You can locate the Unscheduled Payroll option under Pay Employees in the Employees menu, Jenn. Let me walk you through the detailed process of paying your team a Christmas bonus.

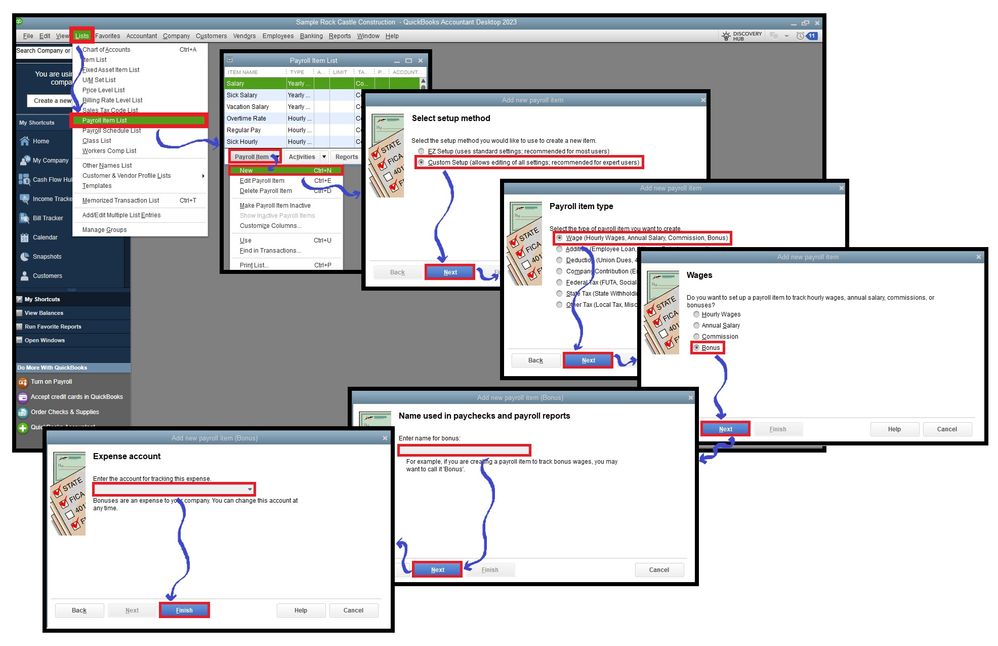

In QuickBooks Desktop Payroll, you need a bonus pay item to give your employees a bonus check. If you haven't added one already, you can proceed to these steps:

- Go to the List menu, then Payroll Item List.

- In the Payroll Item dropdown, click New.

- Choose Custom Setup, then Next.

- Pick Wage, then Next.

- Select Bonus, then Next.

- Provide an item name and hit Next.

- Choose the appropriate expense account used for trading, then click Finish.

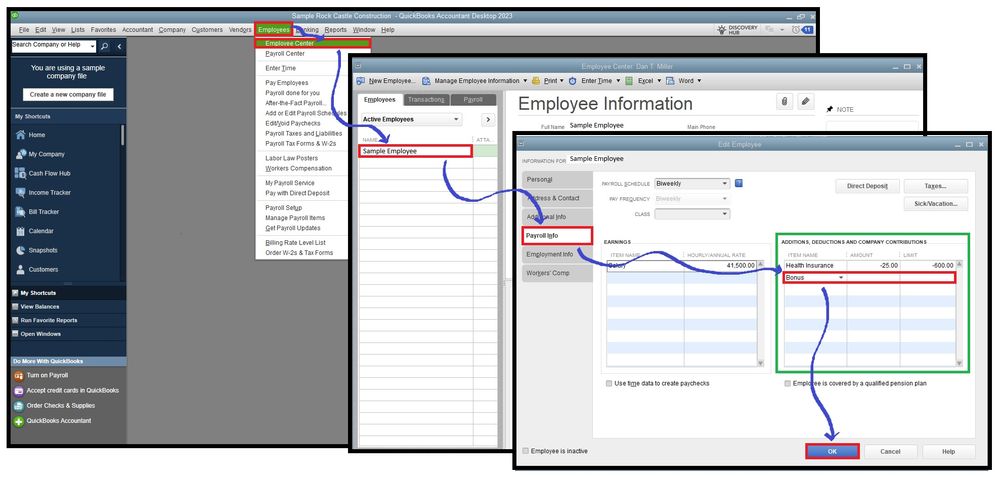

After that, here's how to add the item to your workers:

- In the Employees menu, select Employee Center.

