steps below:

Please know that manually added transactions cannot be interchanged to the Personal or Split category. This will automatically fall under Business Type. Additionally, to select the correct expense accounts available in QBSE, check this article: Schedule C and expense categories in QuickBooks Solopreneur and QuickBooks Self-Employed.

On the other hand, you will need to create an invoice and mark it as paid manually if this entry is a paid service or item from your customer, because making a sales receipt is unavailable in QBSE.

It is essential to record your business transactions from paid in cash to online payments to make sure you track your finances correctly. Return here if you need additional assistance recording entries. I'll be sure to help you right away.

Where did the cash come from? Was it business cash or personal cash? If it was business cash, it must have come from a business bank account, or it was in a cash drawer of some type. If it came from a bank account, you should record a transfer in QB from your bank account to a Petty Cash bank account and pay the bill from the Petty Cash account. If it was in a cash drawer, then that cash should be somewhere in QB. If it isn't in QB, I would still create a Petty Cash account and pay it from there. The balance will be negative in your chart of accounts, but it will serve as a temporary placeholder, and your CPA/tax accountant can make the appropriate adjusting entry to zero it out at tax time. If it was personal cash, then add a negative amount line item assigned to the appropriate equity account to zero out the bill/expense.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here