Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow to set up Charts of Accounts with a LOC - a short term liability - and pay vendors from?

Thanks for posting here in the Community forum, @ER222.

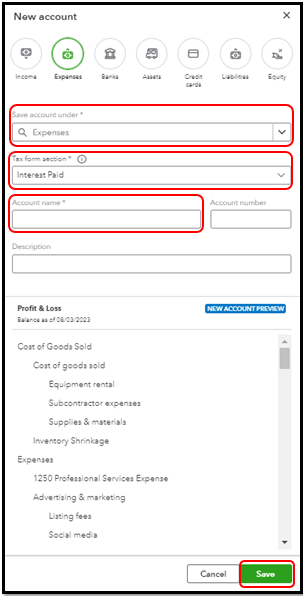

You'll need to set up two accounts to properly track a line of credit in QuickBooks Online (QBO). One account is for monitoring the principle, and the other is an expense account to track incurred interest. I'll gladly share the steps with you.

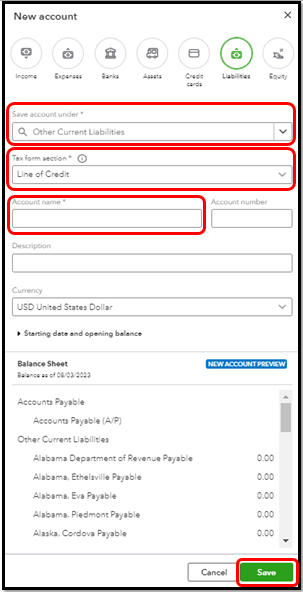

Let's start by setting up a liability account for principle tracking. Before you continue, make sure you’re in the Accountant's view.

Here's how:

Then, follow these steps to set up an expense account for the interest:

Moreover, make sure you record the bills or expenses when you pay for things with your credit.

When you make a payment, you can track what you pay back to your bank or creditor. Visit this article and scroll down to check out the two ways to pay back your credit: Set up and track a line of credit in QuickBooks Online.

Feel free to leave a comment below if you have additional questions about your QBO account. I'm always around to help. Have a good one.

Thank you very much for the instructions. I really appreciate it!

Your are always welcome, ER222!

I'm delighted to hear that my colleague Kevin_C has been of great help in addressing and giving you instructions on managing your chart of accounts. It is our pleasure to assist you anytime.

If you need further assistance handling any other QuickBooks-related concerns, we are available 24/7. Please don't hesitate to reach out to us again by clicking the Reply button. We wish you a prosperous year ahead with QuickBooks!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here