Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @Fairway LC.

You'd want to make sure to deposit the credit card payments to the correct bank account. Let me walk you through transferring your funds from the Undeposited Funds account to your desired bank account.

Now, you can review and categorize them with the downloaded transactions. Once completed, you can reconcile your account to make sure they match your real-life bank statements. Just go to the Accounting menu and select Reconcile.

Keep me posted if you have other questions about tracking your customer's credit card payments. I'm always here to help.

Just dropping by to check on you, @Fairway LC.

Making sure you're able to reconcile your bank account is my priority. That being said, were you able to deposit your customers' credit card payments using the steps I've shared?

Always feel free to visit us here if you have other questions and concerns about managing your accounts. I'm always here to lend a hand.

Hmmm... After looking they have been deposited within my books into my business checking account however they can't be reconciled. They're left over at the end of every reconcile session. My books balance except for these payments. All of these payments were made via the online interface. I can only assume they either didn't deposit to my checking account or there's a duplicate within my books? Thank you for your help.

Finding the cause of incorrect balances is my specialty, @Fairway LC. I'm here with some instructions to track it down!

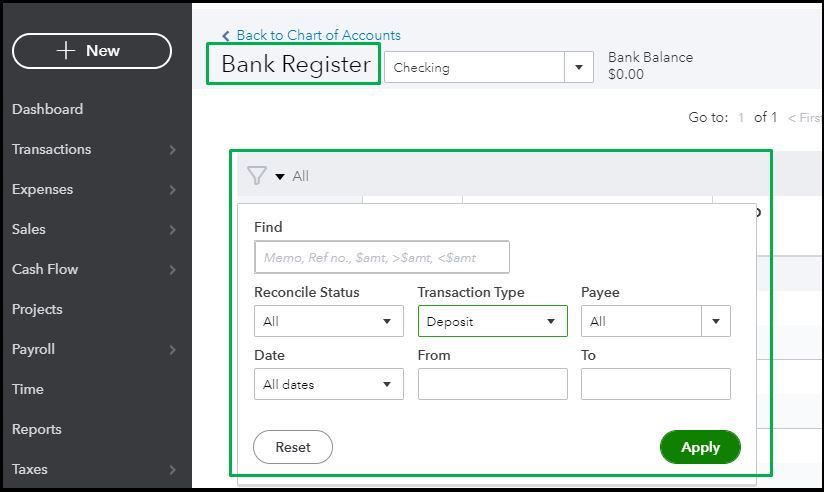

To start, let's check if there are duplicate transactions. To do so, you can use the Filter tool to locate them quickly:

For more details, please visit this link: Search for transactions.

You can also find duplicates by the use of your bank statement. You only need to cross-match the Bank statement with the Bank Register in QBO to determine if there are duplicates.

If you need further assistance with the process, I suggest contacting your accountant. They can share steps on how to find those duplicate transactions. If you don't have one, you can utilize our Find an Accountant tool.

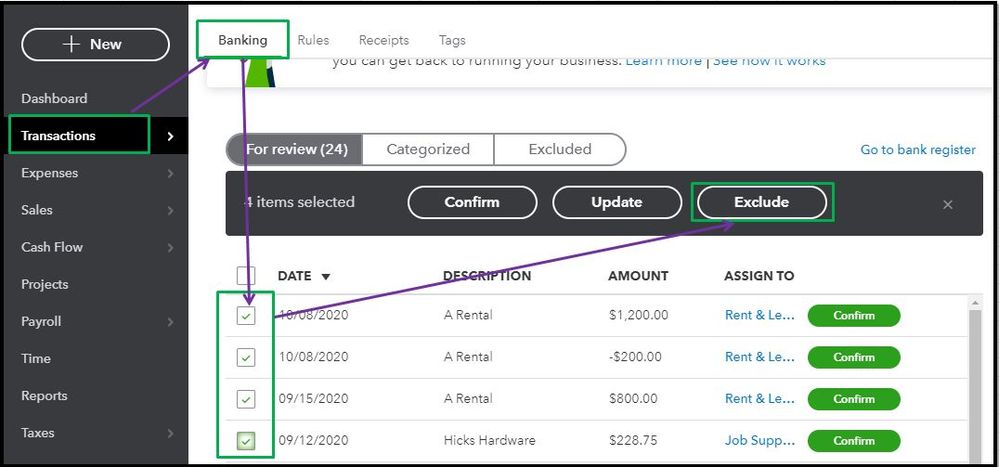

When done, follow along below to remove those duplicates.

Then, to guide you in matching your bank balance with those recorded in QuickBooks, head to our Reconciliation hub at this link.

Should you need anything else, don't hesitate to comment below if you have further concerns in reconciling your account in QuickBooks. I'm always around to help. Stay safe and take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here