Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

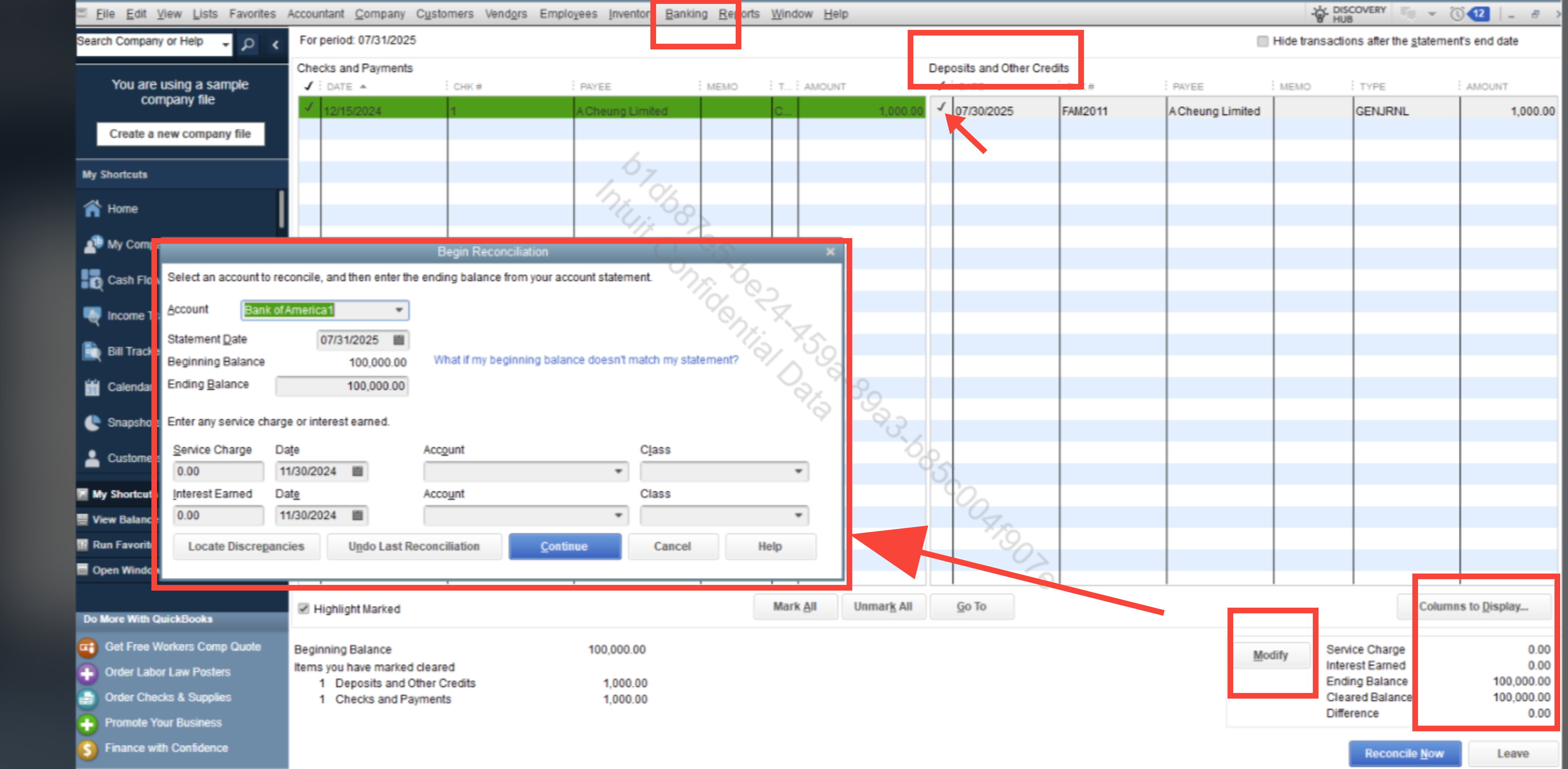

Buy nowI am working on my Bank Reconciliation and noticed that a Journal entry is showing up on the deposit/credit side. However, it is for a stale dated check from a prior year. Can I just go to the register and mark it clear. This is for Desktop not Online QB.

If the journal entry is to offset a stale check, then you should have the stale check on Checks and Payments side. Is the check there? If so, clear them against each other. If not, then what happened to the stale check?

Hi there, Claudia.

In QuickBooks Desktop, journal entries can affect either the debit or credit side, depending on the accounts involved. If you created a journal entry for a stale-dated check, it credited the bank account, showing as a deposit during reconciliation.

If you’ve determined that the journal entry is accurate and belongs in your reconciliation, you can mark it as cleared directly in the bank register. However, before doing so, it’s a good idea to ensure the entry was recorded correctly and aligns with how you’re handling that stale-dated check.

Here are some steps to help:

If you don’t see the stale check or journal entry, verify that both transactions have been entered with the correct account and date range to show in the reconciliation. Ensure neither one was archived, deleted, or voided.

In the Reconciliation Window:

These two items are offsets to one another, and clearing them together ensures they cancel out.

Let us know if you have any further concerns. We are here to assist you promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here