Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowwhere do i increase limits on direct deposits

Solved! Go to Solution.

I've got you covered, @tomklos1.

You have to submit an . This required documents you need to upload along with the request form. For example, a bank statement. For a detailed guide, head to our Direct Deposit limit page.

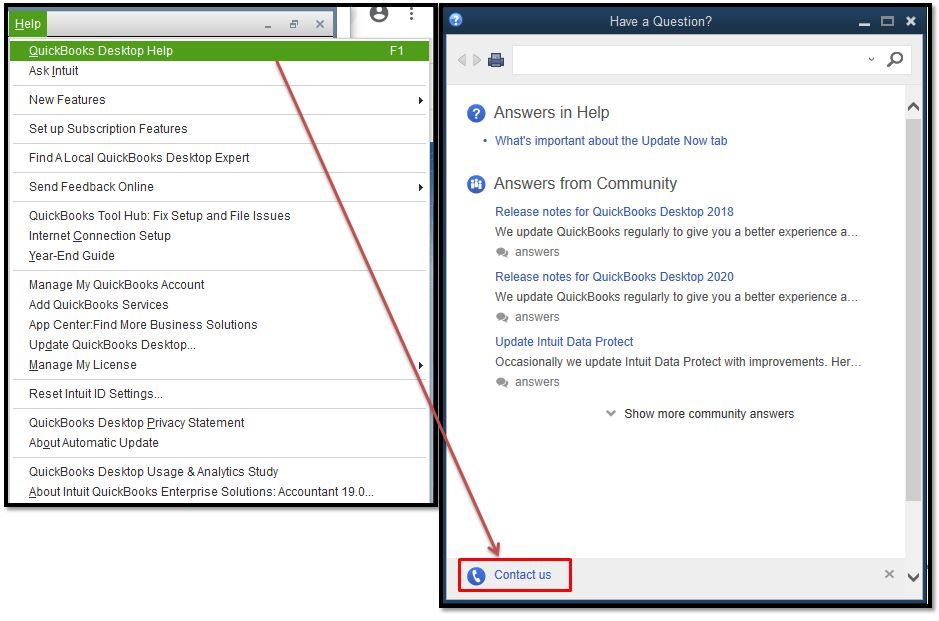

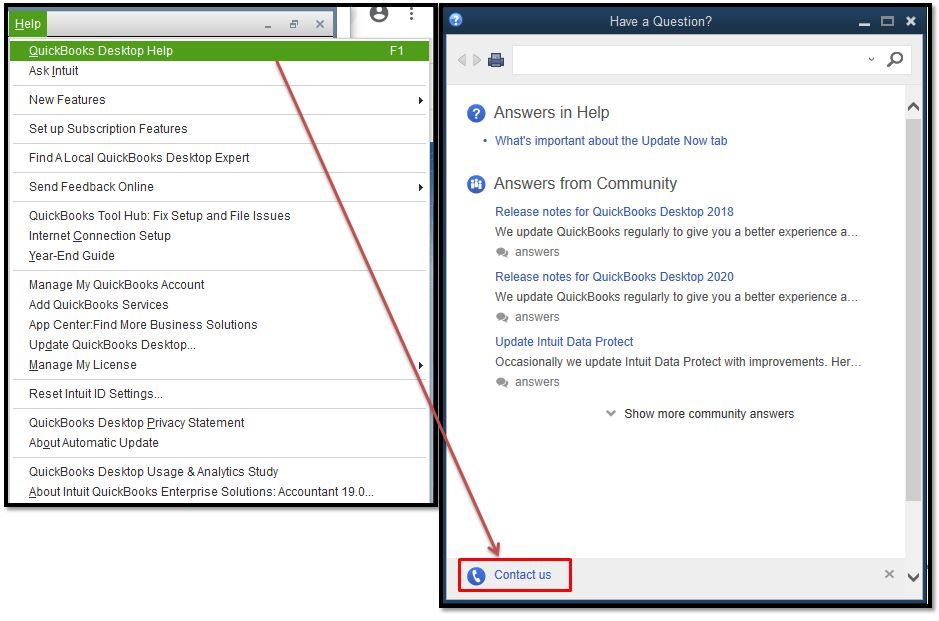

Then, to be able to know your Direct Deposit amounts, you'll need to connect with our Payroll support team. To do so, refer to these easy steps below:

Also, QuickBooks gives you the option to change your direct deposit funding time. To know more, please visit our Direct Deposit funding time page.

Feel free to get back here if you have further questions about this. I'm always here to help you. Have a good one.

I've got you covered, @tomklos1.

You have to submit an . This required documents you need to upload along with the request form. For example, a bank statement. For a detailed guide, head to our Direct Deposit limit page.

Then, to be able to know your Direct Deposit amounts, you'll need to connect with our Payroll support team. To do so, refer to these easy steps below:

Also, QuickBooks gives you the option to change your direct deposit funding time. To know more, please visit our Direct Deposit funding time page.

Feel free to get back here if you have further questions about this. I'm always here to help you. Have a good one.

How to increase a direct deposit limit for a client-QB Payroll desktop

You'll have to let the direct deposit payroll's primary principal of your client's account submit an online request to increase their direct deposit limit, @vlgilles. Let me share further details about this.

Only the direct deposit payroll account's primary principal is recognized to request a limit increase. This is due to the security of your client's account and because there might be additional documentation (i.e., bank statement) that needs to be submitted. Their request will be reviewed within 2 business days. Then, they'll receive an email notification regarding the result.

To learn more about this, I'd recommend checking out this article: Direct Deposit Limit. It also includes details about the options to pay your client's employees.

Also, you can refer to this article if you wish to learn more about how the direct deposit service works using QuickBooks Desktop Payroll: Direct Deposit service agreement. It includes details about activation, limitations, and your responsibilities, to name a few.

Keep me posted on how it goes in the comments below. If you have other payroll concerns or inquiries about the direct deposit in QuickBooks, I'm just around to help. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here