I would be happy to assist you in adding the state commuter tax to your employees' profiles, janusinvestigati.

Once added to the employee's profile, the tax will automatically be calculated and deducted from their pay. Here's how you can do it:

- Go to the Payroll menu and select Employees.

- Click the name of the employee that is taxable to NY Metropolitan Commuter Transportation Mobility Tax.

- Proceed to the Tax withholding section, then click the Pencil icon or the Edit button.

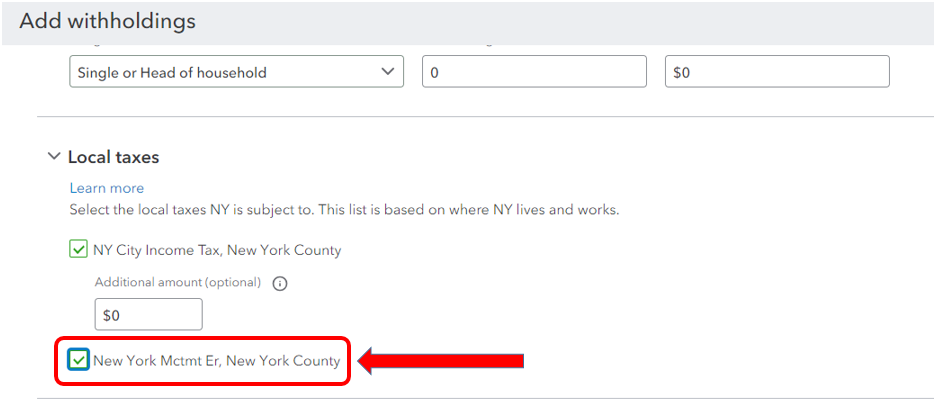

- From Local taxes, select [County] Mctmt Er, [County].

- Select Save.

- Repeat steps 2 - 5 for each NY employee.

You can also follow these steps to add or change the rate for this local tax:

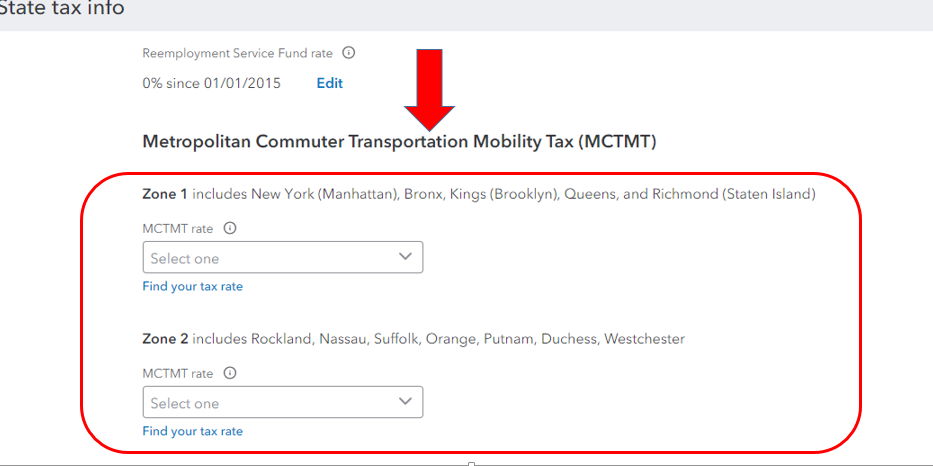

- Go to the Gear or Settings ⚙ icon and select Payroll settings.

- Look for New York tax, then choose Edit ✎.

- From Other Setup, select your rate from the dropdown ▼. (You may need to select Edit first).

- Enter the effective date.

- Click Save.

Here's an article about this for more details: Track the New York Metropolitan Commuter Transportation Mobility Tax (NY MCTMT).

Additionally, here are some articles that provide additional resources for tracking local taxes in New York:

Don't hesitate to reply back to us if you still need more help when managing payroll in QBO. The QuickBooks Team is always here to make sure you get the help that you need.