Hi there, @Becky118. Happy to walk you through the steps of adding holiday pay for your employees.

We'll need to go through each employee's profile and add the Holiday pay.

Here's how:

- Go to the Payroll menu.

- Navigate to the Employees tab.

- Choose the employee for whom you want to add holiday pay.

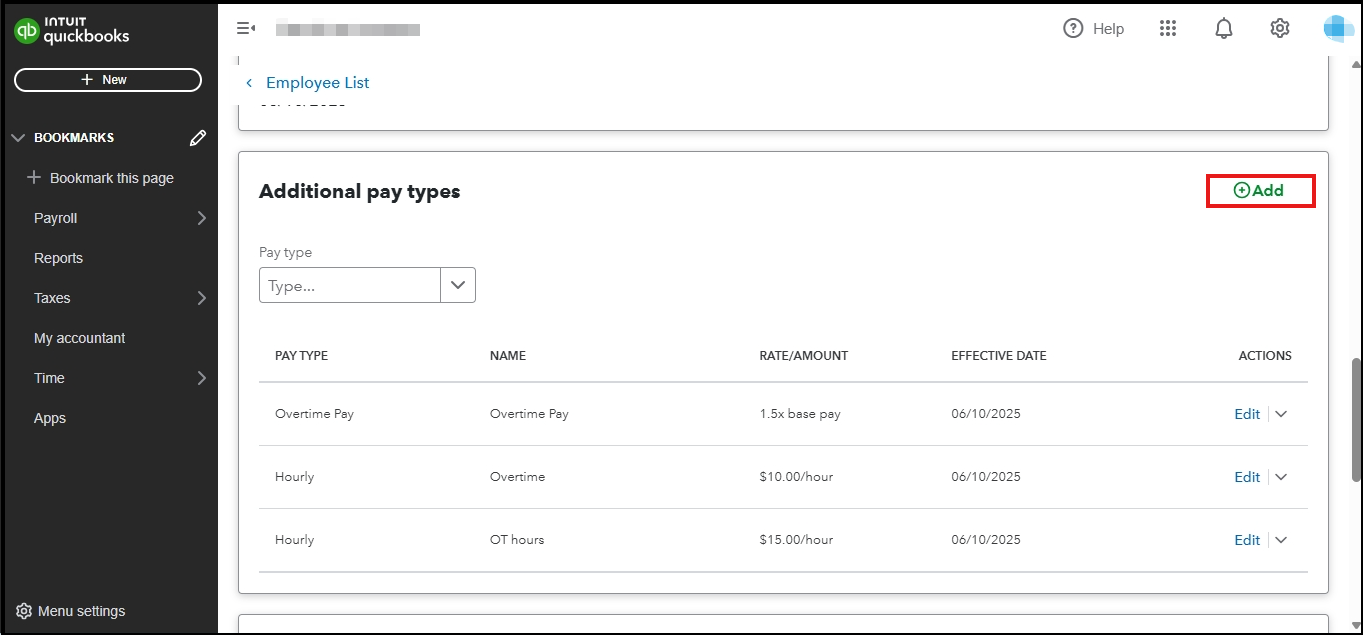

- Scroll down to Additional Pay Types.

- Click the + Add and select Holiday pay.

- Choose the effective pay period you prefer and the end pay period.

- Once done, click Save.

Please feel free to add a comment below if you have any other questions.