- Locate and double-click on your employee.

- Head to the Payroll Info tab and include the bonus item in the Additions, Deductions, and Company Contributions section.

- Select OK.

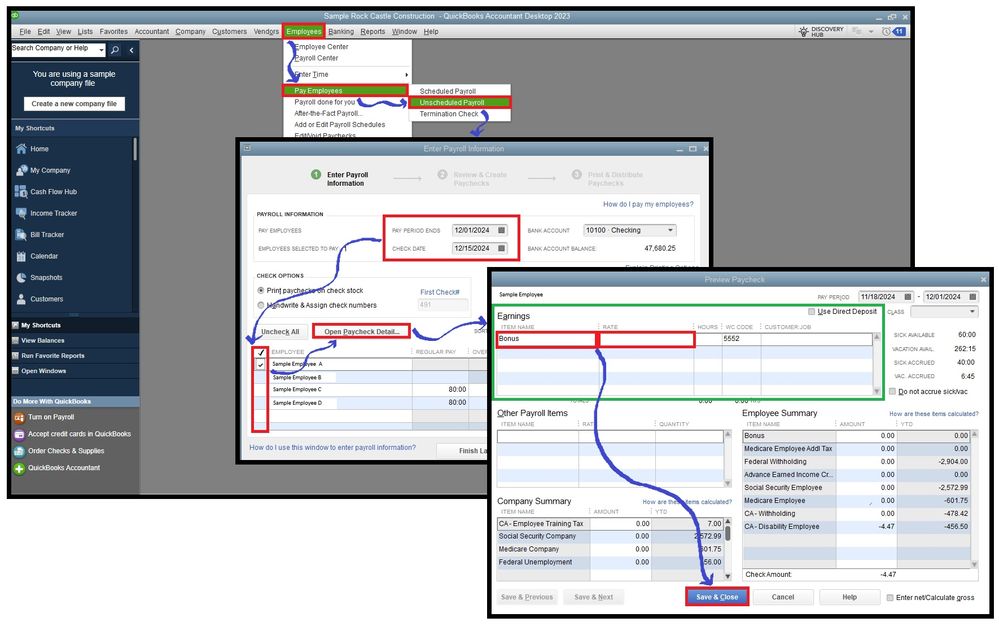

Lastly, you have two options for giving bonuses to your employees. You can generate a separate paycheck or include them in your regular pay run. For bonus-only payroll, gross up your paycheck to enter a net pay bonus. If it's a gross pay amount, refer to the procedure below:

- Choose Pay Employees in the Employees menu.

- Pick Unscheduled Payroll and verify the date in the Pay Period Ends and Check Date fields.

- Select the employees you want to pay, then Open Paycheck Detail.

- If necessary, clear the Earnings and Other Payroll Items.

- Enter the bonus item in the Earnings section and the gross amount in its Rate column.

- Modify the federal and/or state withholding taxes as needed.

- Hit Save and Close or Save and Next.

On the other hand, scroll down to Option 2 under Step 2: Pay out the bonuses in this article for complete instructions on adding bonuses to regular paychecks: Pay employee bonuses.

Moreover, here are materials to help you update existing paychecks and review related data depending on your business needs:

We're always ready to assist you in effectively managing employee bonuses in QuickBooks Desktop Payroll. Please share your questions below so we can promptly provide you with all the relevant information and resources to address them.