Welcome to the Community, cfwnole.

I’m here to help and guide you on how to record and remove the late fees. Let’s use the Assess finance charge to record the late fees or interest on unpaid balances.

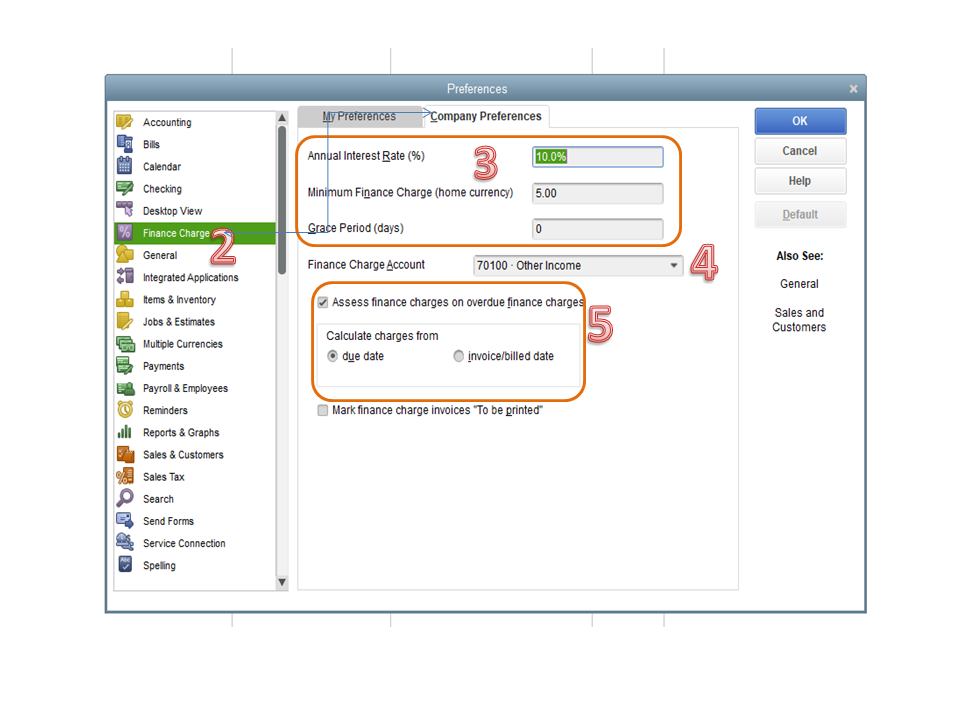

To activate the feature:

- Tap the Edit menu at the top bar to select Preferences.

- Choose the Finance Charge menu on the left panel to choose the Company Preferences tab.

- Fill in the Annual Interest Rate (%), Minimum Finance Charge, and Grace Period (days) fields.

- Click the Finance Charge Account drop-down to choose the account you use to track income.

- In the Calculate charges from section mark the box for the correct selection: due date or invoice/billed date.

- Press OK to save the changes.

Next, you’ll have to assess the late fees in QuickBooks. For detailed instructions, click here and proceed directly to the Assess finance charge section.

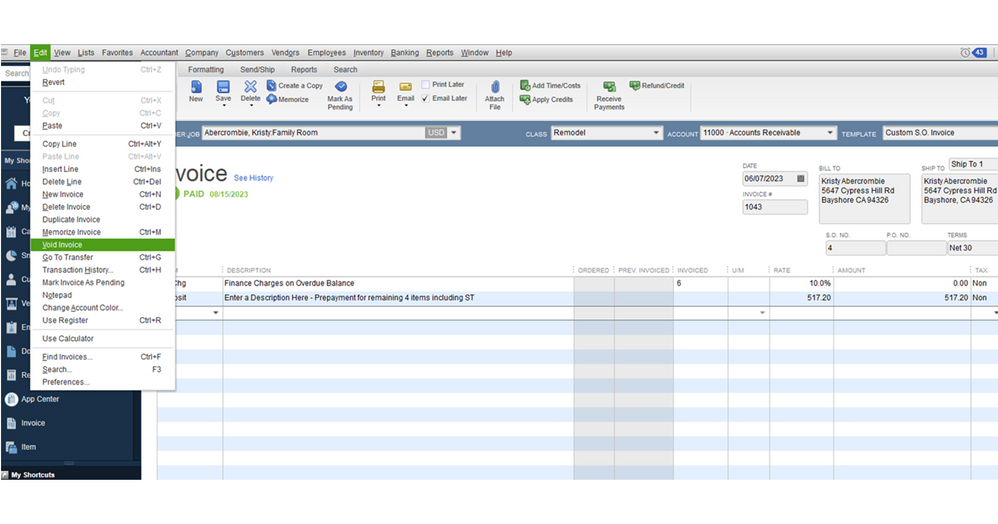

Next, void the invoices where the late fees are recorded. Here's how:

- Open the invoice you want to void.

- From the main QuickBooks menu, choose Edit and then Void Invoice.

- Click Save & Close to keep the changes.

The invoice amounts are changed to zero and marked as VOID. For future reference, here's a link containing a breakdown of articles to help manage the company's income: Sales and customers

If there’s anything else I can help you with, click the reply button. I’ll be right here to assist further. Enjoy the rest of the day.