Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

We currently buy dies that we use to stamp out gaskets. We have been entering the dies as non inventory items, which I don't think is correct. What should we be entering them as?

Hi @Mark Rhoa,

Your company’s Chart of Accounts is as unique as your business. Having said that, I’d recommend asking your accountant about how to categorize the dies. That way, went it comes to tax time, they are reporting correctly.

I’d be happy to help with any other questions or concerns, just drop a comment below. I’ll be here!

When do Non Inventory items get charged to COG? After they are bought or after they are invoiced?

I'm happy to help clarify non-inventory items for you, @Mark Rhoa!

The Costs of Goods Sold (COGS) account tracks all costs associated with the items you sell, which allows you to calculate gross profits accurately. Generally, COGS is affected only when you sell your items.

That means non-inventory items are recorded in your Profit & Loss statement when they're purchased or invoiced. You just need to make sure that purchase information is set up so QuickBooks will track them properly.

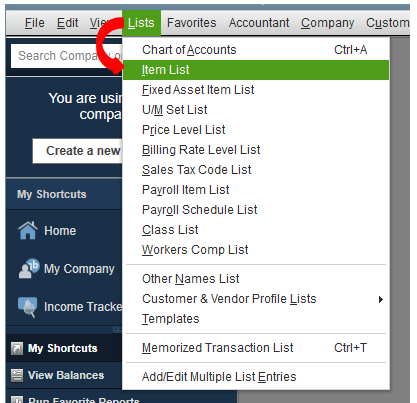

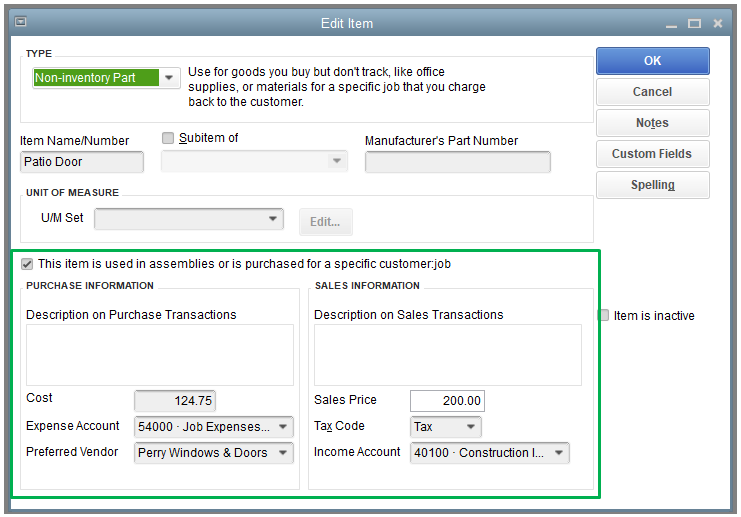

Here How:

I’ve added resources here to learn more about managing your items in QuickBooks. It has a list of frequently asked questions, along with its answers.

Just let me know if you have any additional questions about Non-Inventories. I’m always here to help. Happy New year!

Hello,

Where can I find that option in QBO?

Hey there, @ASB2. Thanks for joining the thread. I'm here to help you out.

First, I'll need you to clarify the option you want. This way, I can share the correct information for your concern. Additional information will be greatly appreciated.

However, if you want to know where we can enter a non-inventory item, I'll show you how.

You can refer to this article for more details: Add product and service items to QuickBooks Online.

Additionally, you may visit this article as a guide on how you can track your products and services: Set up and track your inventory in QuickBooks Online.

If you'd like to see your sales and inventory status in the future, you can check out this article: Use reports to see your sales and inventory status.

Feel free to post a reply if you need anything else or if you have any additional information. I'd be glad to assist you anytime. Take care!

Thank you, well in our case we don't have inventory parts.

We buy material to manufacture (builder, not resell it. So, it would be a non-inventory part right? I was checking in QBD there's an option for tracking it. However, I can't find it in QBO. How should I set up the lists if I want to track how much I spend on each material.

Hi there, @ASB2.

Thank you for the prompt response and for the additional details of your concern. I'd be glad to provide information about tracking how much you spend on your non-inventory items in QuickBooks Online (QBO).

To start, you'll want to follow the steps outlined by GebelAlainaM above to learn how to enter your non-inventory items.

Then, once you have recorded your bills or bill payments, we can proceed to pull up the Purchases by Product/Service Detail report to show your purchases.

Here's how:

You can also run the Purchases by Vendor Detail report, then customize it to show the details that matter the most to you. For more info about customizing reports, kindly refer to this article: Customize reports in QuickBooks Online.

Just in case you want to memorize the report you've customized, feel free to check out this article for the detailed steps and information: Memorize reports in QuickBooks Online.

I'd like to know how it went after running the report, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Have a wonderful day!

Hello!

It sounds like you're looking for the right way to categorize your dies in QuickBooks. Since the dies are used in the manufacturing process, they might be better categorized as "Other Charge" items or "Fixed Assets" if they’re expensive and have a long lifespan. Non-inventory items are typically used for goods you don’t track in inventory, so this might not be the best fit.

Alternatively, if you're looking for a more robust solution to track inventory, you might consider using Warehouse 15 for QuickBooks. It helps manage inventory in real-time, print labels, and scan barcodes directly from a mobile device.

For more info on Warehouse 15, check out Cleverence Warehouse 15.

https://www.cleverence.com/solutions/quickbooks-warehouse-15/

Hope this helps!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here