Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI purchased a company's assets (thus forming a new company) but bought the old company's name as part of the transaction. So now I have a new entity with their name.

As such, payments for their outstanding open invoices at time of sale are being collected on their behalf and I post them to a liability account (since I owe that money to them at some point).

The problem I have is that a customer just sent me a single lump ACH payment which covers 3 of our invoices and the remainder goes to the liability account.

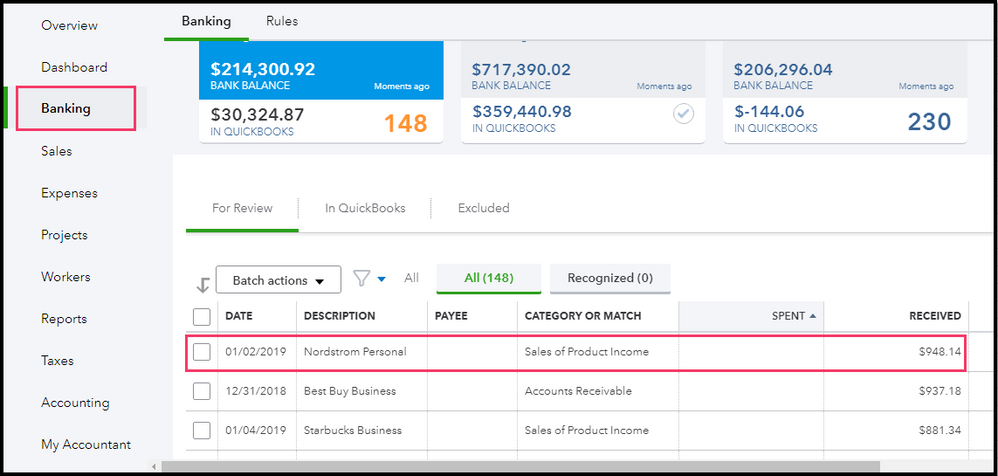

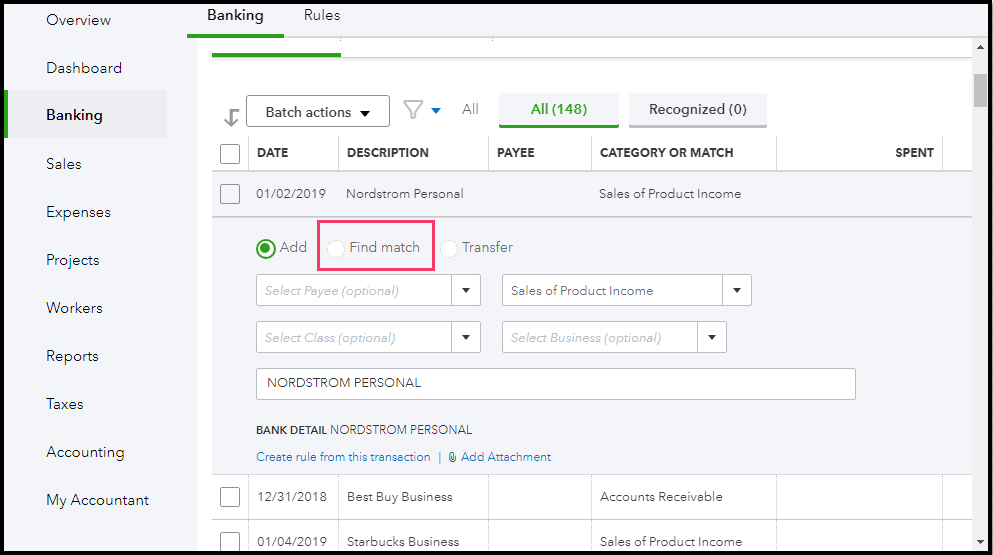

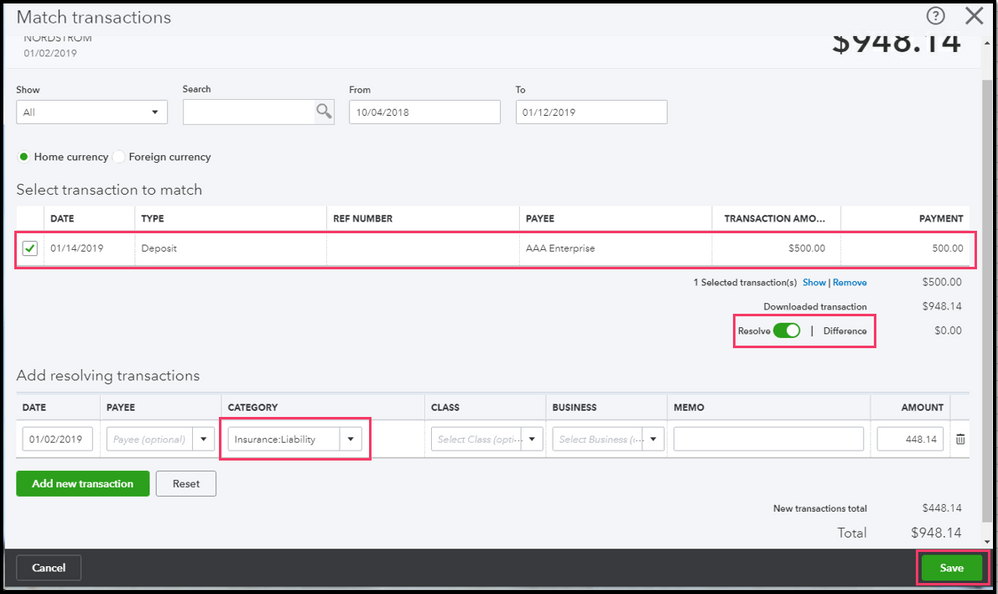

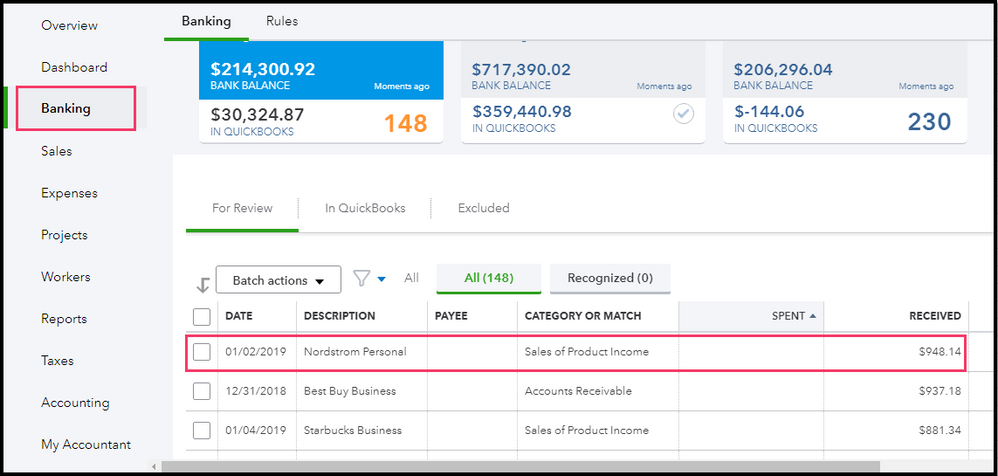

So I went into 'Receive Payment' and marked the 3 invoices as being paid by ACH, and then put them to undeposited funds. Then the ACH showed up in the banking feed but I can't figure out how to properly split it so that it puts part into the liability account and the other 3 against the invoices...

Do I just change the received payment from Undeposited funds to the bank account and then split the deposit between the liability account and the bank account and call it a day, or will that double up the amount in the bank since the receive payment *and* the deposit are both putting money towards it?

Solved! Go to Solution.

You're almost there, @Adalius.

The next thing to do is create a bank deposit for the three payments and deposit them to the right bank account.

