Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI use Quickbooks Desktop for personal finances and do not use it for tax reporting. I would like to be able to record loan payments that I make as an expense so that they show up on the P&L Report instead of the Balance Sheet. I realize that is not the proper way to do it but that is how I want it. Is there any way I can do this?

I've got your back on recording loan payments as an expense, @MMD3.

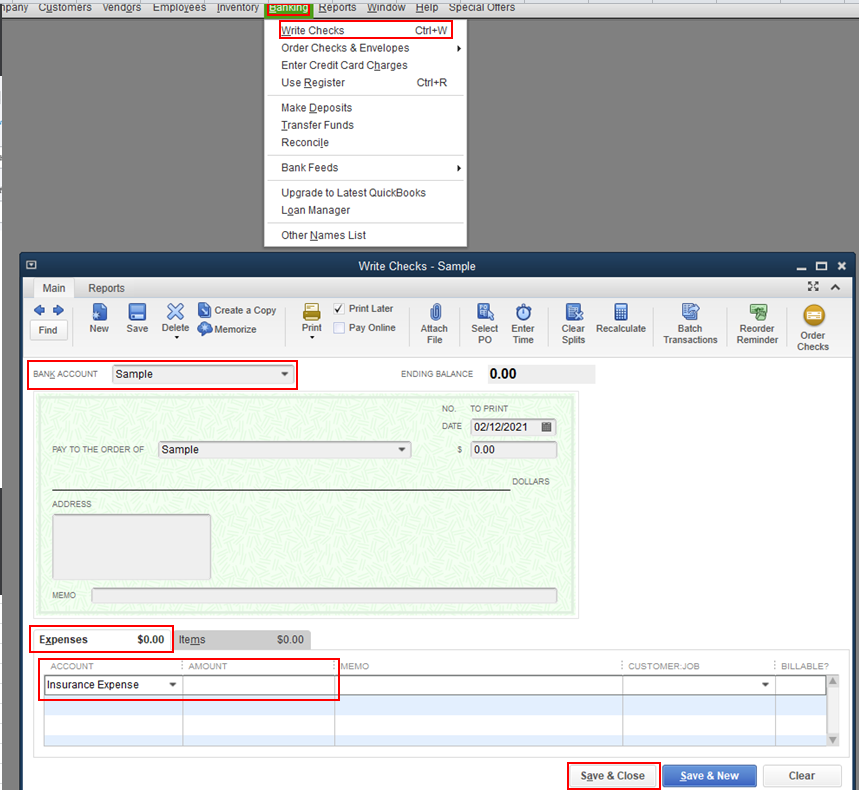

You can simply write a check for your loan payment and associate it with an expense account. This way, the transaction will show on your Profit and Loss report. However, this won't track the payables of the loan, only the payment. Here's how:

I'm adding this article to learn how to properly record loan payments in QuickBooks Desktop: Manually track loans.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Sure. Use an expense account on the payment and then it will show up on your P&L.

I set up an expense account for my mortgage principal payment and that does put it on the P&L and budget. My problem is that now the loan balance is not decreased. Is there another entry that can be made to make this happen?

Thanks for joining the thread and sharing your concern, @Thomas46.

I'm here to give additional insights about recording loan repayments.

The expense account you set up for your mortgage payment won't show on the P&L budget report. Instead, it will show on the Balance Sheet report given that it's a payment for a liability account.

In addition, ensure to record the loan payments correctly by filling in the right information under the Expense tab. I'll show you how:

Here are some reminders before repayment:

For more information on how to manage loan payments in QBDT, click on this: Manually track loans in QuickBooks Desktop.

It's always my pleasure to help you. Just fill me in for additional queries about this matter or QuickCooks. Stay safe!

How can I balance my P&L report to my budget when the principle payment of our loan is recorded on the balance, which is the right way.

Since your only using this for personal tracking and do not need to use in tax reports, here is a "quick and dirty" solution.....

Create a bill for the total of the loan and expected total interest expense (which should be stated with loan docs) and then enter a bill payment for each months expense payment. The only issue with this is that any deviation from consistent, regular payments of the monthly amount (i.e. prepayments, overpayments, minimum or late payments) will effect the total amount of interest over the life of the loan, meaning your original bill total will change... But this is how you could quickly allow for the total loan value to decrease as paid, as creation of the bill itself creates the liability on the balance sheet while the actual payment expenses show on the PnL....

I wouldn't use this if you need to track and report accrued interest though as the amount of each payment assigned to interest vs principle within each payment is calculated based on its proportion of the total original bill, and not an accurate accural of interest...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here