Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hey there, @ellen10.

Happy to help out here. What I recommend is that you record the Invoice and Payment without any bank fees, then create a deposit from that payment, where you can deduct the bank fees. Check it out:

That's it! You've just recorded your payment along with your bank fees in QuickBooks Online. You can also check out this article for an alternative to the above method: Record bank charges when receiving payment from customer

Let me know if you have any other questions by using the Reply option below. I'll be here to help.

Hey there, @ellen10.

Happy to help out here. What I recommend is that you record the Invoice and Payment without any bank fees, then create a deposit from that payment, where you can deduct the bank fees. Check it out:

That's it! You've just recorded your payment along with your bank fees in QuickBooks Online. You can also check out this article for an alternative to the above method: Record bank charges when receiving payment from customer

Let me know if you have any other questions by using the Reply option below. I'll be here to help.

Thank you!

Hi - I've been following the steps that you recommend in your post. When I do, the deposit shows correctly, net of the fees.

At the same time, I then have separate debits for those same fee amounts which show up as payments in the bank reconciliation (duplicates) that I then have to delete.

Not sure what is happening here.

thanks.,

QBProadvisor - Andrea

Hello there, @ibizconsult.

Thanks for following the steps shared by my colleague and letting us know of the result. Allow me to help you find where the duplicate payments came from.

Before proceeding, let me share some information on why there are separate debits for the same fee on the bank reconciliation This can happen when fees are added twice.

For example, there’s already one entered in the bank register. Then another fee is recorded in the Service charge section on the Reconciliation page.

