Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI closed one bank account and opened a new one. I used "transfer funds" in QB Desktop to move the money from the closed account to the new account. How do I reconcile the closed account? The closed account reconciliation shows the deduction to close the account but it also shows the same amount of $$$ as a discrepancy. How do I fix this?

Glad to see you in the Community, CS2020.

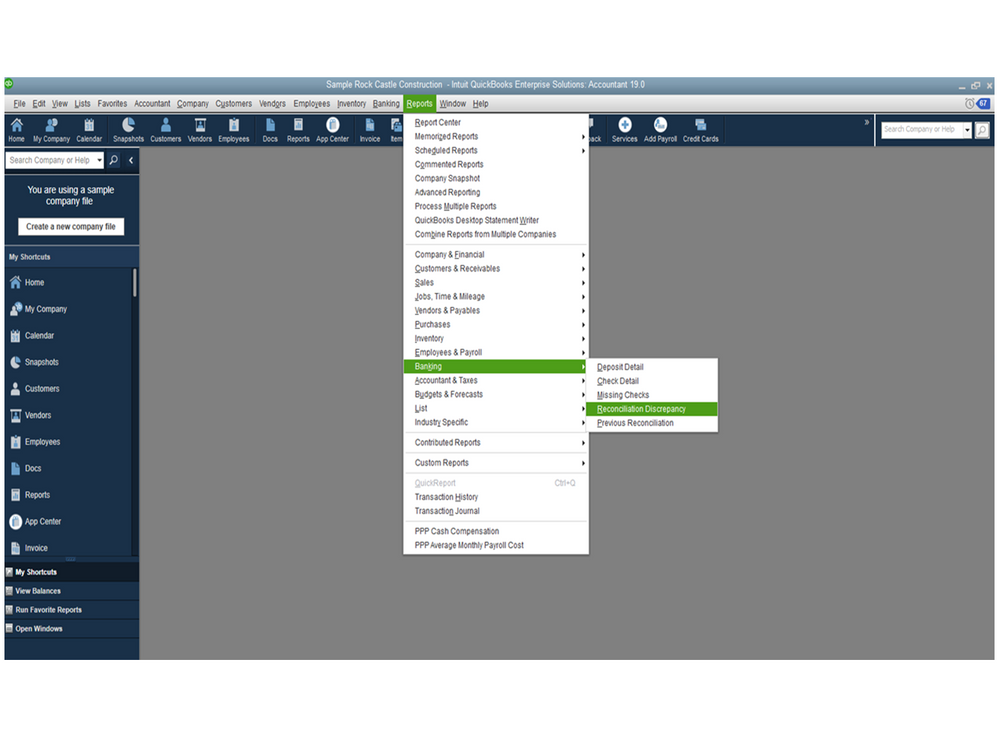

In QuickBooks, there are several ways to fix reconciliation issues depending on the scenario. Based on the information, you can run any of these reports to find the transactions causing the discrepancy: Reconciliation Discrepancy, Audit Trail, and Previous Reconciliation.

Then, undo the previous reconciliation and reconcile again. Otherwise, let QuickBooks enter an offsetting adjustment.

For this one I’m using the Reconciliation Discrepancy, follow these steps to build it. Here’s how:

This will display all entries that were modified since the last reconciliation. From the list, look for the one that’s causing the difference. Once found, take note of the transaction date and the Entered/Last Modified.

When you’re ready, continue performing the troubleshooting in this article and proceed to Undo a previous reconciliation and redo it section: Fix beginning balance issues in QuickBooks Desktop.

I’m also adding some articles to help you in the future. From there, you’ll find the complete instructions on how to perform the following.

Keep me posted if you have any clarifications about the process or other QuickBooks concerns. I’m always ready to answer them for you. Take care and have a great day.

I’m back to check if everything is taken care of, CS2020.

We’re you able to find the discrepancy and reconciled the account? It’s my priority that your records are in tiptop shape.

If you encounter any hurdles performing any of these steps, leave a comment below. I’ll be right here ready to lend a helping hand. Wishing your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here