Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI assume that you mean the Credit Card account within QBO shows a negative balance after you enter a payment to the same Credit Card account.

Credit Card accounts work differently than bank accounts. They are a liability, not an asset.

So, when you pay for something with a credit card and enter that transaction into QBO, it will increase the Credit Card account balance by the amount of the transaction. This balance represents how much you owe the relevant credit card company.

Likewise, when you make a payment to the credit card company and enter said transaction into QBO, it will reduce the Credit Card account balance. This is because, after paying some or all of your credit card balance off, you will not owe as much to the relevant credit card company.

If you have not been entering all of the purchases you charged to your credit card, but still enter all of the payments you make to your credit card company, it is possible that you will end up with a negative balance on your Credit Card account within QBO.

This is because you are entering more payments than QBO has been led to believe that you owe to said credit card company.

It is similar to taking out a $1,000.00 loan and choosing to send them a check for $10,000.00 the next month. You are overpaying your liability.

Hello there, Rick.

In addition to what @FishingForAnswers provided, a negative balance on your credit card can also be a sign that you overpaid what you owe and that you'll want to review your transactions to ensure they're accurate. Keeping track of your purchases using credit cards inside your QuickBooks Online (QBO) company is one way to help you get a hold of your transactions. In this way, you can review and match them with your bank statements.

On the other hand, you can visit these articles to help you manage bank transactions and reconcile accounts inside the program:

We look forward to having you here again if you have other questions or need help handling bank transactions inside QuickBooks. We'll be more than happy to help you out again. Keep safe and have a good one.

Hello,

I'm having the same issue. Every time i select "Record as credit card payment" for my credit card payments from my business checking, my credit card balance goes further and further negative (currently at -$69K). But If i choose "Match" and match it to the credit card payment entry, then the credit card balance increases positively.

I never had this issue before, I had always done "Record as credit card payment" but now it's just causing the balance to go further and further negative.

Is this an issue with the categorization method (match vs record as cc payment), or are my credit card expenses not being recognized as liabilities?

Thank you!

Hi there, dkoenigkann. Welcome to the Community.

If you've connected your bank account to QuickBooks Online (QBO), it will automatically download your transactions. If you've already recorded a credit card payment in QBO before the bank generates transactions, there may be duplicate records resulting in a negative balance.

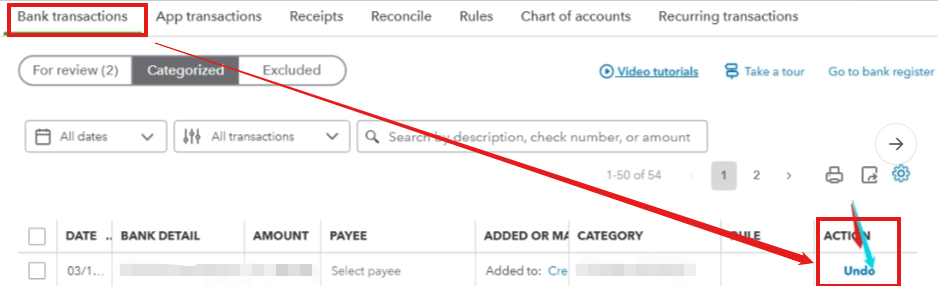

To avoid getting a negative balance, you can match transactions and see if they have duplicates. You can undo the payment that you've recorded as a credit card payment and delete it afterward.

Here's how to undo transactions:

You can keep track of your expenses and maintain accurate financial reports by recording your payments to credit cards in QBO.

In addition, You can start reconciling your account once your bank and credit card statements are categorized and matched.

Don't hesitate to comment if you still have concerns about your bank transactions. I'm always here to help you.

Balances should never be negative in any balance sheet account regardless of the type of account. If it shows a negative balance it's an error (automatically). I'm not sure why QBO presents it this way or why the thousands of accountants working at Intuit don't realize it. All balances on any balance sheet should ALWAYS be a positive number.

Mine is doing this a well only it doesn't record correctly even accepting it from the downloaded ones. If I pay $3,000 it shows as subtracted from my business checking but then my credit card also shows that I owe an additional $3,000 instead of paying down the $3,000. Did you ever end up figuring it out?

Thank you for detailing your concern, Jenn3741. Could you please let me know how you recorded your payment? Usually, issues like yours came from transactions being incorrectly categorized or having duplicate entries that affect the balances. I'm here to assist you in resolving this problem.

