Thanks for dropping by the Community, Hendricks6.

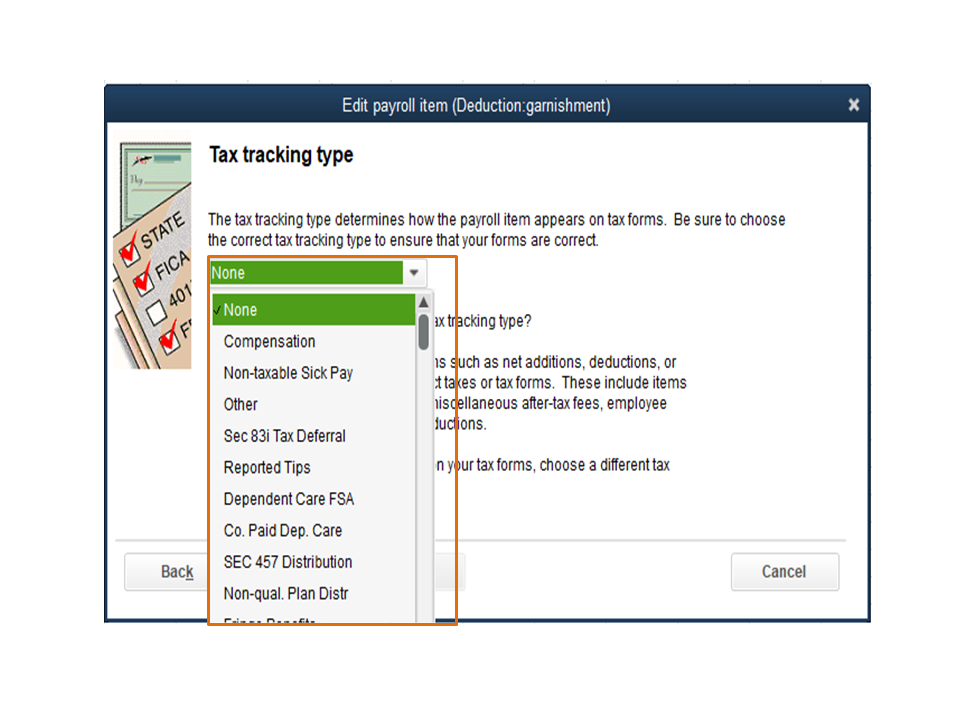

In QuickBooks Desktop, you can set up the garnishment item and enter 25% for the rate. Since it has to be pre-taxed, I suggest consulting an accountant or tax adviser for further assistance. They can recommend the correct tax tracking type to use and make sure it’s reported correctly on the employee’s check.

Here’s how to add the payroll item:

- Click the Lists menu at the top to choose the Payroll Item List.

- Scroll down to the bottom of the page and tap the Payroll Item drop-down and pick New.

- In the Select setup method window, tick the radio button for Custom Setup and hit Next.

