Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Match transfers between what type of accounts? Undeposited Funds to Checking, Checking to Savings, Liability Accts? A little more info would help. :)

And the transfers from the Old Acct. Do they look like correct transfers, just coming from the wrong Acct? Maybe you're pulling up so memorized items and they are defaulting to the old Acct. So a little clearer picture will help.

Sorry, I'm still pretty new at all this. They are transfers from an old bank account to an existing PayPal, payroll or tax account. I hope that helps.

Thank you for dropping by the Community today, msmith717-yahoo-.

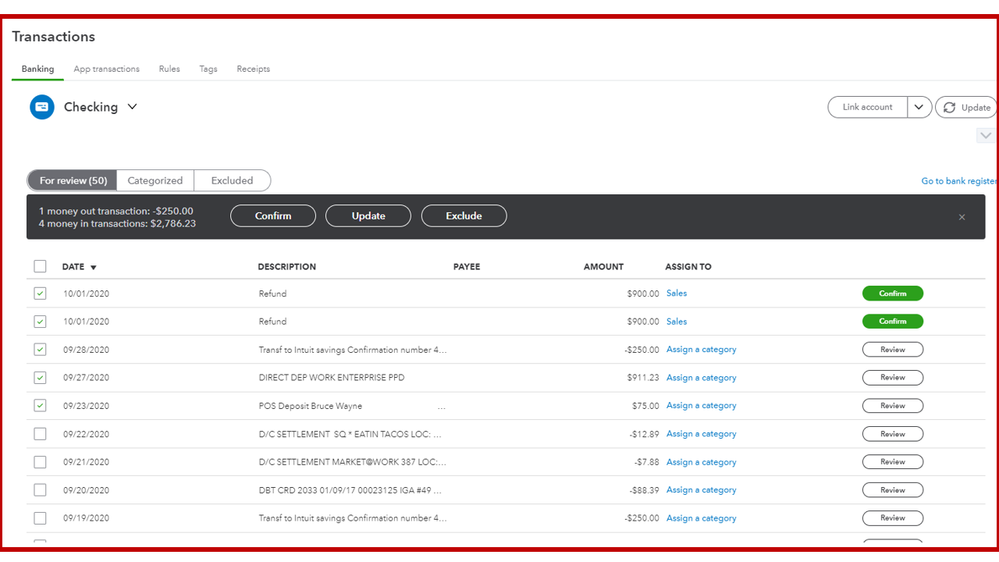

In addition to @Pete_Mc response, let’s use the Exclude feature to keep your banking data in order. I’m here to help show you through the steps.

Here’s how:

The transaction moves to the Excluded tab of the Banking page. This reference provides more in-depth information into this process: Exclude a bank transaction you downloaded into QuickBooks Online. It includes instructions on how to perform the task using a mobile device.

You can also bookmark this article in your browser for future reference: Categorize and match online bank transactions. The following resource will guide you on how to classify downloaded entries and match them to the ones in the company.

Stay in touch if you still have additional concerns about matching transfers. I’m more than happy to get this taken care of for you. Enjoy your day and stay safe.

The transaction says "Bank Detail funds transfer from acct xxxx...." The account mentioned is not an existing account.

Wouldn't I then loose the deposit amounts when it comes time to reconcile that account?

Hi there, msmith717-yahoo-.

I appreciate you for adding more details about your concern, especially the error message. This information gives a clearer view of what’s happening to your transactions.

When excluding entries, they don’t show up in any account registers or financial reports. Reconciling an account may be easier or harder depending on the type of transaction.

Thus, I recommend consulting with your accountant. They can guide you on how to handle your bank transfers and ensures your books are in order.

Here’s an article that will guide you on how to troubleshoot any reconciliation discrepancies, and edit a reconciled account: Learn the reconcile workflow.

For other bank-related activities, this link contains topics that will show you how to accomplish each one in QuickBooks Online (QBO): Self-help articles.

Keep me posted below if you have additional reconciliation concerns or questions on how to manage your bank data. I’ll jump right back in to make sure this is taken care of for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here