First, let's start by undoing the transaction. Here's how:

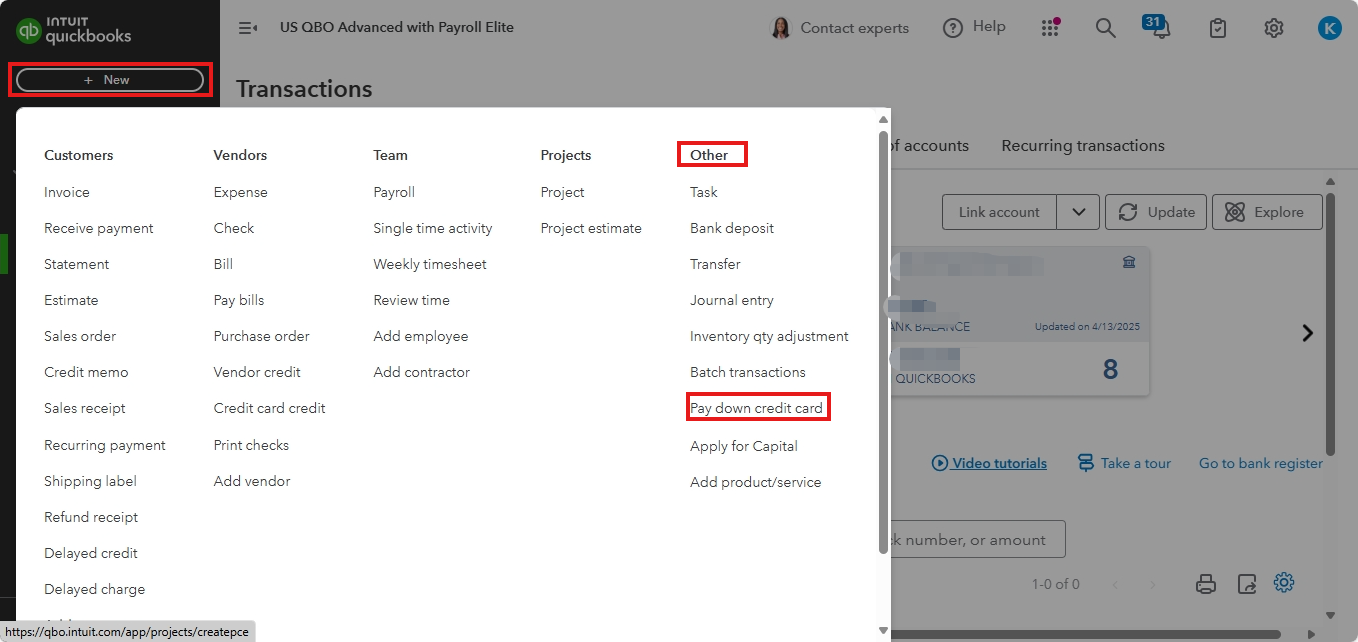

Next, let's properly record your payment to the credit card. Kindly follow the steps below:

Lastly, make sure to match the transaction in both your business checking account and your credit card account. Once this is completed, return to your bank register to verify that everything has processed successfully.

Additionally, proceed with reconciling your accounts to ensure they consistently match your bank and credit card statements. This is a vital step for maintaining financial accuracy and reliability.

Furthermore, you may want to explore our QuickBooks Live Expert Assisted service to keep your books updated and your financial records precise. Our team of experts is available to help with matching and categorizing transactions and regularly reconciling your accounts.

If you have more questions regarding your transactions, please don’t hesitate to hit the Reply button. I’m here to help you every step of the way!

I have done them as a transfer or as pay down credit card which you suggested. There is no undo on Bank transactions there is only add or match. Once they have been added they disappear. They don't go into the regular register, most of the time they're just gone.

Either way I enter them they deduct out of my checking account correctly but when I go look at that transaction in the credit card it does not pay down that amount it as it as a liability even though it shows in the payment column not the expenses charged column. Or sometimes it won't even show in the credit card account at all. I've double checked it's from and to the correct accounts but it doesn't make a difference. Always shows correctly in the checking and never correctly in the credit card account

RE: Balances should never be negative in any balance sheet account regardless of the type of account.

That is not correct. You can easily make a balance sheet account balance negative, and some accounts are naturally negative. For example, if you pay off your credit card balance and include a little more than the balance, then the credit card balance will be negative. Similarly, if you've paid off all of your A/P balances and then a vendor gives you a credit, the A/P account balance will be negative. An example of an account that had a naturally negative balance is accumulated depreciation.

I appreciate you taking the time to follow all the suggested steps. @Jenn3741. I'll discuss why your checking account may not reflect as a payment on the credit card.

If the payment from your checking account isn't showing as a credit on your card, it may have been recorded incorrectly. For credit card payments, use Expenses, and for direct payments, use Check. If it appears as a liability, it might have been incorrectly entered as a bill payment instead of an expense. Make sure you match the transactions from your credit card (connected online banking) so it will also correctly appear in the credit card register.

Since the credit card balance is incorrect, please reach out to our support team directly. They have the necessary tools to investigate and take a look at the discrepancies with credit payment recordings. Here's how to contact them.

Moreover, to check our availability hours, refer to this article: Get help with QuickBooks products and services.

Furthermore, this article guides you on how to reconcile to know if everything matches or if your accounts are balanced and accurate: Reconcile an account in QuickBooks Online.

If you have questions about recording your payments, let me know by dropping a comment in the thread. I'm here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here