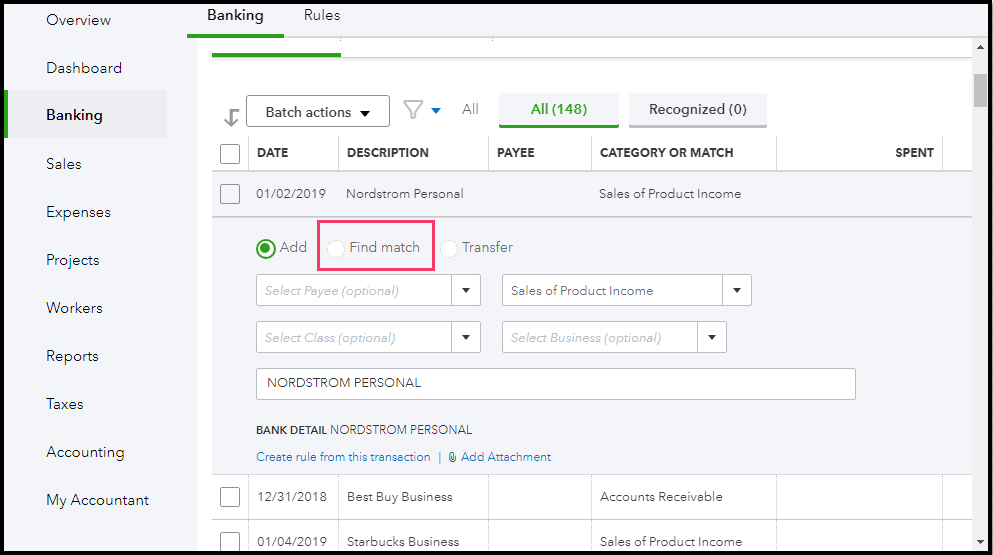

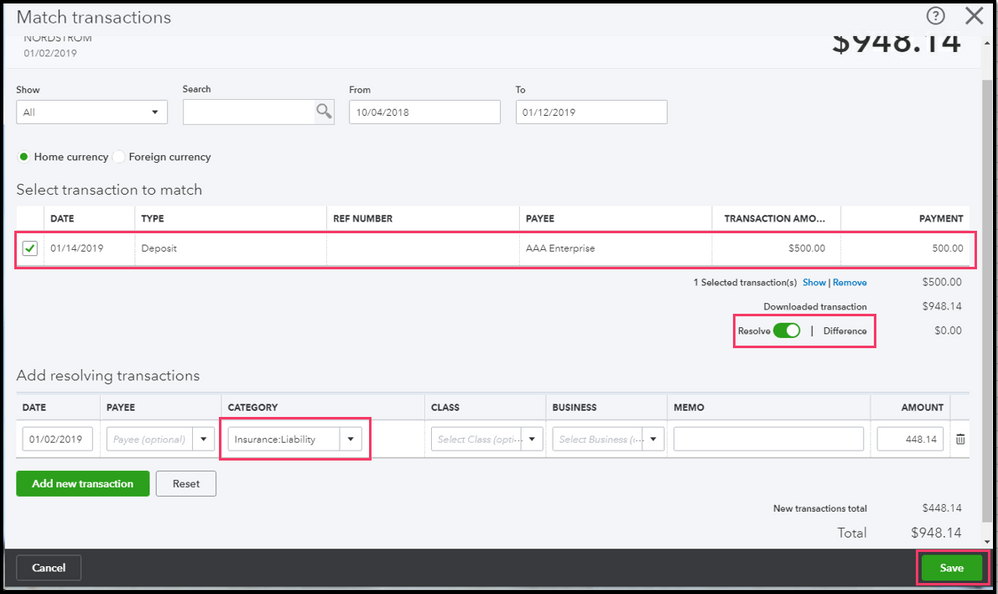

Once done, you can find match downloaded transactions, then resolve the difference in your banking feeds. This way, you'll be able to see the remainder and deposit it to your liability account.

Let me show you the steps for additional guidance:

I've added this article for more details with find matching transactions : Add and match downloaded banking transactions.

Let me know hos this goes by leaving a comment below. I'm always around here in the Intuit Community whenever you need help.

You're almost there, @Adalius.

The next thing to do is create a bank deposit for the three payments and deposit them to the right bank account.

Once done, you can find match downloaded transactions, then resolve the difference in your banking feeds. This way, you'll be able to see the remainder and deposit it to your liability account.

Let me show you the steps for additional guidance:

I've added this article for more details with find matching transactions : Add and match downloaded banking transactions.

Let me know hos this goes by leaving a comment below. I'm always around here in the Intuit Community whenever you need help.

I split my phone bill, but the original bill still shows, (so now there are 3 charges to Verizon for that day) so is it the original bill still going to be deducted? Should I exclude the original bill?

TIA!

Thanks for reaching to the Community space about your split bill concern, @Lori H.

I want to make sure this gets taken care of for you. I just need some more details about the issue.

How did you enter or record the split phone bill? Is this an online banking transaction or did you manually enter them in QuickBooks? If the original bill is just a duplicate from your split phone bill, then you can exclude it.

If that is not the case, please let me know by adding a comment below. I'm looking forward to your response.

Hi,

Thank you for responding. So far this program has a lot of limitations that are making it hard to work with, especially not being able to have custom categories. They don't match what my accountant wants i.e cell phone, business expense, on personal no medical or dental etc...and I can't find a way to make it work. It's been very frustrating.

After I posted the question on splitting my bill the duplicate went way.

Is there a way that I could have a separate one for my personal to keep my business and personal completely separate. Is that possible to create another separate one without having to pay for another account? Hopefully they will work on improving the customization capabilities of this program!

Thank you again for your response, Lori

and how come if I search for categorizes i.e. advertising

only 2 come up, but when I am looking at my whole year many of them come up. the search tab seems to flawed?

Thanks for getting back to me, Lori H.

I want to let you know that we're taking note of your feedback and suggestions to improve the experience we're providing.

Meanwhile, I believe your concern about the split bill has already been resolved. However, if you have additional questions, just keep me posted.

Regarding your second question, yes, you have the option to create separate accounts for personal information and your business. You can either set up a new parent account or create two sub-accounts.

Here's how:

About your Search tab inquiry, the system only detects the word "advertising" if it was used for a customer, vendor, transaction, or report, and not accounts. Most likely the word "Advertising" was added as a description that's why it shows as a result. To get all the transactions under a category, you'll have to run and customize the reports (which you already did).

That should do it, @Lori H. Please remember I'm here anytime you have additional questions or concerns with QuickBooks Online. You can reach out by posting a response below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here