Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, CJ1857.

Thank you for reaching out to the Community. Let me provide you with some insight into how the reconciliation works.

When you reconcile your accounts in QuickBooks Online, the payroll transactions will appear for reconciliation if they have been recorded correctly and are within your selected reconciliation period. Payroll transactions, such as employee salaries, taxes, and deductions, should be included in the reconciliation process to ensure the accuracy of your financial records.

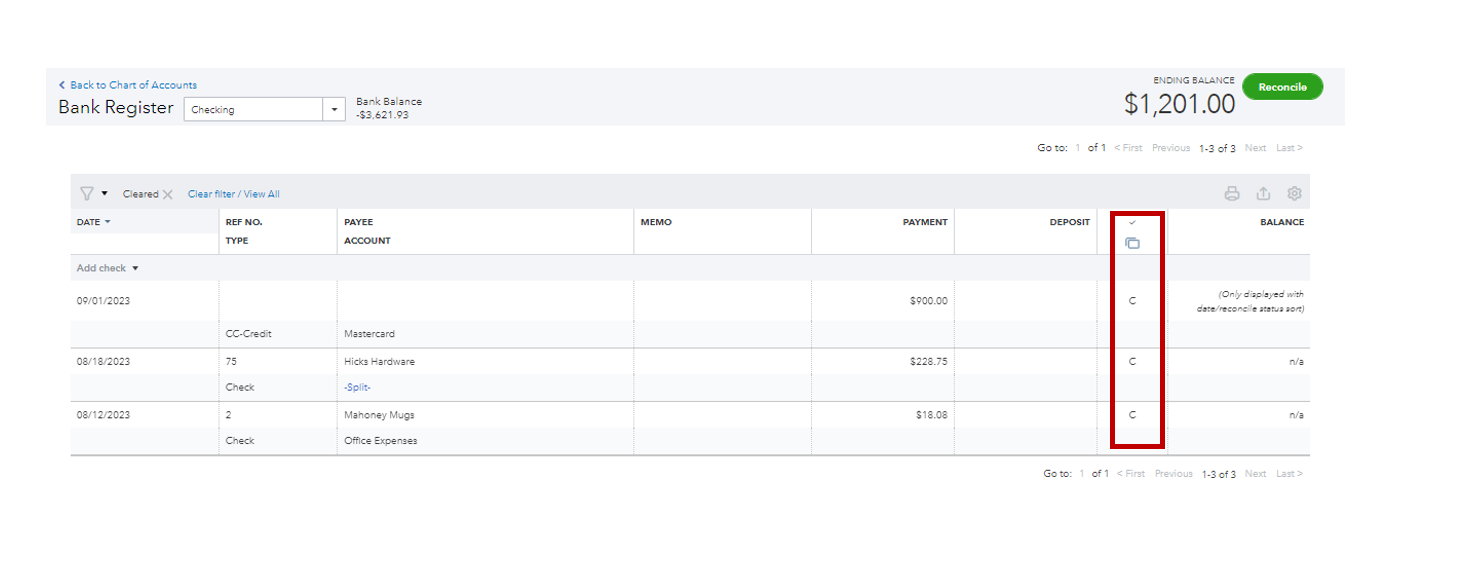

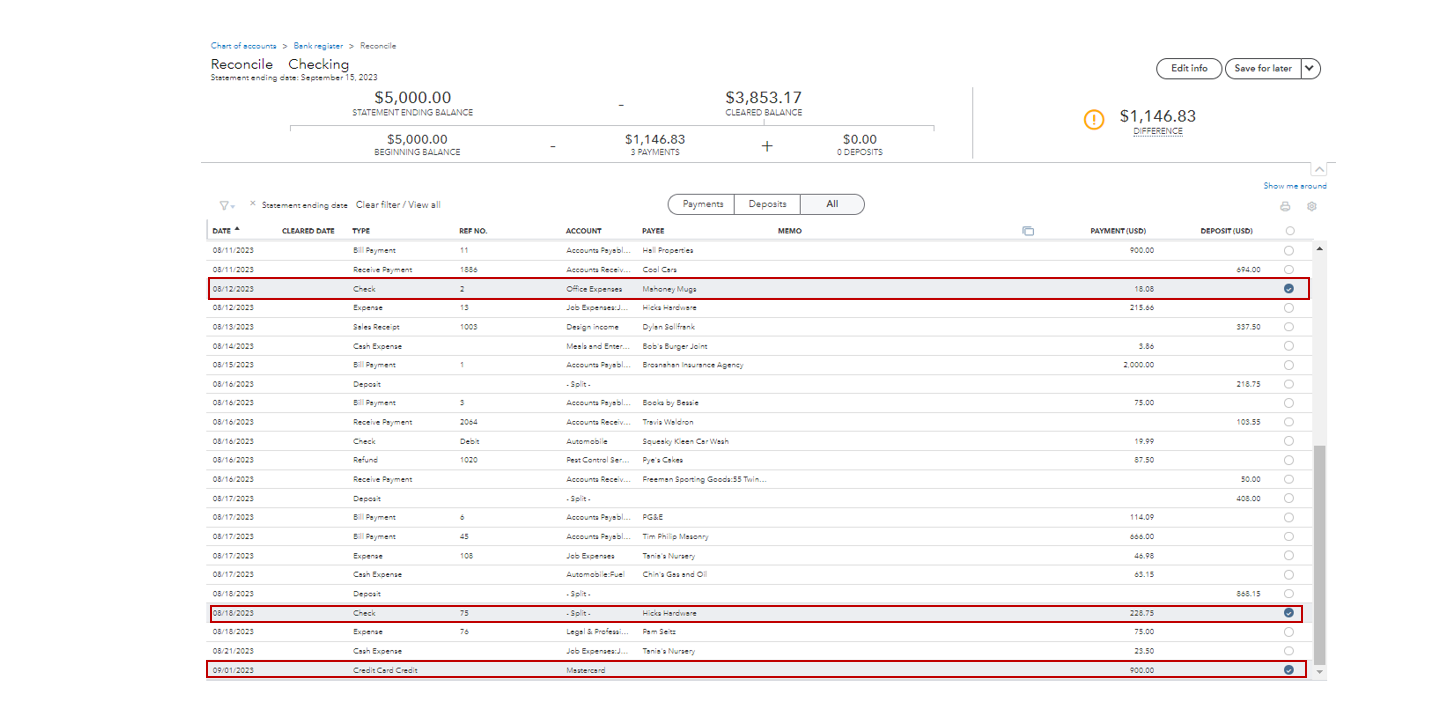

Let's go to your bank register and check if the checks are marked as "C." This should appear on the reconciliation page once you reconcile it.

Another possible reason why checks for payroll are not showing up in the reconciliation in QuickBooks Online are:

If you have checked these factors and the payroll checks still do not appear in the reconciliation, using a different browser, like an incognito/private browser, may be helpful. This helps determine whether the issue is browser-specific or related to the software.

To learn more about reconciliation topics, you can browse them through this one-stop hub article: Learn the reconcile workflow in QuickBooks.

Additionally, here are some articles that you can read to help speed up the review process of categorizing your bank transactions:

Let me know if you encounter any specific errors or need further assistance reconciling payroll in QuickBooks Online. I'll be here as soon as I can. Have a great day!

No. Still issues with syncing our payroll. Keep getting the same message

Thanks for getting back to the thread, @CJ1857.

Before we start, can you share with me more details on how these transactions are being posted to your bank's register?

In case you're using a third-party app to sync your payroll data into QuickBooks, I recommend reviewing the fields mentioned in the error message. It's important to ensure that these details are still active during the data synchronization process.

If the issue persists, I suggest reaching out to the customer support team of your third-party application. This will help us investigate if there is an issue on their end and assist you in resolving the problem.

Once fixed, you can resume the reconciliation process for your checking account. You may also refer to our reconciliation workflow for guidance on performing or rectifying a reconciliation.

Please keep us updated on your progress by posting an update in this thread, and we will be more than happy to provide further assistance.

Sorry. That's not it. It has something to do with my multiple payroll sync errors when they did the migration. It keeps happening and now the paycheck history doesn't even show up. I can't reconcile bank statements because payroll checks are not showing up. It's bigger than anyone at Intuit can solve since no one has been able to figure it out and I keep having to call tech support back. Unfortunately, I have to run a business and can't stay on the phone for hours. Multiple techs and still no resolve or solution. It keeps getting worse and worse.

We are not using a 3rd party app. I'm just using QB. It's on their end. No one seems to know how to fix it at Intuit and it's getting worse. I enter in all my payroll info directly on QB online.

