You can record the bill as usual, and it will show in your profit and loss report, @botompkins.

How exactly it appears in the report depends on how you categorize it.

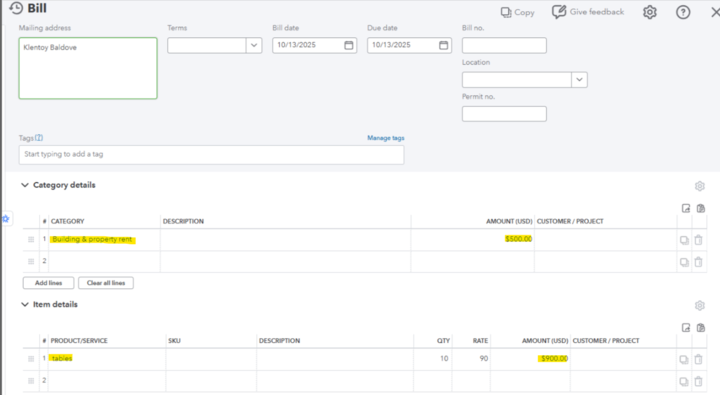

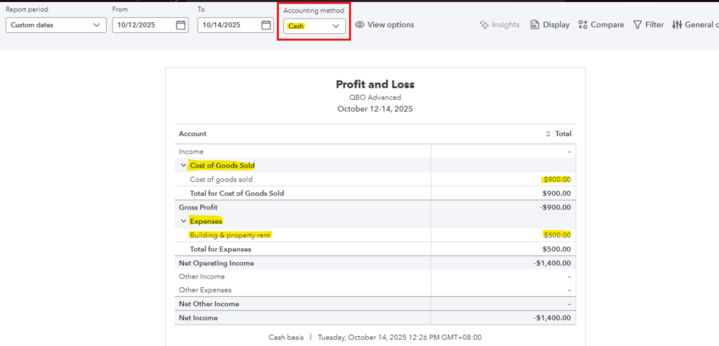

For example, if you record the bill using an income or expense account in the Category section, it will show under Expenses in the profit and loss report.

On the other hand, if you record the bill using a product or service item with a cost, it will show under Cost of Goods Sold (COGS) in the report.

Keep in mind that if you use the Pay Bills feature, your profit and loss report should be set to the Cash accounting method to correctly reflect the payment. However, if you are using the Bill section and the bill hasn't been paid yet, ensure that you use the Accrual accounting method instead.

Let us know if you have further concerns.