Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

I can help you get all your missing purchases, @mikelv98.

When adding transactions from your bank feed, QuickBooks depends on the information from your bank.

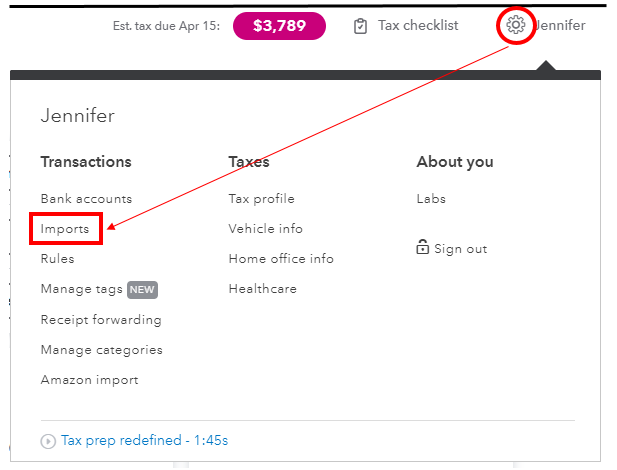

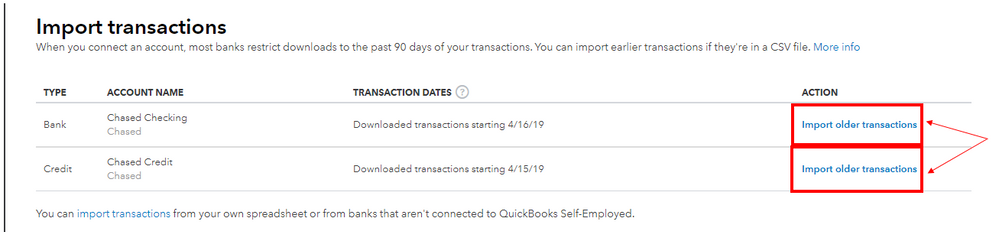

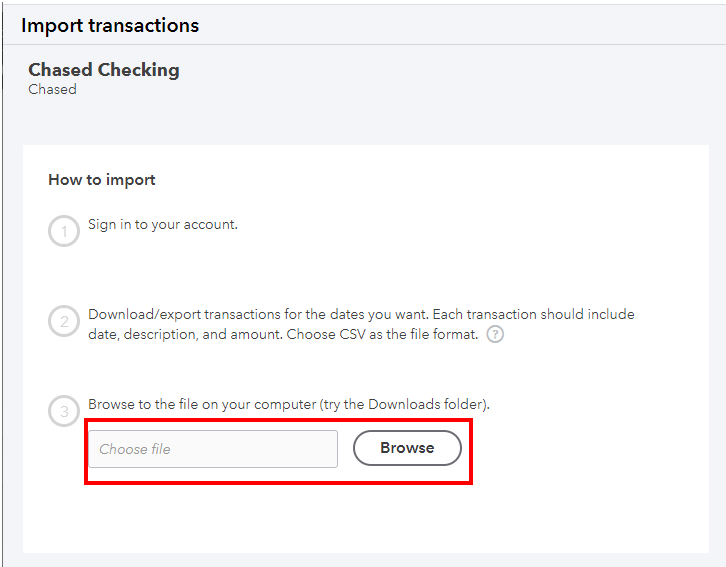

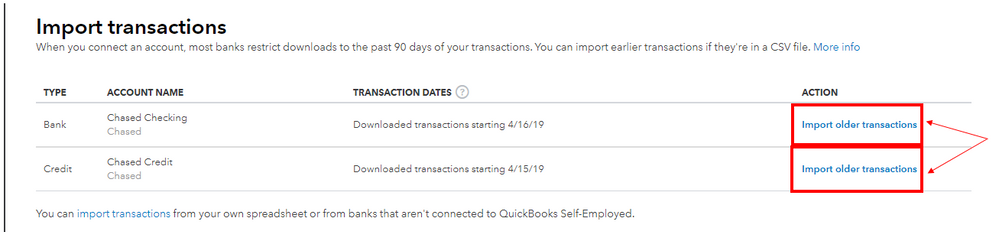

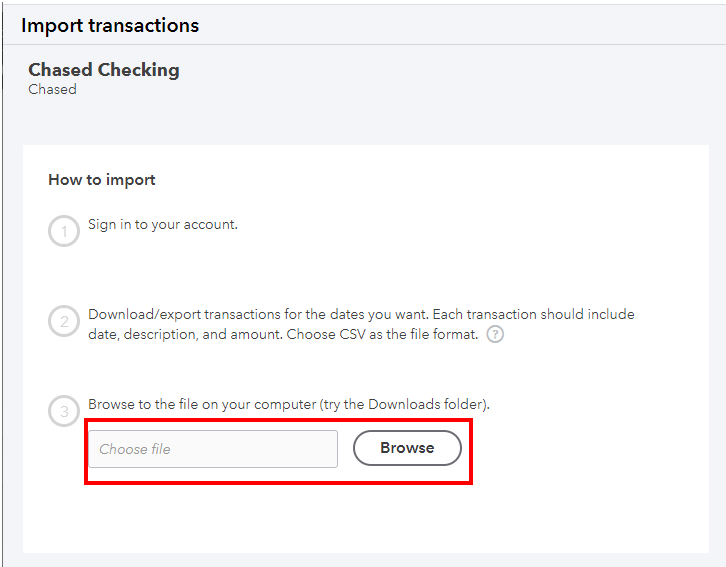

You have the option to add these purchases manually using CSV format. You’ll want to export the events from your bank and then import them into QuickBooks. Once you’re ready, you can follow these steps below to import them:

You can use this detailed guide to manually import transactions into QBSE. This helps you ensure all purchases will be entered successfully. In addition, here’s a reference to categorize the transactions.

I’ll be here anytime if you need further assistance with your bank entries. Have a good one!

I can help you get all your missing purchases, @mikelv98.

When adding transactions from your bank feed, QuickBooks depends on the information from your bank.

You have the option to add these purchases manually using CSV format. You’ll want to export the events from your bank and then import them into QuickBooks. Once you’re ready, you can follow these steps below to import them:

You can use this detailed guide to manually import transactions into QBSE. This helps you ensure all purchases will be entered successfully. In addition, here’s a reference to categorize the transactions.

I’ll be here anytime if you need further assistance with your bank entries. Have a good one!

Thanks for the response MadelynC. I had found this info in the through the virtual assistant as well and it does work! My concern was why the problem occurred in the first place as I am planning to use QuickBooks for tax purposes this year. With the IRS we want to be absolutely certain that everything is accurate so it might be a better practice to upload all transactions with a .CSV file in the first place at least as far as Capital One bank cards are concerned. I also called a representative and she told me that this can happen if you don't log into your QuickBooks account at least twice a week. I had no idea that was a requirement but I'm sure it is somewhere in the instructions and I just missed it. We go months without logging in so this seems to be another good reason not to depend on automatic synchronization between this software and my bank card. Other than that it seems to work well for the most part.

I just wrote a detailed reply that disappeared once I logged in. In short:

Thank you for the response. This works! Do not depend on automatic synchronization between QuickBooks and Capital One bank cards. A phone representative from QB told me that I must also log in at least twice a week to prevent this problem from occurring. That may not always happen so I'll be going through my transactions one at a time to make sure everything is recorded properly each year. With the IRS we cannot be too careful about accuracy.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here