Yes, Vickiratermann. You can easily set up a 401(k) contribution for the employees you select within your organization.

Please note when setting up a retirement plan for your employees in QuickBooks, you can only choose one deduction for your 401(k) contribution. However, if you have already made 401k contributions before, we need to delete the other contributions you've already set up to avoid errors. Let me guide you how:

- Go to the Payroll tab and select Employees.

- Select the employee's name.

- From the Deductions & Contributions section, click Edit.

- Choose the deduction you want to remove by clicking the Trash bin icon.

Once done you can now create a catch-up contribution plan for designated employees to replace the new contribution, follow the steps below:

- Go to Payroll and select Employees.

- Click the employee's name and select Edit in the Deductions & Contributions section.

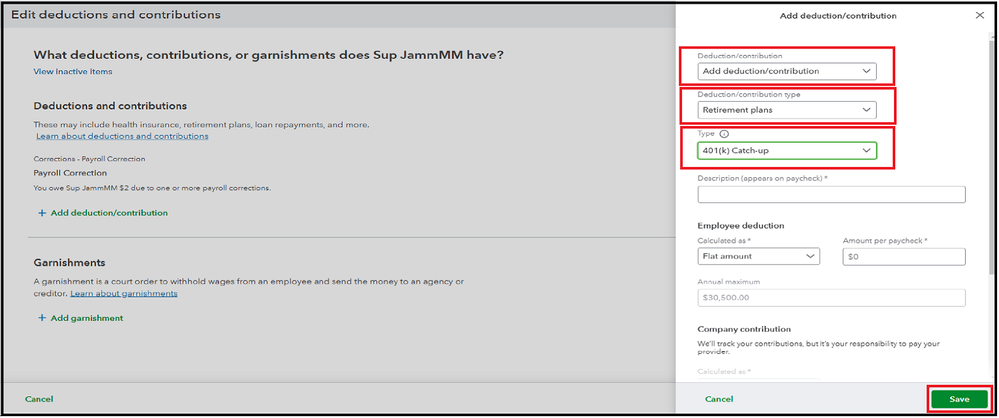

- Click + Add deduction/contribution.

- In the Deduction/contribution dropdown arrow, select the + Add deduction/contribution.

- Choose the Retirement plans in the Deduction/contribution type.

- On the Type dropdown, choose 401 (k) Catch-up.

- Fill in other necessary fields, then Save.

For more information on how to set up deductions in QuickBooks, you can refer to the article: Set up a retirement plan. This resource will also guide the annual contribution limits associated with retirement plans.

Moreover, you can run payroll reports in QBO to monitor your payroll totals, including details of your employees’ deductions and contributions.

In response to your concerns about catch-up 401(k) contributions, I would be glad to include you in further discussions and help you navigate the process effectively.