Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen I first set up the credit card account in 2020, its billing cycle crossed the 2019 year end, so I had to enter some card transactions and a payment from 2019 so that I could reconcile and balance that first 2020 credit card statement.

That 2019 credit card payment is still hanging out there on my checking reconciliation screen, uncleared.

How can I clear it or get rid of it?? What's the best practice?

Thanks,

Lisa

It's great to see you here, Kelly,

You can do an off-cycle reconciliation to make corrections to a previously reconciled account. This includes cleared transactions that were modified in the account register.

Here's how:

Please note that the end balance after the reconciliation becomes the beginning balance of the following cycle. If the new entries did not change the Ending Balance of the account, you no longer need to undo the reconciliation for the following period. Do otherwise if it does.

To learn more about the off-cycle reconciliation and how it works, see this article: Reconcile previously deleted and re-entered checking or credit card transactions

Let me know if you have additional questions or clarifications about the special reconciliation steps. I'll be right here if you need anything. Have a nice day!

I hope to return to this issue today or tomorrow. I've had other pressing deadlines.

Thanks,

Lisa

Good afternoon, @Lochkelly.

Thanks for reaching back out and keeping us in the loop.

Let us know, when you're ready, if you have any questions or concerns about the details my colleague provided above to help resolve your issue.

We're always here to have your back. Looking forward to hearing a good outcome!

I finally got a chance to work on this old, original credit card payment from when we converted to QuickBooks.

I tried your suggestion but since I have no "opposite transaction" (deposit) to match the credit card payment to, a mini reconciliation isn't working. What can I do now?

I'm being extra cautious so that I don't screw up our bookkeeping history.

Thanks,

Lisa

Hello again, @Lochkelly. I want to make sure you can clear all your transactions from 2019.

To clarify, did the amount suddenly appear on your checking reconciliation screen? You mentioned that you entered some 2019 transactions included in the first 2020 billing statement so that you can balance them. If you reconciled this payment before and unexpectedly showed up again, there may be an issue with your file.

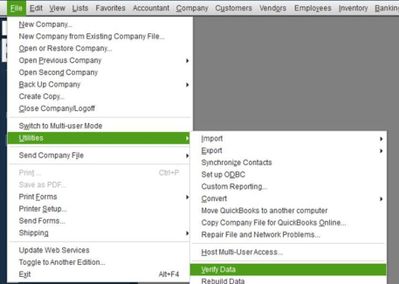

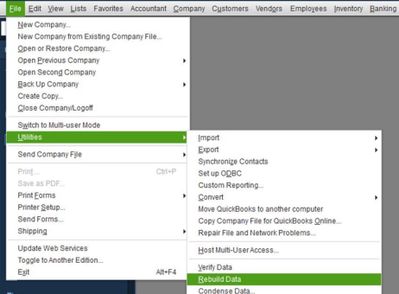

We can perform basic troubleshooting to identify what's causing the issue. You can run the Verify/Rebuild tool. Verify will detect any damaged data. Rebuild will attempt to fix the damaged data detected. It also allows your QuickBooks software to refresh the data inside the company file. Make sure to create a backup copy of your company file before doing the process. If there are changes that occur, having a backup copy allows you to restore it to undo the changes.

Follow the steps below on how to verify data:

Next, here's how to rebuild data:

Additionally, make sure your QuickBooks Desktop is up-to-date. This way, you always have the latest features and fixes.

Otherwise, if this was mistakenly uncleared from your register, you can do a mini reconciliation as suggested by my colleague. You don't need any opposite transactions as long as you get a difference of "$0.00."

Drop me a comment below if you have other concerns or follow-up questions. I'd be more than happy to assist you again, @Lochkelly.

No, it did not suddenly appear. I had to enter it when we started with Quickbooks in order to reconcile the first credit card statement. (We were formerly using CDM+ for accounting.) Since our checking statements run on a calendar month basis, the credit card payment was from the previous year, there was no checking statement including it to be reconciled in QB.

Lisa

@LieraMarie_A wrote:

Otherwise, if this was mistakenly uncleared from your register, you can do a mini reconciliation as suggested by my colleague. You don't need any opposite transactions as long as you get a difference of "$0.00."

That's my concern as it was not a mistake. I know that I won't get a zero dollar difference. If you re-read my original message, you will see that the credit card payment was necessary in order to balance the very first credit card statement and since that payment came from our checking account in QuickBooks it has been "hanging out there" all this time. In setting up QuickBooks for the very first time, the first credit card statement started in 2019 but our first checking statement started in 2020. So the 2019 payment to the credit card company appears in our checking account. Deleting it will throw the credit card account out of balance.

Lisa

Hey there again, @Lochkelly.

Thanks for reaching back out again on this thread.

If the transaction is showing as uncleared, that means it hasn't been reconciled. If the period has since been closed, you'll need to redo the reconcile and include the uncleared transactions in the new reconcile.

Review this guide as a future reference: Reconcile previously deleted and re-entered checking or credit card transactions.

I hope this helps answer your question in the end. Don't hesitate to come back if you need us. Have a wonderful day!

I hope this answers all questions and clears up any confusion. You see, there really wasn't negligence in not reconciling a transaction. I just knew of no way to do it. January 2020 was my first time setting up checking and credit card accounts in QuickBooks.

If only there was some way to either 1.) remove the $1731.07 payment without throwing off the reconciliation of the credit card account or 2.) enter a transaction on the checking side without throwing off the checking reconciliation. I'm at a loss here as to what to do.

Thanks,

Lisa

Hey Lochkelly,

Thank you for sharing this. For this situation, it will be best to connect with your accountant to see what would be best for your business. If you don't have one, no worries! We offer a ProAdvisor service where you can connect with experts within your area. All you have to do is select this link, enter your zip code, and browse through the options. Many even offer a free consultation!

Let me know how that goes! If you have any other questions, don't hesitate to let me know! My team and I will be here to assist! Take care.

Why not just not enter the payment at all? It was on a previous software and used to pay the previous statement. You would need to adjust the opening balance for the credit card to match. All the charges on the statement are the current charges so you are good. Reconcile as normal

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here