Thanks for the clarification, @moBama. I’ll help you track what's causing the double value in your income and correct it so you can manage your transactions smoothly.

It's possible that you've noted deposits and added them to a certain income account. You might have also recorded customer payments using the Receive payment option. This can lead to duplicate income.

To fix this, you can pull up the Deposit Detail report and remove the deposit. Here's how:

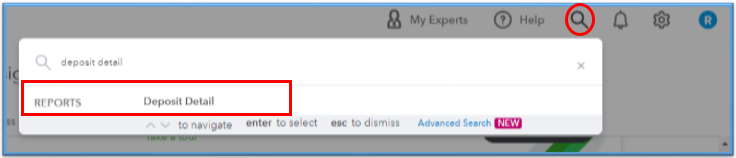

- Go to the Search icon on the top right.

- Type deposit in the textbox and then select Deposit Detail.

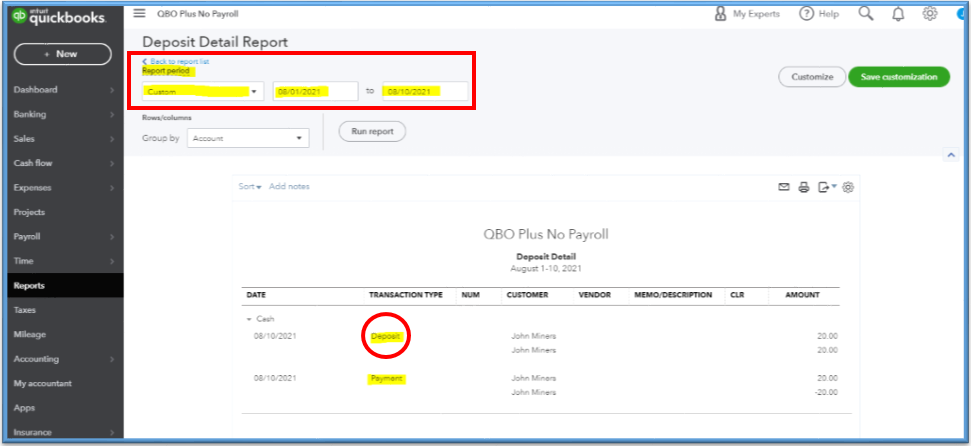

- From the Deposit Detail report window, change the Report period to when you recorded the invoice payments or deposits and then click the Deposit.

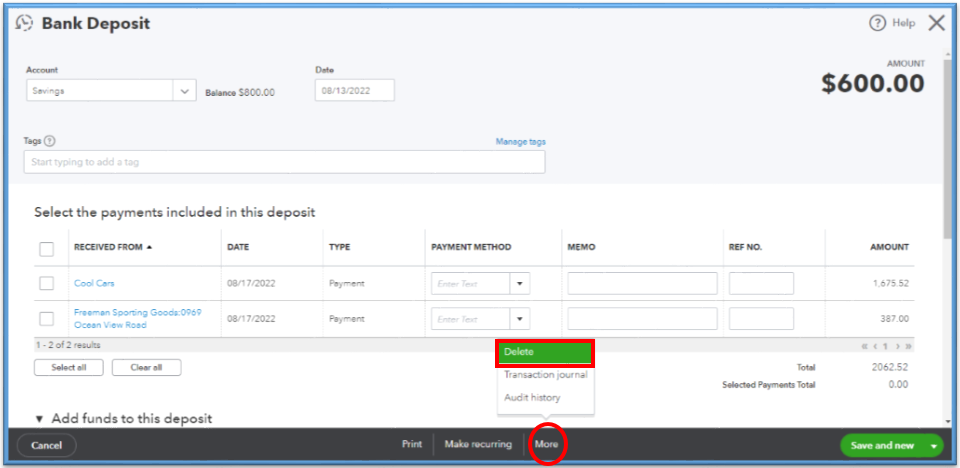

- From the Bank Deposit window, tap More and then choose Delete.

I’ve added some screenshots below for your reference:

You can also link your customer’s bank deposit to an invoice if you’re only recording their deposits and haven't used the Receive payment feature. See this article for the complete steps: Link a bank deposit to an invoice.

Additionally, since you've downloaded the entries from your bank, you might already have added them to your account register. Instead of putting customer payments directly into the account register, they should be matched to a specific invoice or deposit.

Here's how to get the recently added transactions back to the For Review tab:

- Go to the Transactions/Banking menu and then select Banking.

- In the Categorized/Reviewed tab, click the Undo button to return the added transactions in the For Review tab.

Once done, you’ll need to match the online banking entries to your QuickBooks records. For more information, take a look at this article: Categorize and match online bank transactions in QuickBooks Online.

Lastly, I’m adding this article that serves as your guide in reconciling your accounts in QBO effectively: Reconcile an account. This way, you can review and ensure that QuickBooks entries matches with your bank account statement.

Please know that you're always welcome to post again here in the Community if you need further assistance in updating your transactions or accounts. Just drop a comment below and I'm just around to help. Take care always.