Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSomeone help please! Newbie here, took me a bit to decide if QBO is worth it. I got done with setup, but noticed issues when I checked the balance sheet report--my checking account is a negative (I was told this should not happen)!

First a quick background as this might be pertinent. I have an UMBRELLA business A, holding a PROPERTY business B (which hold a rental property). They both have their own checking accounts. So renter pays their rent, gets deposited to business B, then transfers some funds to business A, which pays off a HELOC/long term liability loan.

Going from business B to business A, it is just recorded as (click of) TRANSFER of FUNDS for the appropriate business accounts. After rent payment, business B gets a deposit. But the transfer doesn't have any real entry? Not sure about terms. But then business A gets an expense in terms of payment of longterm liability/HELOC. I think this is causing the negative in the business accounts. Appreciate the help in advance!

Thanks for reaching our Community support, Jack Bauer.

You can use the Transfer option to transfer funds between your accounts. I'll show you the steps below:

Check out this article to learn more about transferring funds: Transfer funds between accounts.

Since you're new to QuickBooks, we have easy-to-access articles, webinars, and video tutorials that will help you in familiarizing the different tasks, features, and functions of QBO. Below are the following:

Get back to me if there's anything I can help you with during the process of fund transfer. I'd be happy to assist you further. Enjoy the rest of the day.

Thank you so much Charies for the reply. I may not be explaining clearly I apologize. The funds have been transferred using the "mark as transfer (or something like that)" button on the Categorize tab. And I double checked they are the correct bank accounts that are used for the transfer. My issue is the bank accounts are showing up as negative on the balance sheet after the money flow I explained in my post. I'm wondering if it's the transfer funds button that is causing this, and what to do with it. Thank you again.

Thanks, for getting back to us, Jack Baue.

Allow me to share some information about why you're getting a negative bank balance in QuickBooks Online.

The negative numbers on the accounts indicate that the company paid more than the expected amount due to a credit balance. This can be corrected by creating a Journal Entry to credit the affected accounts. This way, the balance will be zeroed out.

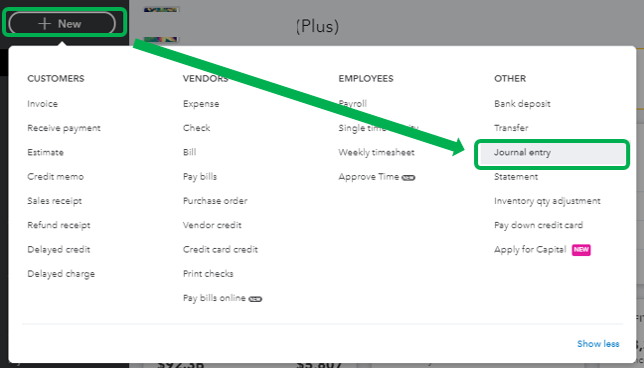

Here's how:

Also, I'd suggest checking its transaction report. This way, we can track all the transactions associated with your bank account.

Here's how:

I've got a visual guide on Understanding the Balance Sheet: Asset, Liability,; and Equity. This contains helpful information about managing the balance sheets in QBO.

Additionally, you can get more insights about the Chart of Accounts in this write-up: Learn about the chart of accounts.

Get back to me if you need further assistance managing your banking transactions. Drop a comment below and I'll get back to you as soon as I can.

Thank you. Is the 'transfer' funds in the categorize tab (for bank transactions) not working as I thought it would? Because why do I need to add journal entries to correct it? I looked at one of the bank accounts that is negative. The transfer of funds from bank A to bank B as a contribution did not increase the balance of bank B. Hence it became negative as it only recorded expenses. Thank you for your help with troubleshooting.

Allow me to step in and share some insights to ensure your bank accounts have correct balances, Jack Bauer.

You need to manually categorize transactions downloaded from your bank.

QuickBooks will only automatically categorize them if you have set up a bank rule. Check out this article if you need to learn more about this: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Also, you don't need to enter a journal entry since you only need to make sure that your transfers are categorized under income, not expenses. That way, your bank accounts won't have negative balances.

To help categorize your bank transactions, please browse this article as your guide: Learn how to review downloaded bank and credit card transactions and put them in the correct account....

I'm also adding this article in case you need help with tracking loan payments: Set up a loan in QuickBooks Online. It'll show you one way to put the loan money into your bank account.

Stay in touch with me if there's anything else you need. I'll be right here to guide you.

Thank you again everyone. I've watched all the videos suggested. My issue is the RECORD AS TRANSFER button on the categorize tab. When I use this, it seems to not record it as a deposit on the receiving account. Or something like that. Wondering if the issue is the 2 bank account the money flows through before the umbrella business pays the loan (as an example). I realize it doesn't make sense to record the same money recorded as income when RENTER pays BANK/BUSINESS B which transfers it to BANK/BUSINESS A which pays a HELOC loan in the end. As a side note, it is set up like that for asset protection. Thanks for the patient everyone! --noob

Hello, Jack.

I'd like to step in and shed some light about the transfer process.

The general rule of the thumb is that we want to follow what happened in real life. And yes, transfers are normally recorded as "Transfer" in the checking account's register instead of "Deposit."

Now, let's go back to the negative balances issue. In the Banking Feeds, a different transaction may have been selected so it's one thing to take note of.

If this is the case, we'll want to go to the Categorized tab and click on Undo to remove the entry.

Review the downloaded and categorized entries, and if you manually uploaded those transactions, check the Spent and Receive amounts.

QuickBooks will automatically determine the transfer amounts and pair the transfer entries together as seen here:

Another reason is that when setting up those checking accounts, an opening balance may not have been entered. This can cause some issues on the succeeding entries when recording them.

In this case, we can enter a journal entry to add the balances on your business checking account. We can take a look at this article as a guide: What to do if you didn't enter an opening balance in QuickBooks Online.

Let's also make sure that the loan entries and the corresponding payments are recorded properly. I see that my colleague had linked the article. Just for convenience, we can review the steps here: Set up a loan in QuickBooks Online.

After correcting the balances and recording the entries, we can take a look at the videos if you need help with QuickBooks Online (if you haven't checked them out yet): Tutorial videos.

If ever you need help with the reconciliation process, let's take a look at this guide for more details: Reconcile an account in QuickBooks Online.

I'm ready to help again if you have more questions about your entries. Do you have concerns in setting up your QuickBooks Online account? Let me know and I'll gladly lend a hand.

I tried exactly this but it looks like I did it right the first time. Thank you first for the detail and screen shots, they were extremely helpful. The problem remains in the balance sheet.

I think I found out the problem (not necessarily the solution).

My QBO setup in the plus subscription uses LOCATIONS for the holding business (business A) and CLASSES for the property holding businesses (business B). There are 2 total locations and a few classes below the locations.

So what I did was make a balance sheet which filters them via LOCATIONS. I want to see the balance sheet specific to each umbrella business (business A in our example).

The default balance sheet actually has correct positive numbers. It's when I used my customized balance sheet, filtered out via LOCATIONS that the problem exists. Typically when I categorize any transaction I specify locations and classes. There is not an option like this when I RECORD as TRANSFER.

I know I'm now off topic, but thoughts? Solutions? Thanks everyone. I think I'm close.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here