Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for checking this with us, @dave156,

At the moment, QuickBooks does not allow adding negative hours into the employees paycheck. The system uses these hours to calculate the employees compensation for the payroll run.

Instead, you only need to input the actual hours worked by the employee to get the correct YTD amount. Otherwise, if you need to deduct an amount from their pay, set up a deduction item for it.

Here's how:

To learn more about this, see the following links about the supported pay types in QBO: Add or change pay types.

Let me know if you have any more questions about this. I'll be right here to guide you with your payroll processing. Have a nice day!

OK. I understand QB will not allow negative hours. As an alternative, is it possible to enter a negative pay amount on a specific pay type in payroll entry? The gross pay amount for the employee would be a positive number. I just need a way to allocate costs between different pay types. For example, on payroll entry:

Pay type 1 = 100.00

Pay type 2 = (50.00)

Pay type 3 = 50.00

Total gross pay for employee = 100.00

Will QB accomodate this?

Thanks for keeping in touch with us here, @dave156.

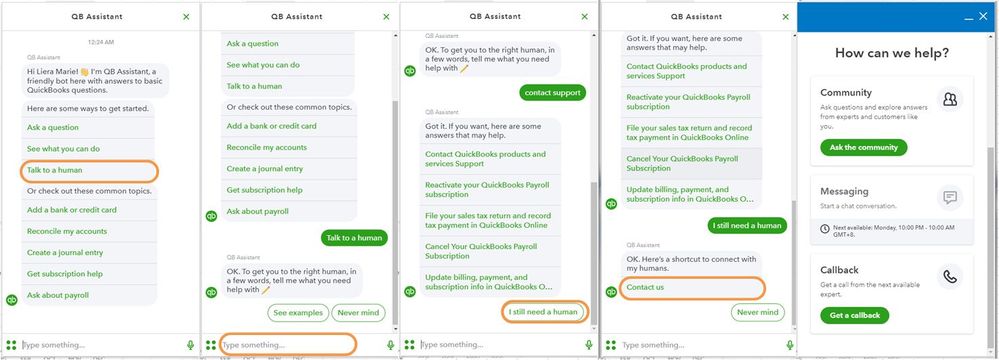

The only way to reduce paycheck wages is to deduct the number of hours you overpaid to the next payroll run. Otherwise, you can follow the steps provided above by my colleague to create a miscellaneous deduction to change the gross wage amount using non-taxable deduction. I'd suggest reaching out to our Customer Care Team to help you with the tax adjustments. They can run a remote-viewing session to walk you through the steps.

Here's how:

To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. For more information, check out our support hours and types.

Here are some articles that you can refer about to dealing with payroll issues in QuickBooks Online:

Keep in touch if you need more help with this, I want to make sure you're taken care of. Thanks for reaching out, wishing you all the best.

Hi,

Any way Quickbooks configuration team could allow negative hours. I would like to keep track of hours in the bank and be able to deduct those hours when they are taking...

Hi there, jblai011.

Thanks for bringing your question forward here in the Community. I'd be glad to point you in the right direction about employee hours in QuickBooks Online.

As you may have already found, there isn't currently a way to enter negative hours for your employees within QuickBooks Online Payroll. However, I do see how having that ability could be useful and I recommend sending a message to the Product Development Team. This can be done directly through your account. Here's how:

1. Click the Gear icon in the top right corner.

2. Select Feedback.

3. Enter your suggestion in the panel that appears and then send the message.

You can check the Firm of the Future site for these types of product updates and feature releases. If you have any other questions or concerns in the mean time please don't hesitate to reach back out.

For others who find this post looking to do something similar (like I did)... Assuming you still can't add negative hours or compensation amounts to correct for past payroll runs.. I believe you need to request a "payroll correction" from QBO support. We've had to do this a couple times due to issues caused by QBO payroll (which is why we're switching to Gusto soon).

To request a payroll correction:

Our first one took 6 months to correct. I'm told other large payroll providers have much better processes for dealing with things like this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here