Greetings, plunsford! Ensuring your employees have health insurance guarantees they can obtain essential medical care. It also contributes to their overall well-being and results in a healthier workforce. The insurance provider currently available in QuickBooks Online Payroll is Allstate Health Solutions.

QuickBooks has partnered with Allstate Health Solutions to provide employee health benefit options for QuickBooks Online Payroll customers. If you don't have an insurance benefit plan, refer to this article for more information: Sign up for health insurance.

If your company provides an insurance benefit plan, there's no need to worry. You can easily track it by setting up items in QuickBooks.

Here's how to set this up:

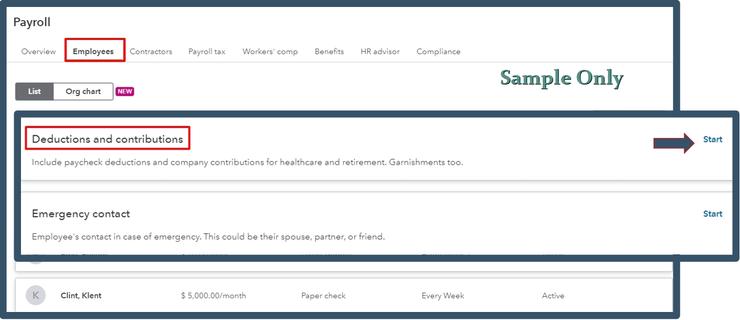

- Hover to the Payroll, then Employees.

- Pick your preferred employee.

- Head to the Deductions & contributions section. Click Start or Edit.

- Select + Add Deduction/contribution.

- When adding a deduction/contribution, you should specify the type. It could be Medical, Vision, or Dental Insurance.

- If you're setting up a pre-tax item that is not listed, such as a commuter benefit, AFLAC accident or cancer, etc., choose Vision Insurance.

- Type in the provider's name in the Description field.

- Determine how your deduction is calculated. Enter the amount or percent per paycheck.

- Pick between Pre-tax insurance premium or Taxable insurance premium.

- Add an amount or percent per paycheck for the company contribution if you contribute a matching contribution.

- Hit Save and Done

For more information, refer to this article: Set up and manage payroll items for your insurance benefit plan.

I'm adding these resources for future reference in managing your employees efficiently:

Choosing your employee insurance plan is essential for supporting their health, offering financial protection, and ensuring regulatory compliance. It also contributes to the overall success of the business. Let me know if you have other concerns or questions. I always got you!