Hello there, @Anonymous,

Only the gross pay, taxes withheld, deductions, and net pay are shown on the employee's paystub.

You can open the Payroll Details report to see paycheck details, including amounts, taxes, and employer contributions.

About the $43.00, if this amount is non-taxable, you can create a reimbursement pay type for the additional pay type.

Here's how:

- Select Workers from the left menu, then select Employees.

- Click the employee.

- Go to the Pay section.

- Click the edit (pencil) icon beside Pay.

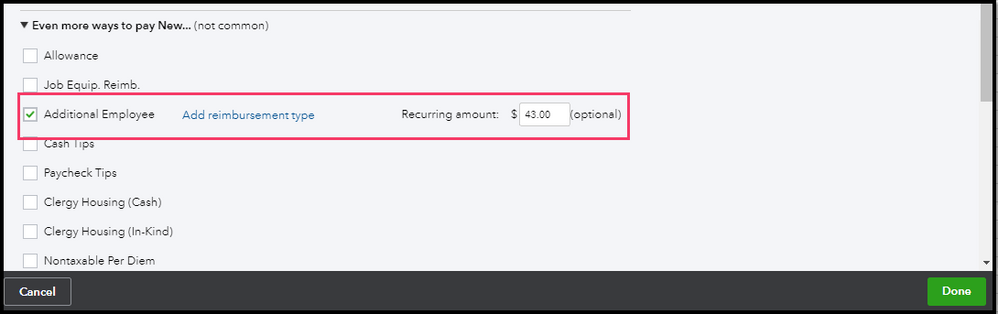

- Under How much do you pay, go to Even more ways to pay.

- Click Add reimbursement type.

- Enter the description of the pay type, then enter the amount.

- Click Done.

That answers your concern for today.

Let me know if there's anything I can help you with your payroll. I'm always around whenever you need help.