You can record them as regular checks, admin335. This will ensure they're properly included in the 1099 forms for tax purposes.

I'd be glad to share the steps with you. Here's how:

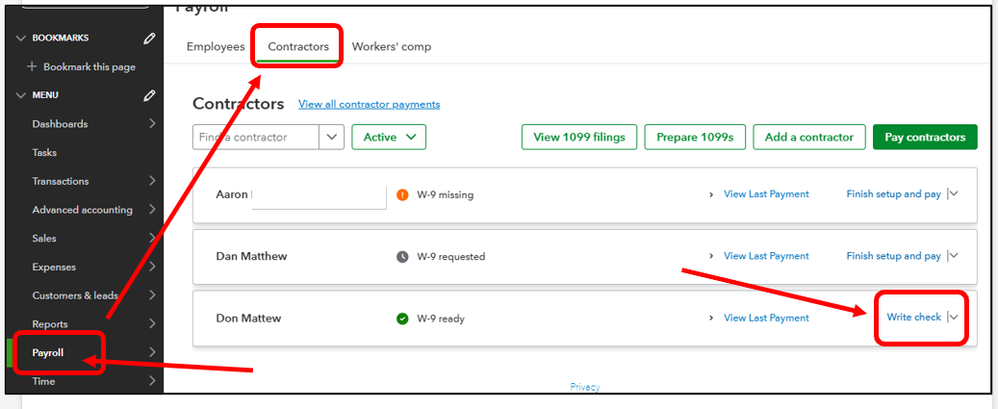

- Go to Payroll and proceed to the Contractors tab.

- Select the dropdown next to the contractor's name and then Write check.

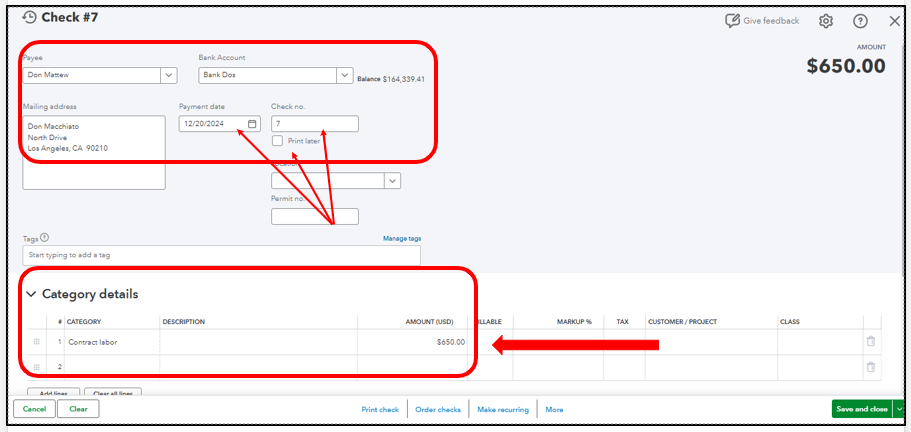

- Choose the correct bank account and complete all required details.

- Make sure the payment date is correct.

- Uncheck the Print later checkbox since the payments are already processed. You can also manually enter the transaction number if you need to.

- Click Save and close to close the check window or Save and new if you need to create another check.

To further assist you with preparing and filing 1099 forms, I've compiled these resources:

You can always reach out again if you encounter any issues while recording contractor-related transactions or have additional questions about the 1099 filing. You're welcome to continue this conversation or start a new thread with any specific concerns.