Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowThis is just the right place to get the answers you're looking for about sales tax adjustments, @bobby-little.

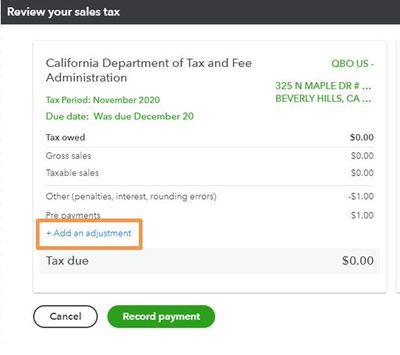

To clarify, do you mean adding an adjustment for two combined reasons? I'd recommend creating an adjustment for each one for tracking purposes. Simply click Add an adjustment and indicate the reason for it.

First, let's create an account for the sales tax adjustment. You can set up an expense account if you need to increase your sales tax due. To decrease the amount, use an income account. With this, I'd suggest consulting your accountant to determine the appropriate account and detail types.

If you don't have one, not to worry! I can help run a search to find an accountant.

Here's how:

Once verified, proceed with the steps below:

Second, let's go to the Sales Tax tab to add an adjustment. I'll guide you how.

These instructions are also available from our guide on creating or deleting a sales tax adjustment for your convenience.

Furthermore, you can get a detailed look at the taxes you owe and why you owe them by running the Sales Tax Liability report. This helps you make sure everything is accurate before you file your return to your tax agency.

You're always welcome to visit the Community again if you have any other questions. I'd be more than happy to help. Take care.

When I click Taxes from the left menu, I don's see a sales tax menu. I see sales tax center, sales tax owed and recent sales tax payments.

I've got some instructions to help you make a tax adjustment, @bobby-little.

First, let's check your user's access. Unable to see some options in QuickBooks might be a cause of the user's limits. For more info, please see this article: User roles and access rights in QuickBooks Online.

Once, verified you have access and still can't see the Sales tax tab. This might be a browser-related issue. To fix this, let's access your QBO company using a private browser. Private mode prevents storing cache and cookies that might cause problems when running websites.

The following are the shortcut keys you can use:

Once signed in, follow the outlined steps provided by my colleague, LieraMarie_A in adjusting your sales tax.

If this works, let's clear the cache of your regular browser. It will remove the stored cache or cookies that might cause the problem and this also refreshes your browser's background processes. If you still can't see the Sales tax menu, use another supported browser. It could be that the one you're currently using has a temporary issue with QuickBooks.

Then, once done and ready to e-file your sales tax payment, head to the filing your sales tax return in QuickBooks Online at this link for the detailed steps.

Keep me posted here if you have further concerns about adjusting your sales tax in QuickBooks. I want to ensure your success. Thanks for coming to the Community and take care.

Nope doesn't work. It won't let you apply a discount only a charge and now I have an error on my return. I can't delete the adjustment because when I do, it gives me a blank page, When I try to do a new return since I delted the old one, the old return is there. The system is totally screwed up. I've been online with support for over 2 hours with no resolution. QB you screwed up our books - I'll be sending our auditors over to you. First time we ever have an entry we can't support.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here