Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a new workers comp carrier this year. I set up this carrier with a new "Company Contribution account"

I deactivated the old one but QBKS only uses the old one regardless. We know this because on the payroll check generated through QBKS payroll module. It shows the old one in the company contribution box "WCI" and in the accounts it shows the ins and outs going to the old one not the new one. Would like to know how to re direct Qbks payroll module to use the new account

Solved! Go to Solution.

Hi there, @Peti135.

I'll be glad to share details about Workers Comp.

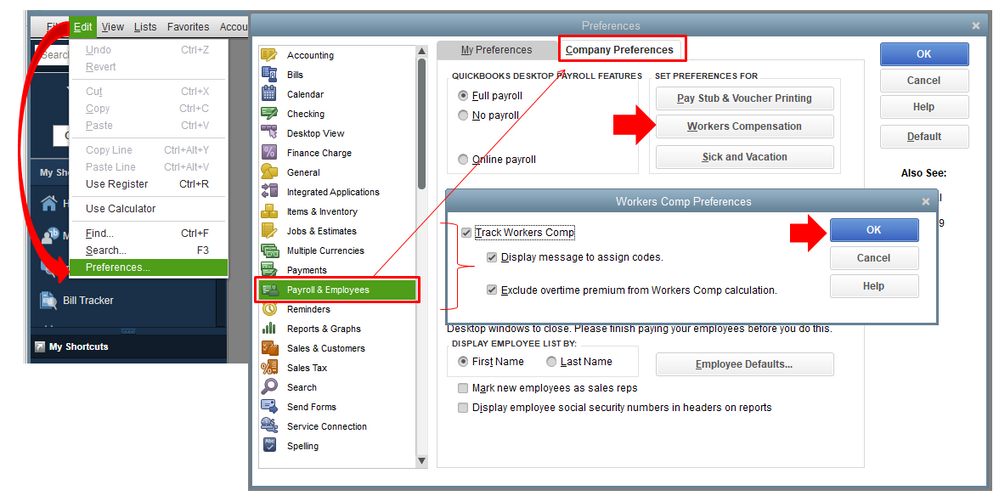

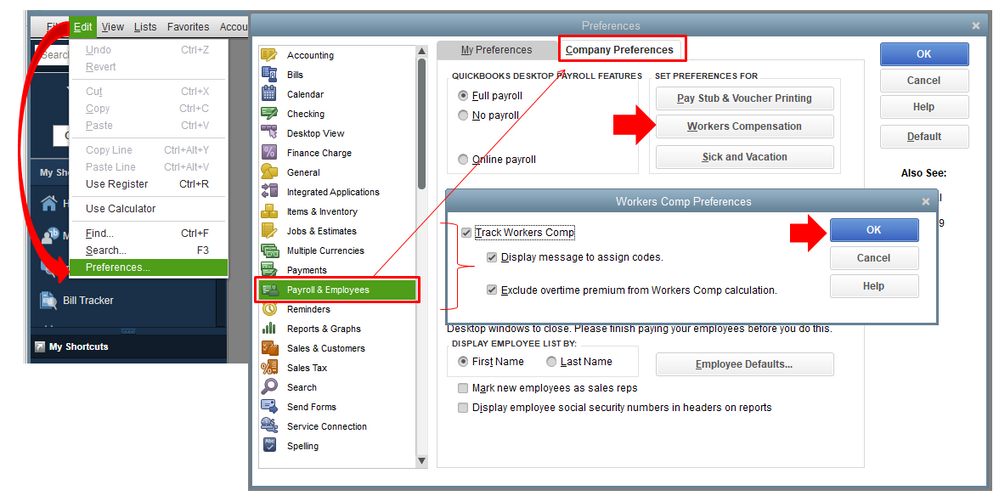

You’ll want to set up worker’s compensation before paying your employees to avoid incomplete and incorrect reporting. You can start by turning on the feature in the program to track them. Let me breakdown the steps for you:

Once the feature is activated, you can directly set up Workers Comp for your employees. Additionally, please make sure that we have the latest payroll tax table. You can update it so we can avoid any issues with your payroll.

For more detailed steps, here's a great resource that you can check on: About Workers' Compensation in QuickBooks Desktop.

In addition, here are the available reports for workers’ comp with their description and how you can run them in QBDT.

Should you have other questions about Workers Compensation in QuickBooks, please let me know. I’ll be happy to assist you further.

Hi there, @Peti135.

I'll be glad to share details about Workers Comp.

You’ll want to set up worker’s compensation before paying your employees to avoid incomplete and incorrect reporting. You can start by turning on the feature in the program to track them. Let me breakdown the steps for you:

Once the feature is activated, you can directly set up Workers Comp for your employees. Additionally, please make sure that we have the latest payroll tax table. You can update it so we can avoid any issues with your payroll.

For more detailed steps, here's a great resource that you can check on: About Workers' Compensation in QuickBooks Desktop.

In addition, here are the available reports for workers’ comp with their description and how you can run them in QBDT.

Should you have other questions about Workers Compensation in QuickBooks, please let me know. I’ll be happy to assist you further.

Abegail, thank you very much for the response. It resolved the issue but raised another. When I get to the screen regarding ex mod rate, the button saying "yes, I use an ex mod rate" is checked, but grayed out such that I can not change the ex mod rate which is currently set a 100%. Any ideas?

next to your name on your reply it says "empl". I presume that means you are an employee of Intuit/Quickbooks. FYI When I called customer support, they said they had no information on how to change the carrier information. If you have a way to have this added to their data base it would be helpful for others.

Abegail, I found the location to change it. So I am all set, Thank you again

I appreciate you getting back to us, @Peti135.

I’m glad to know that the suggestions provided by my colleague above helped you to set up Workers Comp for your employees.

Feel free to tag me in your comment if you have other concerns about managing employees or running payroll in QuickBooks. I'm always here to lend you a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here