Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome aboard to the Community, syam1.

Yes, you can run the 1099 forms automatically in QBO by using the E-file feature. You’ll have to set up the employees as vendors so you can process 1099s for them.

Also, the IRS Form 1099 to a non-employee individual is the tax form you file for employees. Meanwhile, the W-2 is the tax form file for your employees. Check out the following guide for more information: About Form W-2, Wage and Tax Statement.

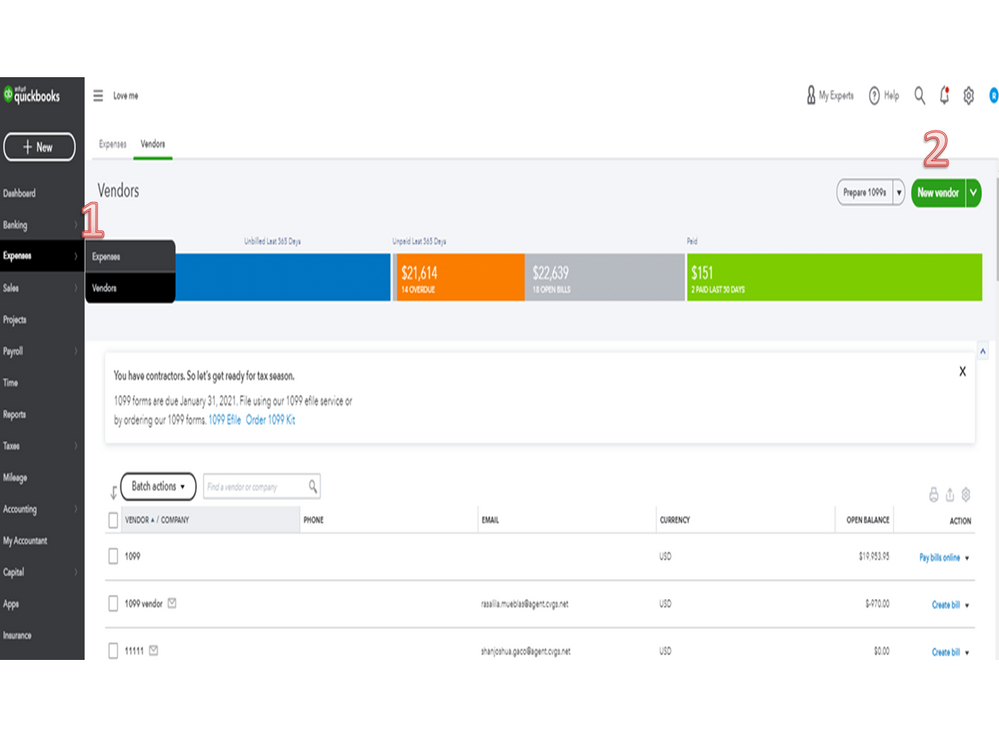

We’ll have to add these suppliers first so you can start tracking the expenses. Let’s go to the Vendors Center to accomplish this task.

For more insights into this process, see the following guide and go to the Set up a contractor in Quickbooks Online section: How to set up contractors and track them for 1099s.

Additionally, these articles provide an overview of how to prepare and file the federal form.

Click the Reply button if you have any clarifications or other concerns. I’ll pop right back in to answer them for you. Enjoy the rest of the day.

Hello again, syam1.

I’m back to check if you’re able to follow the steps I shared? I want to make sure everything is taken care of, and you can run the 1099s.

Don’t hesitate to get back to this thread if you still have additional questions. I’ll be glad to provide further assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here