Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy bank had approved an overdraft line of credit for my checking account. How should I record this? My Checking account may have balance at times how qbo will record if a payment partially went from existing balance and rest from overdraft line of credit?

It's a pleasure to have you here today, amit6.

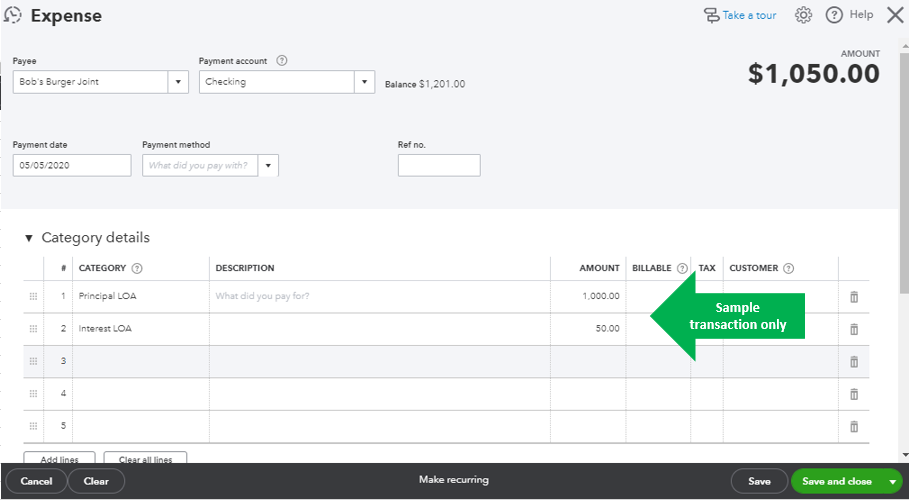

If you're partially paying the bank, you can record the repayment as an Expense in QuickBooks Online. Be sure to split the expense between principal and interest in the category details.

In case you haven't set up a line of credit, you can visit this article for a detailed instructions: Set up and track a line of credit.

Once done, let's proceed to creating the Expense for repayment. Here's how:

You can visit this guide on how to make a payment to your line of credit in QBO: Track what you pay back.

Drop me a reply below if you need more help. I'm always delighted to assist you. Have a great rest of the day!

over draft is NOT a line of credit as @Charies_M seems to think.

Over draft is just the banking paying your check for a fee, when you do not have the funds to cover the amount. All that happens is that the account balance goes negative, and you add in the fee charged driving it further in the negative. As you make deposits the bank takes the funds back raising the negative balance closer to zero.

Thank you all for your response.

Its an overdraft line of credit attached to same business checking account that is connected to my QBO. I agree, that as I use the limit the bank balance will go negative and I shall incur interest on used amount.

For example, I have $100 balance in my checking account and I pay a supplier $150. $100 of this payment will be my existing balance and $50 will be the credit that I receive from my bank. After this payment my balance should be -$50.

This is one transaction but this will be an ongoing process. How should I record above transactions and will I have to manually differentiate between credit from overdraft limit or my own balance every time?

I hope I am able to explain my question better. Please help!

Thank you!

Hi there, amit6.

Thanks for the sharing additional clarifications to your concern.

To make sure everything is aligned, you may reach out to your financial institution and verify if the fifty dollar is a principal line of credit or pure overdraft.

If your bank claims that this is a Line of Credit, you can perform the process I have shared above.

If its an overdraft, you can follow Rustler's recommendation and record it as a regular expense transaction and the enter the payment as a deposit.

Regarding your question on how to record the transaction, you'll have to manually differentiate between credit from overdraft limit or own balance every time.

I'll be right here if you have further questions. Keep safe and have a good one.

Hello Thanks for your reply.

My bank has setup my line of credit but they have added it as overdraft limit and they will charge me interest on the balance used from the overdraft limit. My account balance will become negative when I pay from this limit.

I hope you understand the situation here, how do I record this in quickbooks online.

Thanks for your guidance!

Thank you for providing follow-up details about your concern, @amit6. I'm here to ensure you're able to record the interest on the balance used from your overdraft limit in QuickBooks Online (QBO).

Let's create an expense to record the interest charged by your bank from your overdraft limit. Before that, I'd first suggest setting up a dedicated expense account to track it. I'll guide you how.

For the detailed instructions, see Step 2 from the Set up the accounts for your line of credit section through this article: Managing A Line Of Credit (LOC). It also provides you more information on how to track your LOC.

Once done, let's enter an expense and make sure to choose the expense account you've just created. You've provided a sample of $50 bank credit that you paid to your supplier above. With this, I used the amount on my screenshot below.

After that, let's go to the Chart of Accounts menu. Then, locate the expense account and click Run report from the Action column. This way, you'll be able to keep track of its transactions. View the screenshot below for your visual reference.

In case you're using bank feeds, you'll have to match the $50 charge from your overdraft limit to the expense you've entered. It helps you ensure there are no duplicate entries in QBO. Also, it keeps your records accurate before reconciling your bank account.

I'm just a post away if you need anything else. Enjoy the rest of your day, @amit6.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here