Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I created an invoice amounting is $497.77. However, Stripe deducts its fee and sends to my bank $478.06.

How to match this transaction with this invoice and record Stripe's fee?

Best regards.

I'm here to help keep the process of matching and recording a Stripe fee easy and simple, serkanhaslak.

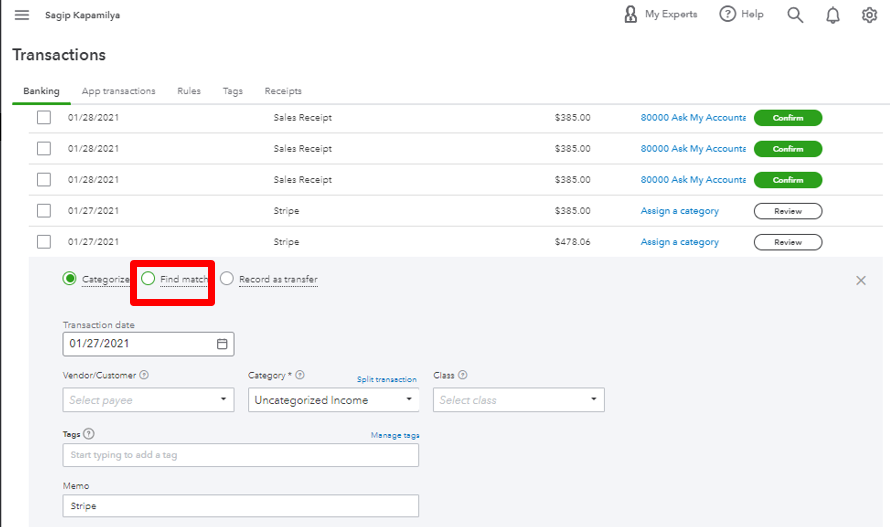

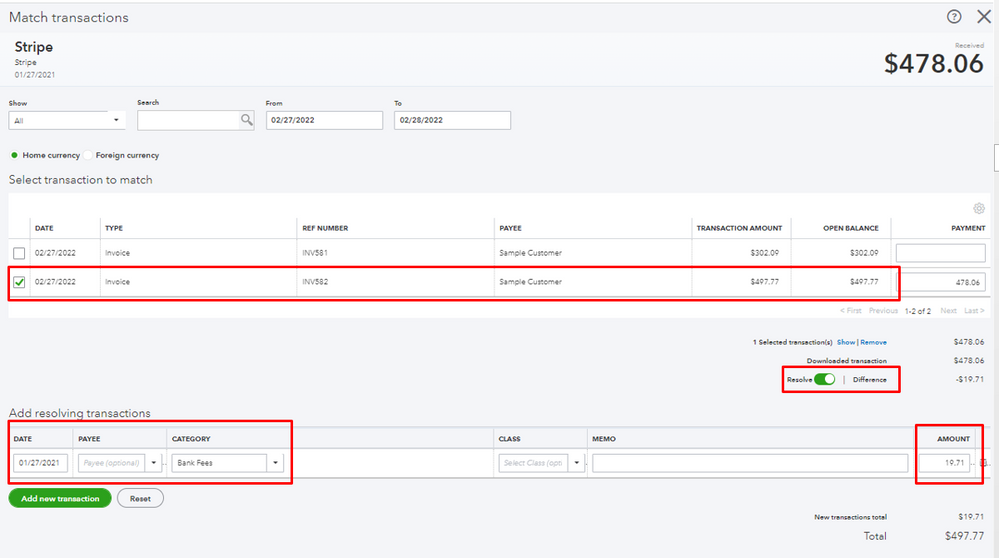

You can record the Stripe fee using the Resolve | Difference option from the banking page when matching the payment to the open invoice. Below are the steps to complete the process:

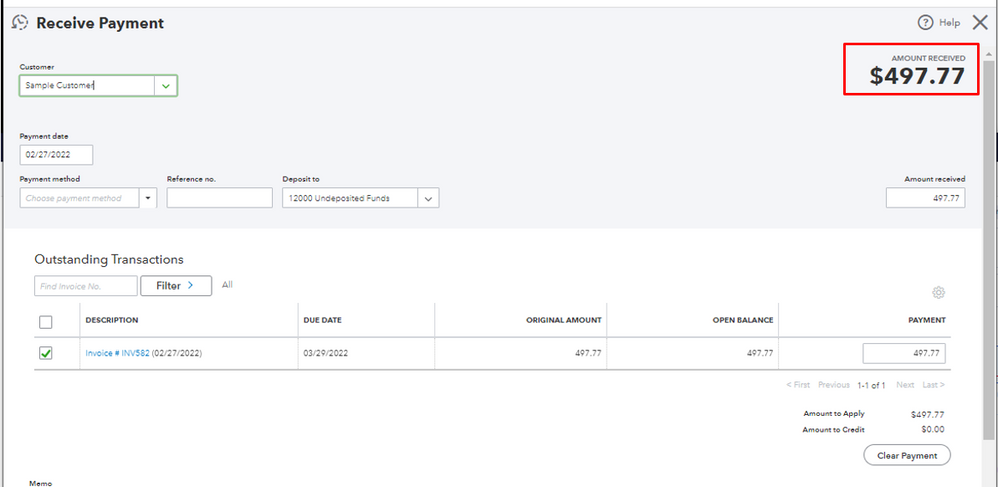

Another way to record a fee is by manually receiving the invoice payment, creating a deposit and entering the fee as a negative amount. Here's how:

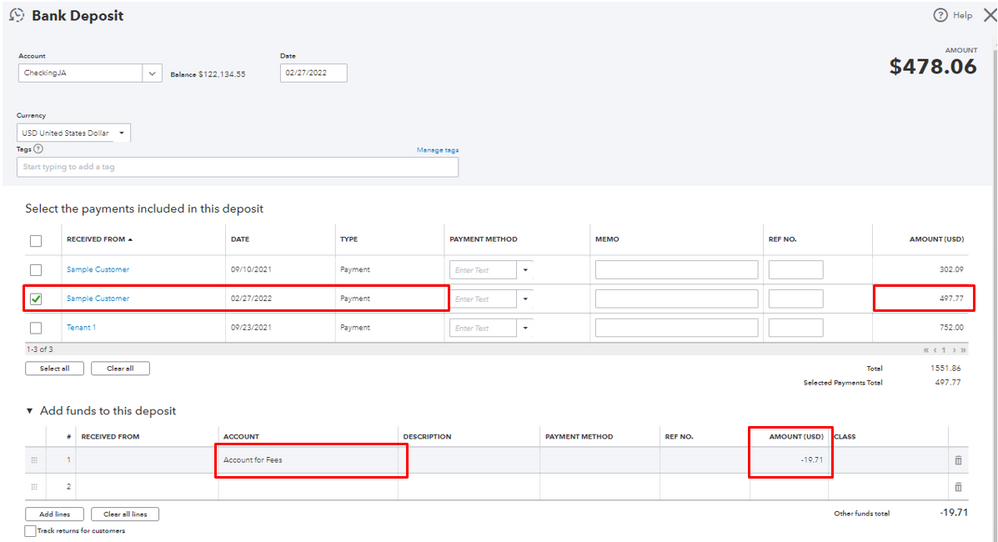

Once done, record the bank fees when creating a bank deposit and enter the charge in a negative amount. Here's how:

After that, you can now match them from the Banking page. See the sample screenshot below:

In case you want to reconcile the account, you can follow the guide in this article: Reconcile an account in QuickBooks Online. This will provide you with steps on how to manually reconcile your account that's not connected to online banking.

Let me know if there's anything else you need in QuickBooks, I'll be around to help. Have a good one.

Hi, serkanhaslak.

Hope you're doing great. I wanted to see how everything is going about matching and recording a Stripe fee. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Based on the first example you have given to match Stripe Transactions, there seem to be some missing steps.

Once I went to the matching transactions tab, I hit the check mark for the invoice the Stripe transfer is being applied to. It incorrectly makes the payment the same amount for the Stripe transfer.

By following your steps and entering the Stripe processing fee in as a positive number, it makes doubles the difference that is trying to be resolved. So I then made the fee amount a "negative" amount. Then hit the "Save" button, but there was a pop-up that stated the total I was trying to match did not match the "downloaded transaction" amount.

I believe I solved the issue by entering the "actual" amount that was paid by the customer towards the invoice, into the "Payment" space under that Invoice. That along with the "negative" amount for the stripe fee, made the difference "zero" out.

Then I hit the "Save" button and the transaction matched successfully. The final "Total" and "Downloaded Transaction" amounts have to match for the transaction to match.

Overall, good steps. Just missing a few vital steps...however I will hold my breath to see if everything actually is reconciled properly at the end of the month.

Hope this helps anyone who has the same issue in the future. It sucks because no one should have to manually add fees and resolve amounts...what if you have hundreds of transactions syncing between Stripe and QuickBooks monthly?

Originally, I was using QuickBooks Payments for processing all payments but started using a new Field Service Management software and it has Stripe integration. I would've have stuck to the Intuit ecosystem, but Intuit FSM software no longer utilizes QuickBooks Payments. Makes absolutely no sense, because I would have to jump out of that software just to take a payment in another software...But now with this whole manual entry of Stripe fees and resolving, I'm stuck jumping back and forth it appears.

Thanks for sharing such a detail, @PCE55.

The information you've shared will help other users to resolve their concerns about adding fees and matching your transactions in QuickBooks.

Keep in touch if there's something else I can do for you. I've got your back. Have a good day and stay safe.

Hi

All the above makes sense unless one syncs the invoices and payments with Dubsado which uses Stripe as the merchant. So the invoices and payments come from Dubsado, and the funding comes from Stripe into Quickbooks. The amounts reflect the fees already deducted. My cash is off and the funds are sitting in undeposited funds. I tried the above but nothing is working as I cannot change the amount of the payment to have the second option work. Any thoughts?

Thanks Adriana

Thanks for joining the thread, zullosinc1103.

I'll provide further details on how to successfully match Stripe transactions in QuickBooks Online.

You can choose to sync invoices and payments automatically or manually when you connect QuickBooks to Dubsado. Please make sure it has already synced in QuickBooks Online before you match it to Stripe. To view the current QuickBooks status, navigate to the Reporting menu on the Dubsado Dashboard and choose Invoices from the dropdown list.

The various statuses are listed below:

If you see the Not Synced status, you can select Sync invoice or Sync invoice and payments by clicking the three-dot icon.

All payments are going to be deposited into the Undeposited Funds (UF) account, and they're all going to show up in the Bank Deposit window automatically. You can then deposit before you can match it with the Stripe transaction.

Here's how:

For your reference, check out this article for more details: Record and make bank deposits in QuickBooks Online.

Once done, you may start matching the deposit to Stripe. I've also included the following guide to help you make sure your QuickBooks balance matches the total on your bank or credit card statement: Reconcile an account in QuickBooks Online.

If you need further assistance matching Stripe transaction in QuickBooks, let us know. We're always available to help you.

@Rose-A If you add one more step in "manually adding part" of your original post so that initial Invoice Payment is deposited to 12000 Undeposited Funds account all will work.

Receive Payment

...

Select the invoice

Select "12000 Undeposited Funds under" Deposit To

Hit Save and close

This way Bank deposit will work.

Hope this will help someone going forward...

Thanks,

R

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here