Hello, Suzanne65.

Thank you for reaching out to the Community. I'll be sharing some information as to why your company contribution is not showing up on the paystubs in QuickBooks Online.

Paystubs provide a record of your employee's earnings, helping them understand their taxes, contributions, and deductions, and allowing them to ensure they were paid correctly. If you have set up a Simple IRA for your employees, it will be visible in their paystub especially when you added a company contribution.

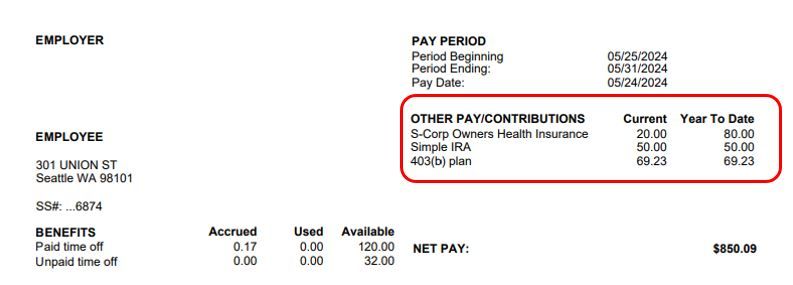

To access an employee's paystub, click on the Paycheck list below the Run Payroll button and then click Print under the Action tab. To view the employer contribution, check under the "Other Pay/Contributions" section of the pay stub in the upper right corner.

Here's a photo as a reference:

Moreover, if you're having trouble viewing the Pay/Contributions paystub/paycheck I recommend clearing your browser's cache. This will remove the historical data and allow you to access QuickBooks with a clean slate. Alternatively, you can also switch to a different supported browser.

Also, if you set up a payroll item in QuickBooks, it will automatically create an account in the Chart of Accounts, unless you create another account to track the amount.

I'm also adding these helpful modules you can browse to determine which plan you want to set up for your employees and review its contribution limits:

Thanks for coming to the Community, Suzanne65. I look forward to being able to help you with any concerns you may have regarding your IRA contribution in QuickBooks. Have a great day.