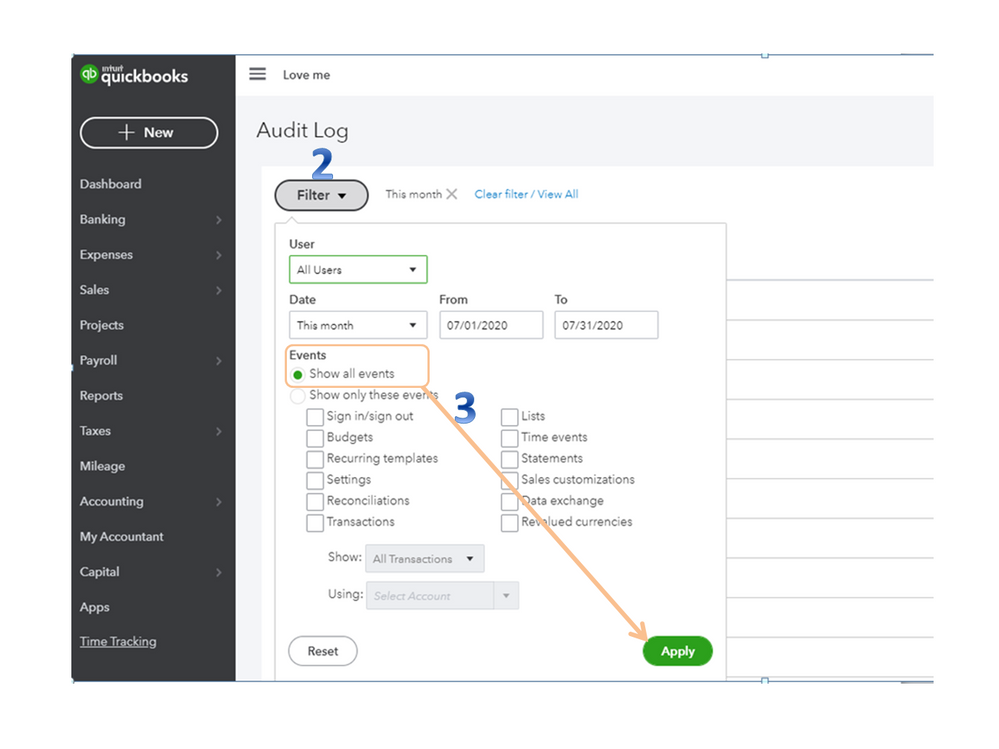

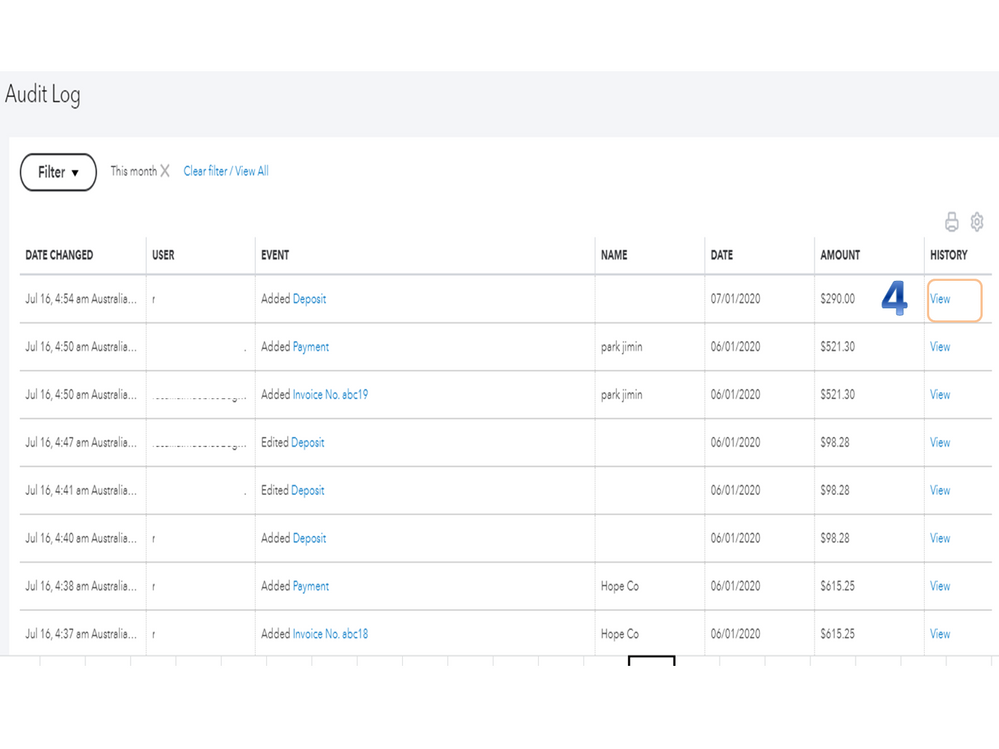

In QuickBooks Online, there's a way to see who made changes to your account. The Audit Log Report gives you a clearer picture of your transaction history.

Opening the report will only take a couple of minutes. I’m here to show the steps.

For more details about the feature and how it can help your business track any type of change or event in the company file: Use the audit log in QuickBooks Online.

Additionally, I'm adding a link that contains detailed instructions on how to include a service fee for products or services you sell to customers: Add service fees manually to invoices.

Keep in touch if you need assistance entering a payment with bank fees. I’ll jump right back in to help and make sure you're taken care of. Enjoy the rest of the day.

Do you still need help with this?

Hi,

When I apply the bank fees, it's not being recorded in the foreign currency. It is therefore, applying to the home currency account. How can this be rectified?

Happy to help you rectify the currency in your account, @sramadhar.

I have steps to take to ensure that the bank charges apply in the foreign currency in QuickBooks Online. This way, your customer report and books are accurate.

Let's ensure that the customer uses the correct foreign currency in their profile. This way, the bank fees will apply to that currency. To check, follow the steps below:

Once done, re-record the bank fees to apply the appropriate currency. See the sample screenshots below for your reference.

Check out this article below on how to exchange rates from IHS Market and split foreign transactions in QuickBooks:

Feel free to get back to me if you have a follow-up question about your currency. I'm always ready to work with you again. Please stay healthy and safe, sramadhar.

These steps no longer work since update how do I do it now. The bank deposit no longer allows me to input fees like direct deposit or rental...

Hi there, TriCoast.

Let me share some information about recording bank charges in QuickBooks Online.

You can still enter bank charges or fees along with customer payments in the program. After you select the existing payment, you'll have to enter the charges as a negative value in the Add funds to this deposit section. I'll show you how:

Alternatively, you can enter the fee as a journal entry in the program. Here's how to do it:

Once done, you can now to settle the open invoice with the journal entry:

Lastly, here's are some articles that will help you manage your bank deposits:

Drop me a comment below if you need more help in entering your other transactions. I've got you covered.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here