Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey, The guys that do our shipping in the warehouse ship stuff and mark it as paid. The stuff that is paid is lumped together and deposited periodically by our payment provider. Can I mark the lump deposits as matched without actually matching the deposits to each individual invoice and it not reflect a double payment? Any help is appreciated and thank you!

Hi there, @MoonFrog.

Welcome to the Community! This is the place to get the answers you're looking for about banking and reconciliation.

When working with bank feeds, duplicates happens when you add downloaded transactions that you already entered manually in the program. To avoid this, you'll need to match the lump sum deposit with the invoices or payments (if they're already marked as paid).

Here's how:

Doing these steps will make the entries cleared (C), which makes it easier for you to reconcile.

Keep me in the loop on how these steps help you or if you have additional questions about managing bank feeds. Let me know in the comments. I'd be happy to assist further.

Thanks for the reply, I understand that matching the deposits to invoices is the proper way to clear things out. I am wondering if I can mark the deposits in the banking as received without matching them to invoices and having this not count as a duplicate. A lot of times the invoices are marked as paid by the warehouse crew. Then we get a bulk deposit from our website/payment system that includes many orders that are already marked as paid in quickbooks invoicing. Instead of matching each invoice that is already marked as paid I would like to just add this deposit as cleared without actually matching it to the individual invoices if possible. Thanks for any other tips or help!

Thanks for getting back to us, MoonFrog. I'll help you handle this properly.

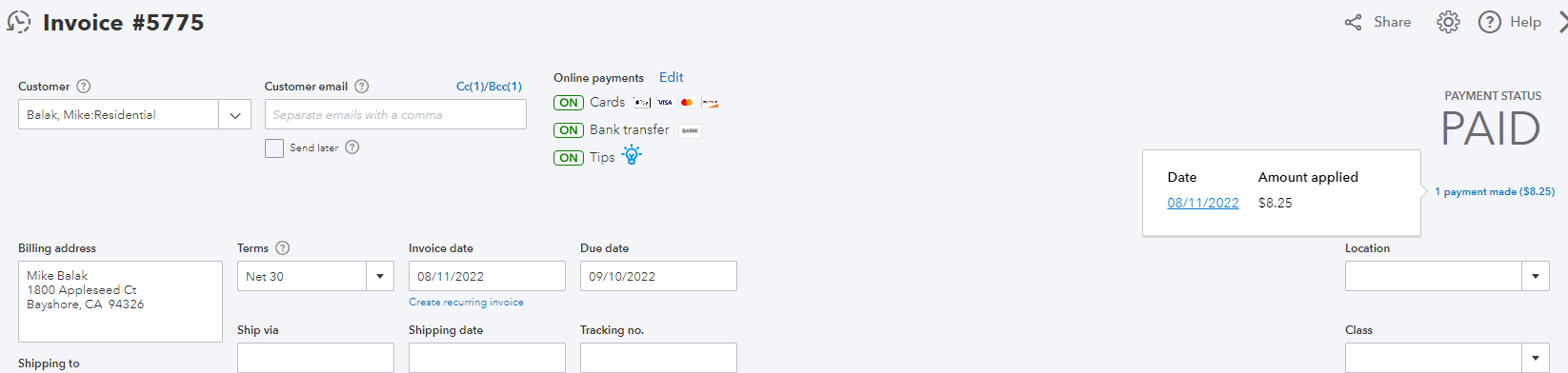

Since the invoices were already marked as paid, we can exclude the deposits from the bank feed. Before that, we'll have to ensure the payment is deposited correctly to the bank account or we can manually create a bank deposit for the payment. I'll show you how:

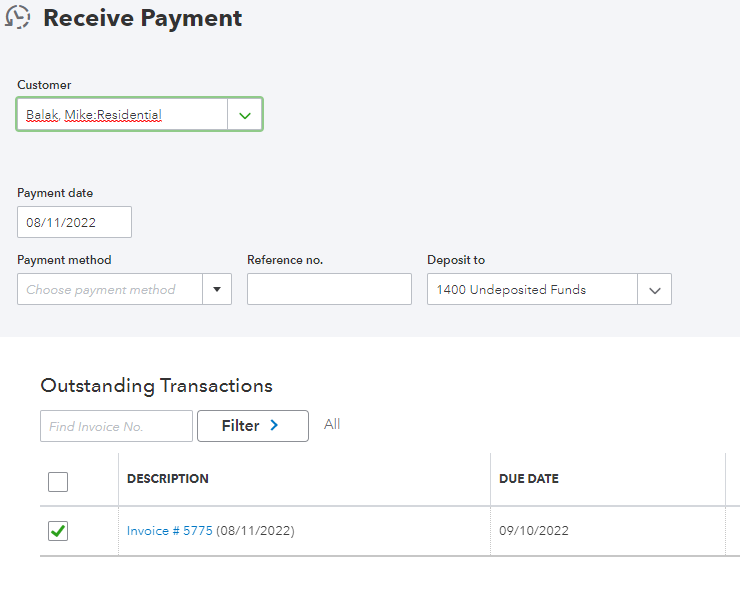

Open the payment:

Once done, we can exclude the deposits from the bank feed. Here's how:

Lastly, we'll have to manually clear them:

We can visit these articles for account-related issues and steps in reconciling your statements. This helps us keep our financial records accurate.

We're always here to help you if you have other questions about handling bank transactions and recorded data within your QuickBooks Online account. Stay safe and be well!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here