It’s great to see you in the Community, crichards.

We’ll have to go to the Employees page to generate the check. Then update the worker’s payroll status to Terminated after creating the final paycheck.

If you’re unable to add the deduction item, let’s set it up on the employee’s profile. With just a few clicks you can perform this task.

Here’s how:

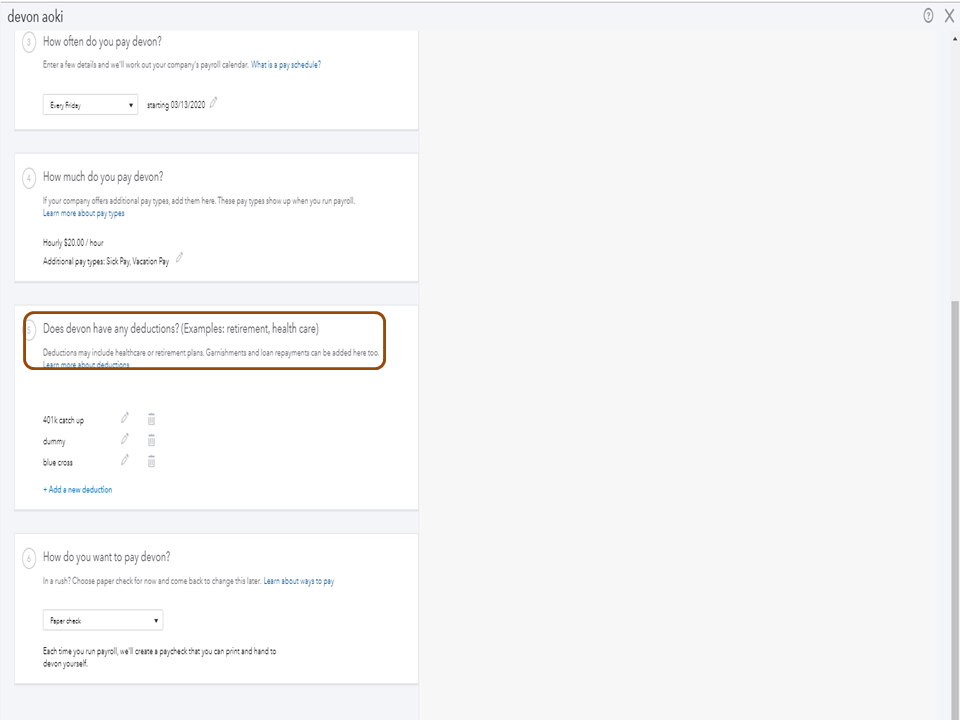

- Go to the Payroll menu on the left panel to choose Employees.

- From the list, click on the worker’s name to view its profile.

- Click the Pencil icon for Pay and navigate to Does the employee have any deductions? section.

- Then, tap the Add new deduction link.

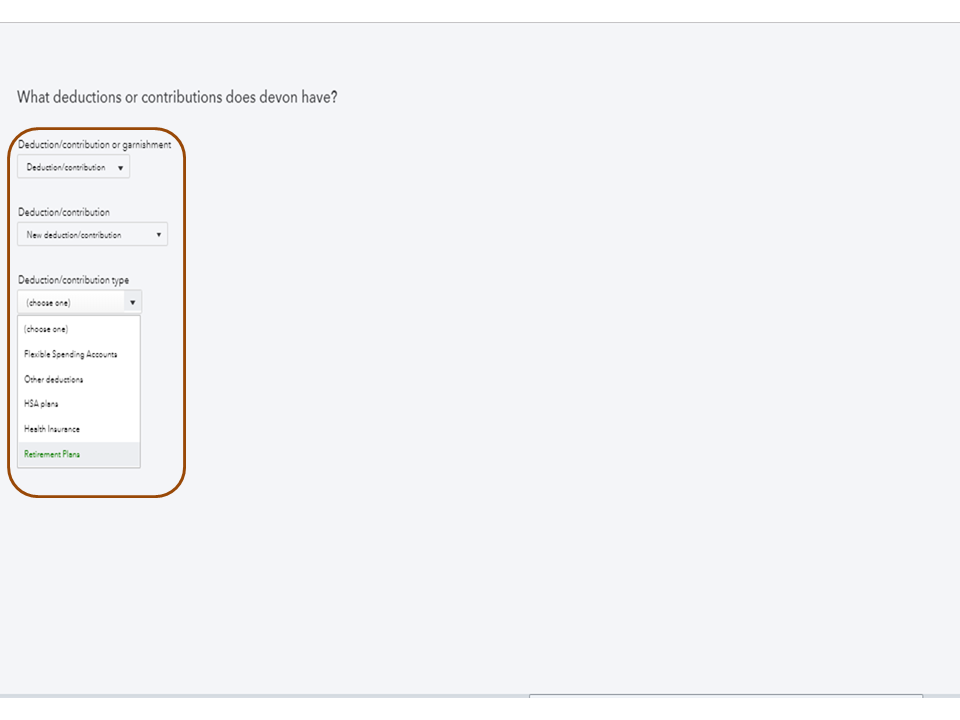

- On What deductions or contributions does the employee have? page, click the Deduction/contribution or garnishment drop-down to select Deduction/contribution.

- Next, pick the deduction type and fill in the fields with the appropriate information.

- Click OK to keep the changes.

Once done, you can now make the final paycheck. The deduction item will now show on the transaction. For detailed instructions, go to Step 2 in this article and tap the click the QuickBooks Online Payroll link: Create final paychecks for terminated employees.

Additionally, this article contains resources that will guide you on how to easily handle your employees’ records: Manage workers.

Don’t hesitate to reach out to the Community if you have any other QuickBooks concerns. Please know I’m always ready to lend a helping hand. Enjoy the rest of the day.