I agree! I'm having the same issue. Why am I paying Quickbooks to run my payroll when I have issues like this? Why can't I reach someone on a Saturday? This is exasperating!

I understand how this situation has affected your business tasks, @ACF1.

I recognize the urgency of resolving this issue promptly so that you can resume normal operations as soon as possible. I know a possible reason why you were not able to reach our QuickBooks Online (QBO) Payroll Support Experts on Saturdays. Let me elaborate on it in detail.

Our support's availability hours are determined by the specific QuickBooks Payroll plan you have subscribed to. Below are the following business hours:

For detailed steps on how to contact our payroll support, kindly visit: Contact Payroll Support.

Additionally, you might consider exploring this hyperlink that contains informative articles to assist you in effectively managing your payroll: QuickBooks Online Payroll Help Articles.

I would appreciate it if you could keep me informed about the progress by leaving a comment below. I will make sure to follow up and provide any necessary assistance you may need.

I just transitioned from Desktop to Online and this issue still exists. I have contacted customer support on multiple occassions (hours on the phone being transferred) and no resolution. How is this not fixed yet?

I know how important to view the employee's checks in the checking register, @bfree935. Let me share some information about this matter.

Since you just transitioned to QuickBooks Online (QBO) from the Desktop version, there are things that you should know. First, the paychecks are moved as regular checks to keep your financial reports accurate. Also, if the payroll is within the current year, this will show as a lump sum in the register. Thus, I recommend checking your check register in QBO for these checks that resemble the amount of the payroll check or the total sum of all your paychecks.

Next, if you're new and haven't run a paycheck for the current calendar year in the program, you'll have to run a prior payroll to add your pay history and data in QBO. However, if you already issued a payroll in the current year, I recommend contacting our Customer Support team and requesting a payroll correction to correct your payroll data in QBO.

Here's how:

Furthermore, once everything is clear, you can resume reconciling your checking account. Also, you can refer to the reconciliation workflow for more guidance to ensure your reconciliation process is correct.

Please let us know if you have other questions about managing your payroll checks in the checking register and reconciling an account in QuickBooks. We'll be right here and willing to help.

I've done all of this and the last time I contacted customer support, he told me that nothing can be done until February 1st since it's tax season. Which means, I can't get accurate W2's since the payroll for 2023 is way off. About $50k or so. All the paychecks I generated on the desktop version (before transition) for 2023 and the paychecks generated on online version (after transition) for 2023, show up on my check register and shows them as reconciled when I reconciled my checking account with bank statements. The amounts on the paychecks from January-May (the ones from desktop) do not show up on the current W2's. They are short.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here