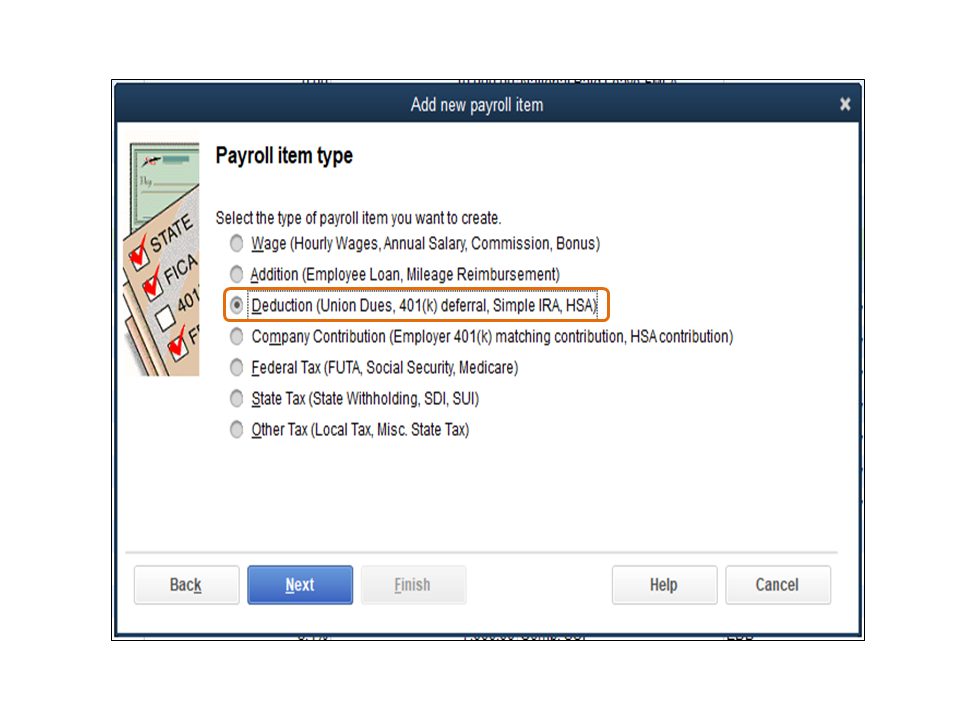

- Mark the radio-button for Deduction (Union Dues, 401(k) deferral, Simple IRA, HSA) and press Next.

- Type the name of the garnishment in the Enter name for deduction box.

- Fill in the fields in the Agency for employee-paid liability window and click Next.

- From the Tax tracking type drop-down, select the appropriate payroll item provided by your accountant.

- Hit the Next button twice.

- In the Calculate based on quantity screen, tick the radio-button for Neither and press Next.

- Mark the radio-button for net pay and click Next.

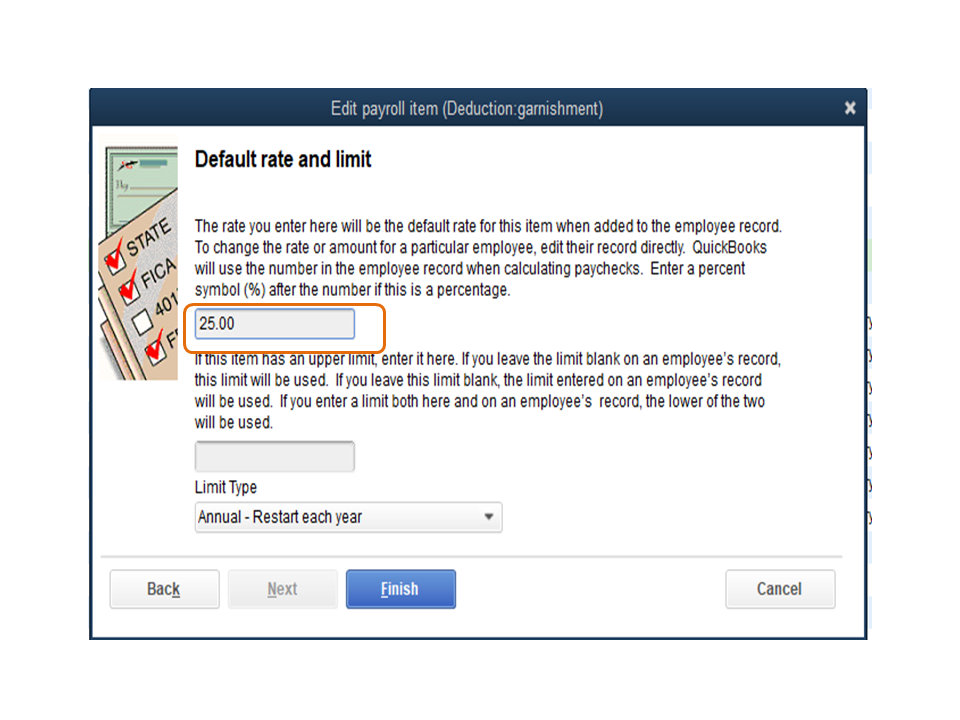

- Then, type 25% in the Default rate and limit box and press Finish.

Now that we’ve added the garnishment, you can associate this one with the employee. For detailed instructions, go directly to the To set up the Garnishment Deduction Item on the employee record. (e.g., for child support) section in this article: Set up a payroll garnishment item.

Here’s a guide that contains articles to help accomplish payroll tasks in QuickBooks Desktop: More Help Topics.

Reach out to me if you have any clarifications or other concerns about QuickBooks. I’m ready to lend a helping hand. Enjoy the rest of the day.