Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickbooks Desktop Premier 2021

After reconciling a bank account over 9 months, 4-5 previous months' transactions were deleted because they were coded wrong (deposits were coded as job incme versus a transfer from another account). These transactions were seemingly re-entered properly, but the Beginning Balance for reconciliation is now off by the exact total of these transactions. Help, I am driving myself crazy.

Solved! Go to Solution.

Hi there, @Rich428.

When previously cleared and reconciled transactions were voided, deleted, or modified some transactions may get unreconciled which affects your balance. Also, you can get the same result if the data file is damaged or corrupted. Let's get this sorted out.

To fix the incorrect ending balance, let's start with running the Reconcile Discrepancy report. Use this report to identify the transaction causing the discrepancy.

Here's how:

If the transactions show they were changed, you'll need to make the necessary corrections. For further assistance, I suggest consulting your accountant. If you have to add entries or you have modified previously reconciled transactions, you can perform a mini-reconciliation. Before doing so, make sure to create a backup of your company file to avoid data loss.

However, if you find no discrepancy in the report, I recommend following the solutions outlined in this article for possible data damage: Fix your QuickBooks Desktop company file.

For additional reference, I've attached links that you can use to prepare for year-end:

Drop me a comment below if you have any other questions. I'll be happy to help you some more.

Hi there, @Rich428.

When previously cleared and reconciled transactions were voided, deleted, or modified some transactions may get unreconciled which affects your balance. Also, you can get the same result if the data file is damaged or corrupted. Let's get this sorted out.

To fix the incorrect ending balance, let's start with running the Reconcile Discrepancy report. Use this report to identify the transaction causing the discrepancy.

Here's how:

If the transactions show they were changed, you'll need to make the necessary corrections. For further assistance, I suggest consulting your accountant. If you have to add entries or you have modified previously reconciled transactions, you can perform a mini-reconciliation. Before doing so, make sure to create a backup of your company file to avoid data loss.

However, if you find no discrepancy in the report, I recommend following the solutions outlined in this article for possible data damage: Fix your QuickBooks Desktop company file.

For additional reference, I've attached links that you can use to prepare for year-end:

Drop me a comment below if you have any other questions. I'll be happy to help you some more.

I am not seeing a drop down menu in Reports that offers "Banking"...?!

Hello there, @amaltz. I'll make sure you'll get the hep you need.

The steps shared by my colleague above are applicable in QuickBooks Desktop. Please see the screenshot below for additional reference.

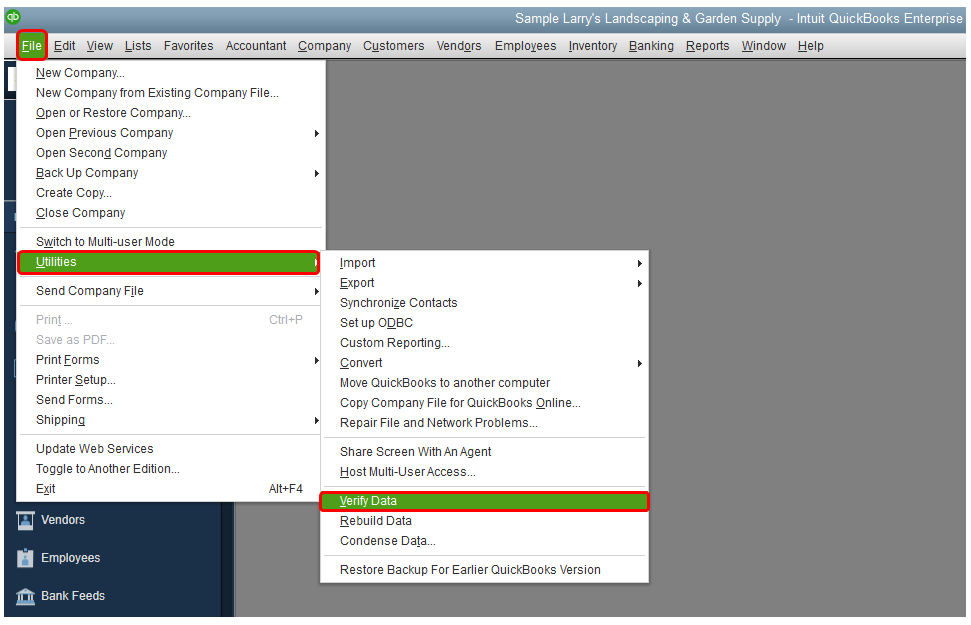

If you're using QuickBooks Desktop but not setting the options above, we'll have to fix data-related issues by running the Verify and Rebuild Data within your company file. The steps below will guide you through the process.

On the other hand, if you're using QuickBooks Online, that's the reason why you're not seeing the same options. You'll want to run the Reconciliation Report to view previous reconciliations. From there, you’ll see if everything has balanced out and check what transactions were recorded.

For additional resources, these articles contain solutions on how to resolve reconciliation discrepancies and handling reports.

Add another post if you have follow-up concerns with QuickBooks reports. Take care and have a good one, amaltz!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here