Thanks for visiting the Community today, Joseph31.

I’m here to ensure that QuickBooks will calculate your 401k contribution and 401k company match from the gross of all compensation payroll items.

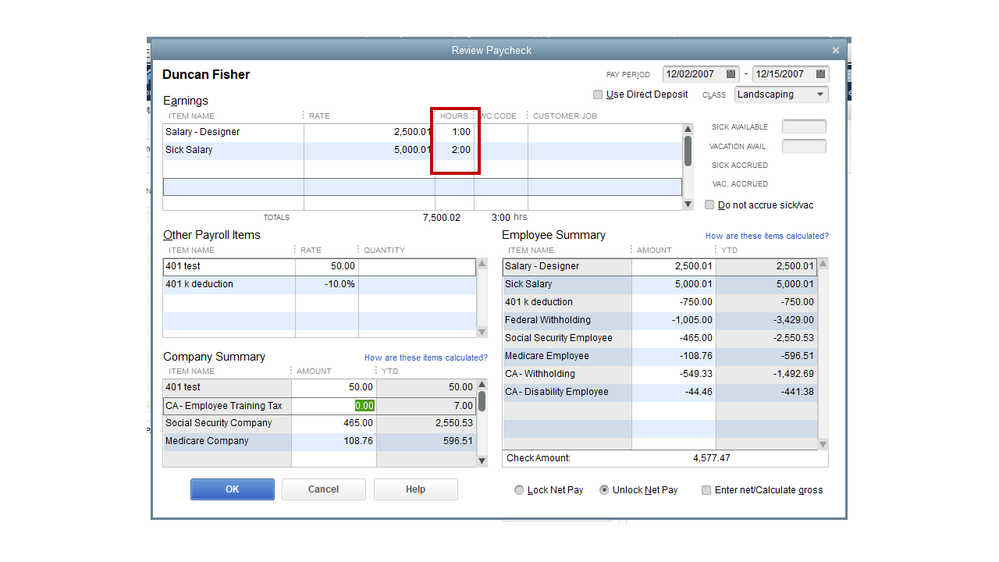

Since your employees are salary paid, you’ll have to enter a specific number in the Hours column. This way, the correct contribution amounts for the mentioned retirement payroll items will show on the paychecks.

Let me share this article to learn more about adding the retirement plans item in QuickBooks: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.). From there, you’ll see some helpful links on how to set the Roth plans for your workers.

To help and guide you on how to prepare the year-end's taxes and forms, you can browse to the

Year-end checklist for QuickBooks Desktop Payroll resource. It provides an overview of the filing period as well as payroll tasks you'll have to perform.

Feel free to add a comment if you have additional questions on how to handle your 401(k) contributions. I’m more than happy to look into this for you. Enjoy the rest of the day and stay safe.